edit will come , suggestions are appreciated if you went through any personal experience

After all you bought your health insurance and now even you read most of clause and aware of many here are few most common ground on which health insurance claims are partially passed in 90 % cases by company not out right rejected because they know customer will go to IRDA

so they pass partial claim stating some sub limit or clause so that most educated fools thinks " jo mila usme khus rho " and never care to read between the line used against them

1 reasonable and customary charges clause - when we talked about buying insurance at zonal level policy , say at village address in bihar has heart surgey costs average 2 lakh but you bought insurance at village address & went to delhi for surgery hence company will pay max 2 lakh no matter surgery costs 2.5 lakh . sometimes u have to pay 20 % co pay

solution is - buy good reputation company which does care about their reputation and not notoriously popular for claim partial rejection

choose agent who will help than ditch

approch ombudsman for insurance oic

2 hospitalization not required - in former case u atleast get some claim but in this they totally out reject all claims . as i told you any claim required 24 hour hospitalization to claim to be valid hence one day OPD gets out right rejected . with evolution and modernization most surgery are less than day thing

say u got dengue and got hospitalized company will say u need not to be admitted could be treated via OPD

so what would you do

firstly - get doctor in writing that u need hospitalization and OPD will not do the job

attach this with documents

if still rejected what else than complaint to ombudsman

or you can choose for day care policy which covers OPD treatment

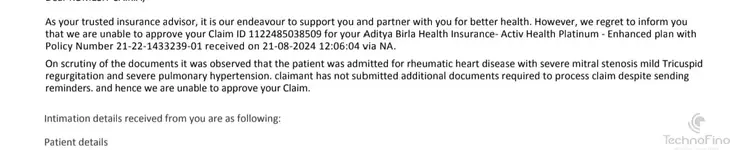

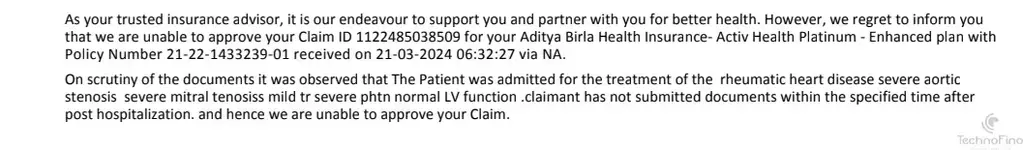

3 discrepancies in documentation - some document you required for reimbursement claim like

original claim form with sign

valid id

doc prescription suggesting treatment in hospital

doc prescription advising tests , meds & consultation

pharmacy bills , ambulance receipt , FIR if required in accident

this usual kicks in time of frauds not genuine cases

4 non disclosure of material facts - if you dont disclose you facts like smoking , dibeties , alcohol or any past surgery which has impact on premium then your claim might get rejected and you cant do anything about it ... be honest

even if you any surgery years ago disclose it

5 NOT understanding exclusions - like

30 day waiting period

war , chemical or biological attack

dental and maternity treatment

infertility treatment

adventure sports , plastic surgrey , weight reduction or gender surgey

etc

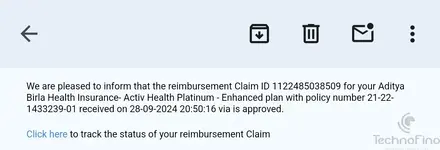

now your cashless claim is rejected you can apply for reimbursement

if still rejected you can complaint at BIMA BHAROSA platform

1 is call

2 is complaint at portal

3 is IRDAI Escalation

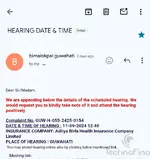

4 CIO ( council of insurance ombudsman ) 17 cities has offline process u can have online hearing too . they solve within 3 months

5 consumer court ( national consumer portal or e- daakhil portal )

6 court

After all you bought your health insurance and now even you read most of clause and aware of many here are few most common ground on which health insurance claims are partially passed in 90 % cases by company not out right rejected because they know customer will go to IRDA

so they pass partial claim stating some sub limit or clause so that most educated fools thinks " jo mila usme khus rho " and never care to read between the line used against them

1 reasonable and customary charges clause - when we talked about buying insurance at zonal level policy , say at village address in bihar has heart surgey costs average 2 lakh but you bought insurance at village address & went to delhi for surgery hence company will pay max 2 lakh no matter surgery costs 2.5 lakh . sometimes u have to pay 20 % co pay

solution is - buy good reputation company which does care about their reputation and not notoriously popular for claim partial rejection

choose agent who will help than ditch

approch ombudsman for insurance oic

2 hospitalization not required - in former case u atleast get some claim but in this they totally out reject all claims . as i told you any claim required 24 hour hospitalization to claim to be valid hence one day OPD gets out right rejected . with evolution and modernization most surgery are less than day thing

say u got dengue and got hospitalized company will say u need not to be admitted could be treated via OPD

so what would you do

firstly - get doctor in writing that u need hospitalization and OPD will not do the job

attach this with documents

if still rejected what else than complaint to ombudsman

or you can choose for day care policy which covers OPD treatment

3 discrepancies in documentation - some document you required for reimbursement claim like

original claim form with sign

valid id

doc prescription suggesting treatment in hospital

doc prescription advising tests , meds & consultation

pharmacy bills , ambulance receipt , FIR if required in accident

this usual kicks in time of frauds not genuine cases

4 non disclosure of material facts - if you dont disclose you facts like smoking , dibeties , alcohol or any past surgery which has impact on premium then your claim might get rejected and you cant do anything about it ... be honest

even if you any surgery years ago disclose it

5 NOT understanding exclusions - like

30 day waiting period

war , chemical or biological attack

dental and maternity treatment

infertility treatment

adventure sports , plastic surgrey , weight reduction or gender surgey

etc

now your cashless claim is rejected you can apply for reimbursement

if still rejected you can complaint at BIMA BHAROSA platform

1 is call

2 is complaint at portal

3 is IRDAI Escalation

4 CIO ( council of insurance ombudsman ) 17 cities has offline process u can have online hearing too . they solve within 3 months

5 consumer court ( national consumer portal or e- daakhil portal )

6 court