Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RBL Bank Aspire/Signature Banking

- Thread starter itssudiptadas

- Start date

- Replies 81

- Views 6K

Yeah purpose is not clear.You said family banking now intrest rate 🧐

Jumping the wagon

T r u eWhy not open add on account for family members in Indus select account itself?

itssudiptadas

TF Select

I need both good interest rate with premium benefits like family bankingYou said family banking now intrest rate 🧐

Jumping the wagon

I want to shift my account from indusind bank, online & offline both services are worst.Why not open add on account for family members in Indus select account itself?

Only new banks want to attract money will givegood interest rate

Benefits of premium banking is one thingpremium benefits like family banking

And ease of doing family banking is another

Even small finance banks have premium benefits like family banking

Online i agreeindusind bank, online & offline both services are worst.

But offline it depends on branch & rm .

Btw which service you are unhappy about

Hdfc remains the top g in family banking ( in top Bank - sbi,hdfc ,axis ,icici .I need both good interest rate with premium benefits like family banking

itssudiptadas

TF Select

Yes I wanted to open Ujjivan SFB Maxima account but they currently not have family banking optionBenefits of premium banking is one thing

And ease of doing family banking is another

Even small finance banks have premium benefits like family banking

I ask my RM upgrade to pinnacle at first he said paid 15k+ GST for some unwanted voucher, i said I need ltf then he told if I make a 5L FD then he can do this ltf i make 5L FD now he ignore my call even I go to branch he said he try it's been 2 months 😑 so now I think closed my family members account and downgrade my account to select and make this zero balance with legend CC.Online i agree

But offline it depends on branch & rm .

Btw which service you are unhappy about

Maybe 5 l fd was just for his target completionYes I wanted to open Ujjivan SFB Maxima account but they currently not have family banking option

I ask my RM upgrade to pinnacle at first he said paid 15k+ GST for some unwanted voucher, i said I need ltf then he told if I make a 5L FD then he can do this ltf i make 5L FD now he ignore my call even I go to branch he said he try it's been 2 months 😑 so now I think closed my family members account and downgrade my account to select and make this zero balance with legend CC.

Better take it in writing. Verbal promises can’t be trusted.Yes I wanted to open Ujjivan SFB Maxima account but they currently not have family banking option

I ask my RM upgrade to pinnacle at first he said paid 15k+ GST for some unwanted voucher, i said I need ltf then he told if I make a 5L FD then he can do this ltf i make 5L FD now he ignore my call even I go to branch he said he try it's been 2 months 😑 so now I think closed my family members account and downgrade my account to select and make this zero balance with legend CC.

doraemon

TF Legend

Dhokha hua haiMaybe 5 l fd was just for his target completion

Aandolan karna hoga

ICICI BM ki Katha sunao op ko

On serious note

Why to bank with these people when they do not care for their customers

itssudiptadas

TF Select

Yes I just realised after his actionMaybe 5 l fd was just for his target completion

I have whatsapp chat historyBetter take it in writing. Verbal promises can’t be trusted.

itssudiptadas

TF Select

That's why I'm planning to withdraw all money and shift to another bank and make indusind exclusive downgrade to select and make it zero balanceDhokha hua hai

Aandolan karna hoga

ICICI BM ki Katha sunao op ko

On serious note

Why to bank with these people when they do not care for their customers

Select and exulsive both are similar in terms of dc ..so why even bother ..That's why I'm planning to withdraw all money and shift to another bank and make indusind exclusive downgrade to select and make it zero balance

Just have select and move on .since u already have legend card

I have Sig + Sig+DCAnyone here hold.

Aspire savings account along with sig+ DC?

Is This combination possible?

Bank employee says it's not possible to have that DC with aspire account.

Last edited:

Sir, is it possible to upgrade the existing account? I have 10k mab account.I have Sig + Sig+

Do you maintain 2L funds or use rbl t&c to your benefit?

You might have asked the Signature + for free OR some misunderstanding.Anyone here hold.

Aspire savings account along with sig+ DC?

Is This combination possible?

Bank employee says it's not possible to have that DC with aspire account.

Last edited:

Don't listen to bank employee that too from rbl bank 😁Anyone here hold.

Aspire savings account along with sig+ DC?

Is This combination possible?

Bank employee says it's not possible to have that DC with aspire account.

Hi, I want to know your experience about RBL Bank Aspire banking or Signature Banking. I want to open this account but no one give proper information about which debit card I get, downgrade and many information from who use this account.

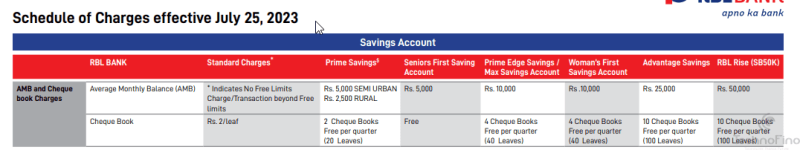

For all practical purposes, the following are the main types of normal SB accounts in RBL.. ( non Salary accounts)

1) Prime (5K - Semi urban, 2.5K - Rural)

2) Prime Edge/ Max Savings ( 10K)

3) Advantage Savings (25K)

4) RBL Rise (50K)

Apart from above there are two very basic SB accounts

1)Basic Savings ( NIL)

2) Classis Savings ( Rs. 2500 METRO/URBAN, Rs. 1000 SEMI URBAN, Rs. 500 RURAL)

Please see attached docs for the complete list of features for the above accounts..

Now , coming back to Banking programs :

1)Aspire ( MAB 1L or TRV of 5L (SB + FD)

2)Signature ( MAB 2L or TRV of 15L (SB+FD)

3) Insignia (MAB 10L or TRV of 30L)

Now in practial terms:

1)Get your SB account ( one of the above listed) opened via Branch

2) Wait for the about 5 days to get this fully KYC actiavated.

3) Generally this comes with a generaic "Classic DC" free of Charge for the first year

4)Order for Sig+ DC , if you want it by paying 5.9K via APP.

5) Maintain 1L/ 2L initially and talk to Branch about upgrde, they generally do it. Normally they wont downgrade. If downgrade happens you will need to maitain the MAB of your account vriant , otherwise pay the NMC. DC charges are levied once in a year after first year. If you take Sig+, its chargeable / waived according to your spending. Read the respective thread for details on SIg+ DC.

Only one DC is allowed per account. Nothing happens about DC until the year end, even if the account gets downgraded.

6)THey way I did, I put 5L FD and got my Sig banking, there by it becomes 0 MAB. RBL offers good FD rates , FD rates now @8.1%.

I prefer this way because we get good FD rate and 0 MAB.. Negotiate for it.. as it is FYE..

ALl the best

itssudiptadas

TF Select

Yes, talk with RM for downgrade and link legend CC.Select and exulsive both are similar in terms of dc ..so why even bother ..

Just have select and move on .since u already have legend card

itssudiptadas

TF Select

What is initial funding for signature banking you paid ?I have Sig + Sig+DC

Please read my detailed post above..What is initial funding for signature banking you paid ?

I opened with 20K , a 10K SB account and then upgraded to Sig with 5L FD..

You can easily do with 1L Initial FUnding as it is FYE..

othrwise 2L funding.. depending upon your negotiations skills

Similar threads

- Question

- Replies

- 33

- Views

- 3K

- Replies

- 8

- Views

- 301

- Replies

- 1

- Views

- 272