gg123

TF Premier

Hi Everyone,

My CC portfolio.

But going forward my spends will be ~3L for entire year

My plan

Thinking of closing axis ACE. is it a wise move considering I can use it for ~17 months without paying annual fee

I'll appreciate Any new card suggestions or optimisation suggestions.

Thanks in Advance.

My CC portfolio.

- Axis ACE - 499/-

- Axis Select - LTF (Burgundy at family level)

- Amex Gold Charge - 4.5K

- ICICI platinum- LTF

- ICICI coral Rupay - LTF

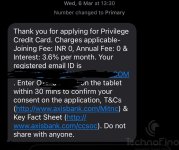

- Axis privilege- LTF (in process)

But going forward my spends will be ~3L for entire year

My plan

- Gold charge - Utilities , Insurance, Online spends like Uber , Swiggy , Zomato and 3rd party sites via Apay Gift vouchers from reward multiplier. 95% of times Apay balance does the trick. (I get about 2-3k points including 1k bonus) Also Fuel without 5X

- Axis Select - Bigbasket, Swiggy offer twice a month, Offline Grocery / House supplies where it 90% of times gives me 2X points, some other categories like education/jewellery where ACE doesn't provide me cash back

- Axis Privilege - Just taking it for Multibrand voucher

- Axis Ace - Doesn't see much need for it now as utility is covered by gold charge and offline spend will give me 4% via Select and Privilege. Probably I might use it for <200 rs spends offline.

- ICICI Plat for instant discounts (Also my first card can't close it)

- Coral rupay for UPI

Thinking of closing axis ACE. is it a wise move considering I can use it for ~17 months without paying annual fee

I'll appreciate Any new card suggestions or optimisation suggestions.

Thanks in Advance.