shazansalim

TF Buzz

Today, I’m sharing my experience of getting the PNB Rupay Select Imperial Debit Card — and honestly, this isn’t just another debit card, it’s one of the most rewarding ones currently available in India.

Let me start from the beginning — I had applied for this Debit Card recently (the only reason I opened an account with PNB) The benefits and vouchers that come bundled with the Imperial variant easily exceed ₹16,000 in total value (maybe even more, I haven’t done the exact math yet!).

What makes it even more interesting is that PNB allows up to two add-on cards, meaning you can actually have three Imperial Debit Cards linked to a single account.

Although a few posts on Technofino already discuss PNB’s new debit card lineup, I wanted to make a dedicated thread exclusively for the Imperial Debit Card — so that anyone planning to apply or looking for real-world experiences can find everything here and discuss their queries directly related to this.

Eligibility: You need to open a basic savings account with PNB (Unnati savings scheme). Then you have to transfer 1 lac into the account in order to be eligible. I have enquired from the people already holding the cars that the balance does not need to be maintained, also PNB does not have any non maintenance charges. If you think any debit card

beats these benefits in the pics shared, let me know!

Only offline application possible.

Code: SAI

Issuance: 708

Annual fee: Around 1100

Benefits:

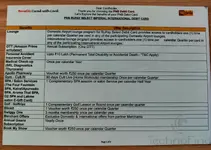

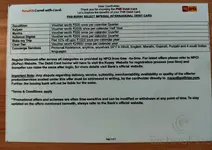

🛫 Lounge Access

Domestic Airport Lounges:

1 complimentary visit per calendar quarter, per card, at participating domestic airport lounges.

International Airport Lounges:

1 complimentary visit per calendar quarter, per card, at participating international airport lounges.

🎬 OTT Subscription

Annual subscription (choice of one):

Amazon Prime or Disney+ Hotstar.

🛡️ Personal Accident Insurance Cover

Coverage up to ₹10 lakh for Permanent Total Disability or Accidental Death.

(T&C apply)

🧬 Medical Check-up

Complimentary health check-up once per calendar year at SRL Diagnostics / Thyrocare.

💊 Apollo Pharmacy

Voucher worth ₹250 once per calendar quarter.

🏋️♂️ Gym / Cult.fit

90 days Cult Live (Home Workouts) membership — once per calendar quarter.

💆♀️ SPA / Salon Services

1 complementary SPA session or salon service per calendar half-year at:

The Four Fountains Spa, Kairali Ayurvedic Spa, Aroma Thai Spa, O2 Spa, or Lakme Salon (E-Gift Card).

⛳ Golf Privileges

1 complimentary golf lesson or round per calendar quarter via Golftripz.

🛒 Shopping & Lifestyle Vouchers

Blinkit: ₹250 voucher once per calendar quarter.

Decathlon: ₹500 voucher once per calendar quarter.

Kalyan Jewellers: ₹2000 voucher once per calendar half-year.

Myntra: ₹500 voucher once per calendar quarter.

Reliance Digital: ₹500 voucher once per calendar quarter.

MakeMyTrip: Flat 10% off (up to ₹1500) once per calendar year.

ClearTax: Voucher worth ₹2950 once per calendar year.

🍔 Food & Entertainment

Swiggy One: 3 months membership once per calendar year.

BookMyShow: ₹250 voucher once per calendar quarter.

Gaana Subscription: Annual membership once per year.

Let me start from the beginning — I had applied for this Debit Card recently (the only reason I opened an account with PNB) The benefits and vouchers that come bundled with the Imperial variant easily exceed ₹16,000 in total value (maybe even more, I haven’t done the exact math yet!).

What makes it even more interesting is that PNB allows up to two add-on cards, meaning you can actually have three Imperial Debit Cards linked to a single account.

Although a few posts on Technofino already discuss PNB’s new debit card lineup, I wanted to make a dedicated thread exclusively for the Imperial Debit Card — so that anyone planning to apply or looking for real-world experiences can find everything here and discuss their queries directly related to this.

Eligibility: You need to open a basic savings account with PNB (Unnati savings scheme). Then you have to transfer 1 lac into the account in order to be eligible. I have enquired from the people already holding the cars that the balance does not need to be maintained, also PNB does not have any non maintenance charges. If you think any debit card

beats these benefits in the pics shared, let me know!

Only offline application possible.

Code: SAI

Issuance: 708

Annual fee: Around 1100

Benefits:

🛫 Lounge Access

Domestic Airport Lounges:

1 complimentary visit per calendar quarter, per card, at participating domestic airport lounges.

International Airport Lounges:

1 complimentary visit per calendar quarter, per card, at participating international airport lounges.

🎬 OTT Subscription

Annual subscription (choice of one):

Amazon Prime or Disney+ Hotstar.

🛡️ Personal Accident Insurance Cover

Coverage up to ₹10 lakh for Permanent Total Disability or Accidental Death.

(T&C apply)

🧬 Medical Check-up

Complimentary health check-up once per calendar year at SRL Diagnostics / Thyrocare.

💊 Apollo Pharmacy

Voucher worth ₹250 once per calendar quarter.

🏋️♂️ Gym / Cult.fit

90 days Cult Live (Home Workouts) membership — once per calendar quarter.

💆♀️ SPA / Salon Services

1 complementary SPA session or salon service per calendar half-year at:

The Four Fountains Spa, Kairali Ayurvedic Spa, Aroma Thai Spa, O2 Spa, or Lakme Salon (E-Gift Card).

⛳ Golf Privileges

1 complimentary golf lesson or round per calendar quarter via Golftripz.

🛒 Shopping & Lifestyle Vouchers

Blinkit: ₹250 voucher once per calendar quarter.

Decathlon: ₹500 voucher once per calendar quarter.

Kalyan Jewellers: ₹2000 voucher once per calendar half-year.

Myntra: ₹500 voucher once per calendar quarter.

Reliance Digital: ₹500 voucher once per calendar quarter.

MakeMyTrip: Flat 10% off (up to ₹1500) once per calendar year.

ClearTax: Voucher worth ₹2950 once per calendar year.

🍔 Food & Entertainment

Swiggy One: 3 months membership once per calendar year.

BookMyShow: ₹250 voucher once per calendar quarter.

Gaana Subscription: Annual membership once per year.

Attachments

Last edited: