As a customer, I decided to explore the ICICI Bank Times Black Credit Card (marketed as a premium offering) in depth. While the application process was seamless, my overall experience has been underwhelming. Here’s a detailed breakdown of the card’s strengths, weaknesses, and overall practicality:

---

Application Experience

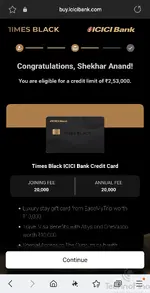

I received a message from Times Black stating that the application process for the card had opened. Given that existing ICICI Bank customers were reportedly getting approved easily, I decided to give it a try. To my surprise, the card was approved within a minute, without requiring detailed documentation or a CIBIL inquiry. It even appeared in my app instantly.

While the process was quick and effortless, it raises concerns about exclusivity. If a card marketed as “premium” is so easily accessible, it loses the prestige it aims to convey.

---

Strengths

1. Premium Appeal: The card is marketed as an exclusive, high-net-worth offering, targeting customers seeking a prestigious image.

2. Milestone-Based Rewards: The card provides milestone rewards, making it appealing to users with significant monthly expenses.

3. Effortless Approval: For existing ICICI customers, the application and approval process is straightforward and hassle-free.

---

Weaknesses

1. Lack of Movie Benefits: Despite being branded as premium, the absence of movie or lifestyle benefits is disappointing. Many mid-tier cards offer such perks, making this omission noticeable.

2. High Spending Criteria: Most benefits, including the ₹25 lakh annual spend for a fee waiver, are designed for individuals with exceptionally high spending capacity. This makes the card impractical for average customers.

3. Limited Rewards Rate: For a premium card, the rewards rate is underwhelming and falls short compared to competitors.

4. Shared Credit Limit: If you already hold multiple ICICI Bank cards (like I do), the credit limit is shared across all cards. This restricts your ability to fully utilize the Times Black Credit Card.

5. High Fees Without Justification: The joining and annual fees (₹20,000 + GST each) feel excessive given the limited rewards and benefits.

6. Potential Devaluation: Based on trends, there’s a concern that the card’s benefits may decrease further over time, reducing its long-term value.

---

Overall Experience

This card seems to struggle between appealing to regular customers and catering to high-net-worth individuals. While it may be worth trying for a year, its lack of unique benefits, stringent criteria for rewards, and shared credit limits make it unlikely to retain customer interest in the long run.

---

Suggestions for Improvement

1. Add competitive movie or lifestyle benefits to match other premium cards in the market.

2. Lower the annual fee waiver criteria to make the card more accessible and appealing.

3. Enhance the rewards structure to provide better value for high-net-worth customers.

---

Final Verdict

The ICICI Bank Times Black Credit Card has potential but falls short of delivering on its promise of exclusivity and practicality. The high fees, restrictive rewards, and lack of additional credit capacity make it a less appealing option for both average and premium users.

Unless ICICI Bank reconsiders its approach and improves the card’s benefits, I predict many customers (myself included) will cancel it after the first year. At its current state, it’s not a card I’d recommend for long-term use.

Feel free to share your thoughts below. Thanks for reading.

---

Application Experience

I received a message from Times Black stating that the application process for the card had opened. Given that existing ICICI Bank customers were reportedly getting approved easily, I decided to give it a try. To my surprise, the card was approved within a minute, without requiring detailed documentation or a CIBIL inquiry. It even appeared in my app instantly.

While the process was quick and effortless, it raises concerns about exclusivity. If a card marketed as “premium” is so easily accessible, it loses the prestige it aims to convey.

---

Strengths

1. Premium Appeal: The card is marketed as an exclusive, high-net-worth offering, targeting customers seeking a prestigious image.

2. Milestone-Based Rewards: The card provides milestone rewards, making it appealing to users with significant monthly expenses.

3. Effortless Approval: For existing ICICI customers, the application and approval process is straightforward and hassle-free.

---

Weaknesses

1. Lack of Movie Benefits: Despite being branded as premium, the absence of movie or lifestyle benefits is disappointing. Many mid-tier cards offer such perks, making this omission noticeable.

2. High Spending Criteria: Most benefits, including the ₹25 lakh annual spend for a fee waiver, are designed for individuals with exceptionally high spending capacity. This makes the card impractical for average customers.

3. Limited Rewards Rate: For a premium card, the rewards rate is underwhelming and falls short compared to competitors.

4. Shared Credit Limit: If you already hold multiple ICICI Bank cards (like I do), the credit limit is shared across all cards. This restricts your ability to fully utilize the Times Black Credit Card.

5. High Fees Without Justification: The joining and annual fees (₹20,000 + GST each) feel excessive given the limited rewards and benefits.

6. Potential Devaluation: Based on trends, there’s a concern that the card’s benefits may decrease further over time, reducing its long-term value.

---

Overall Experience

This card seems to struggle between appealing to regular customers and catering to high-net-worth individuals. While it may be worth trying for a year, its lack of unique benefits, stringent criteria for rewards, and shared credit limits make it unlikely to retain customer interest in the long run.

---

Suggestions for Improvement

1. Add competitive movie or lifestyle benefits to match other premium cards in the market.

2. Lower the annual fee waiver criteria to make the card more accessible and appealing.

3. Enhance the rewards structure to provide better value for high-net-worth customers.

---

Final Verdict

The ICICI Bank Times Black Credit Card has potential but falls short of delivering on its promise of exclusivity and practicality. The high fees, restrictive rewards, and lack of additional credit capacity make it a less appealing option for both average and premium users.

Unless ICICI Bank reconsiders its approach and improves the card’s benefits, I predict many customers (myself included) will cancel it after the first year. At its current state, it’s not a card I’d recommend for long-term use.

Feel free to share your thoughts below. Thanks for reading.

Attachments

Last edited: