Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Slice Card New Terms Update - Credit bureau reporting

- Thread starter TechnoFino

- Start date

- Replies 33

- Views 7K

I understand that regular use will negatively affect the score. What about keeping the card for emergency use? Does the consumer loan account without any use will also affect the score?These so called "Credit Card Challengers" have become "Credit Score devourers" in the true sense.

This is what happens when FinTech tried to " Re-invent the Wheel!"

Another scenario could be using the card smartly, may be once a year for big purchases and paying it off. Will it help to increase the score?

Experts please comment.

Credit Karma

TF Premier

It keeps reflecting as a open loan with approved limit as a balance.I understand that regular use will negatively affect the score. What about keeping the card for emergency use? Does the consumer loan account without any use will also affect the score?

Another scenario could be using the card smartly, may be once a year for big purchases and paying it off. Will it help to increase the score?

Experts please comment.

Which means that "you have almost paid the loan and banks have forgot to close it" kinda thing.

If will keep contributing toward you credit age, total unsecured loan accounts and CUR.

This applies to when you don't use it at all! But I suggest you to close it and switch to CC.

Anon1

TF Premier

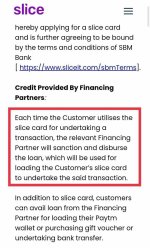

They are doing this since so many years. I believe almost slice users will have minimum two loans in their credit profiles. They just updated now publicly 😉.Slice card's terms of use, read it carefully and then decide.

If you swipe your card for 100 rs, slice will add a 100 rs loan account to your credit history,

if you use your card again for 200 rs, they'll add another 200 rs loan account and so on...

Be careful 🚨

View attachment 2502

I asked slice customer care and got response like this:

"As you know we are a credit entry product and in the credit entry product we do not disburse the loan from the main credit entry (Parent account) rather we will create a child account under a parent ID and disburse loan from it."

In my case I have two parent loan accounts and I used slice from past 3+ years. After getting response like this, I have closed my slice.

I Suggest to close slice account, if anyone don't want to get new loan entries in their cibil.

Sahilhenzy

TF Legend

after all slice is closing their credit line services as of now you won't able to do Tnx after 30 Nov.They are doing this since so many years. I believe almost slice users will have minimum two loans in their credit profiles. They just updated now publicly 😉.

I asked slice customer care and got response like this:

"As you know we are a credit entry product and in the credit entry product we do not disburse the loan from the main credit entry (Parent account) rather we will create a child account under a parent ID and disburse loan from it."

In my case I have two parent loan accounts and I used slice from past 3+ years. After getting response like this, I have closed my slice.

I Suggest to close slice account, if anyone don't want to get new loan entries in their cibil.

some1anywhere

TF Legend

Got some more answers from the Slice team after emailing them.

1. Sparks offers will be available on slice mini prepaid account. The sparks offers are only applicable on spends done using the card, only unlike previously, you now load the amount into the prepaid card to take advantage of the offer. slice offers will not show up for slice borrow.

2. We can close the loan/credit line to use only slice mini and UPI. For closing the slice account, your details will be forwarded to the concerned team/credit bureaus and will be updated correctly.

3. Yes, we can transfer balance from slice mini back to bank account. There will be no charges applied to transfer your slice mini amount to bank account.

As long as you don't use or need slice borrow, you should be ok and will continue to get cashbacks/rewards.

1. Sparks offers will be available on slice mini prepaid account. The sparks offers are only applicable on spends done using the card, only unlike previously, you now load the amount into the prepaid card to take advantage of the offer. slice offers will not show up for slice borrow.

2. We can close the loan/credit line to use only slice mini and UPI. For closing the slice account, your details will be forwarded to the concerned team/credit bureaus and will be updated correctly.

3. Yes, we can transfer balance from slice mini back to bank account. There will be no charges applied to transfer your slice mini amount to bank account.

As long as you don't use or need slice borrow, you should be ok and will continue to get cashbacks/rewards.

Yes, But I don’t agree with people saying about CIBIL getting destroyed. I have been using Slice, Uni, Postpe, Lazypay etc for more than a year now and my CIBIL right now is 770 which was even higher couple of months back and declined due to multiple ccc applications. I think people haven’t tried this and made perceptions. I am not saying that it’s a fantastic thing and people should start using it but I haven’t seen any negative impact on my CIBIL atleast.Does Amazon Pay Later works in a similar way?

They are converting it into pre-paid card like pencilton or junio cards, where you load your own money via UPI or debit card and then use it.What will happen to the SLICE CARD?

It is my Starbucks Card ... 😎

So when an offer comes for Starbucks and Chai/Coffee stores ..... will load from UPI and pay ..... right?They are converting it into pre-paid card like pencilton or junio cards, where you load your own money via UPI or debit card and then use it.

yupp.So when an offer comes for Starbucks and Chai/Coffee stores ..... will load from UPI and pay ..... right?

crazyuploader

TF Premier

Very true, even I have used Slice, LazyPay, PayTM Postpaid and all sorts of BNPL and my CIBIL wasn't at all "destroyed".Yes, But I don’t agree with people saying about CIBIL getting destroyed. I have been using Slice, Uni, Postpe, Lazypay etc for more than a year now and my CIBIL right now is 770 which was even higher couple of months back and declined due to multiple ccc applications. I think people haven’t tried this and made perceptions. I am not saying that it’s a fantastic thing and people should start using it but I haven’t seen any negative impact on my CIBIL atleast.

Anon1

TF Premier

How many no of loans from slice alone you have in your cibil?Very true, even I have used Slice, LazyPay, PayTM Postpaid and all sorts of BNPL and my CIBIL wasn't at all "destroyed".

crazyuploader

TF Premier

Only one, "Quadfin" with 35k limit initiallyHow many no of loans from slice alone you have in your cibil?

Similar threads

- Question

- Replies

- 62

- Views

- 7K

- Replies

- 7

- Views

- 972

- Replies

- 28

- Views

- 2K

- Question

Offer Fulfilled!

(OVER)Free Rupay Credit Card to Bank Transfer(Educational Purpose)

- Replies

- 172

- Views

- 9K