Surprise from Yes Bank! Yes Bank has devalued all their credit cards.

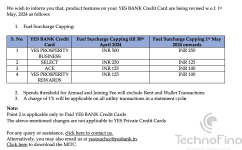

Effective from 1st May, 2024, Yes Bank will change the fuel surcharge capping for a few of their credit cards. The new fuel surcharge capping is as follows:

Spends made on rent and wallet loading using paid Yes Bank credit cards will not be counted towards the annual fee reversal criteria. But wait, these are all basic things; almost all banks follow this.

Here comes the surprise from Yes Bank: an additional 1% charge will be levied on all utility bill payments made in a statement cycle. Wow! This is truly astonishing from Yes Bank. First, rent, then wallet, and now on utility bill payments, they will charge an extra 1%.

This is a totally unwelcome move by Yes Bank. I hope Yes Bank credit card holders will refrain from using their cards for any utility transactions. And hopefully, no other bank will follow this move. I mean, putting a cap on reward earnings in the utility category is understandable as it's a low-margin category for banks, but charging extra is too much.

One good thing is that Yes Bank's private credit card remains unaffected.

Update: 1st april, 2024

Yes Bank finally made some good changes in their last communication. Seems like Yes Bank is listening to our voice! Amazing 👏

We should really appreciate banks if they start listening to their customers' opinions.

The changes are:

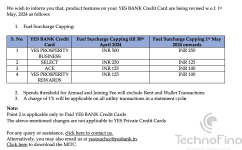

Now, a charge of 1% will be applicable on all utility transactions on spends above INR 15,000 in a month. Earlier, Rs. 15,000 capping was not there and customers had to pay 1% extra on all utility spends. But after our post and negative opinions, the bank decided to allow Rs. 15,000 per month spends on the utility category without any extra fees, which is a good capping in my opinion.

Now, a charge of 1% will be applicable on all utility transactions on spends above INR 15,000 in a month. Earlier, Rs. 15,000 capping was not there and customers had to pay 1% extra on all utility spends. But after our post and negative opinions, the bank decided to allow Rs. 15,000 per month spends on the utility category without any extra fees, which is a good capping in my opinion.

Effective from 1st May, 2024, Yes Bank will change the fuel surcharge capping for a few of their credit cards. The new fuel surcharge capping is as follows:

Spends made on rent and wallet loading using paid Yes Bank credit cards will not be counted towards the annual fee reversal criteria. But wait, these are all basic things; almost all banks follow this.

Here comes the surprise from Yes Bank: an additional 1% charge will be levied on all utility bill payments made in a statement cycle. Wow! This is truly astonishing from Yes Bank. First, rent, then wallet, and now on utility bill payments, they will charge an extra 1%.

This is a totally unwelcome move by Yes Bank. I hope Yes Bank credit card holders will refrain from using their cards for any utility transactions. And hopefully, no other bank will follow this move. I mean, putting a cap on reward earnings in the utility category is understandable as it's a low-margin category for banks, but charging extra is too much.

One good thing is that Yes Bank's private credit card remains unaffected.

Update: 1st april, 2024

Yes Bank finally made some good changes in their last communication. Seems like Yes Bank is listening to our voice! Amazing 👏

We should really appreciate banks if they start listening to their customers' opinions.

The changes are:

Now, a charge of 1% will be applicable on all utility transactions on spends above INR 15,000 in a month. Earlier, Rs. 15,000 capping was not there and customers had to pay 1% extra on all utility spends. But after our post and negative opinions, the bank decided to allow Rs. 15,000 per month spends on the utility category without any extra fees, which is a good capping in my opinion.

Now, a charge of 1% will be applicable on all utility transactions on spends above INR 15,000 in a month. Earlier, Rs. 15,000 capping was not there and customers had to pay 1% extra on all utility spends. But after our post and negative opinions, the bank decided to allow Rs. 15,000 per month spends on the utility category without any extra fees, which is a good capping in my opinion.

Last edited: