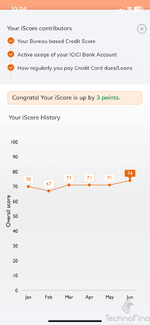

I am sharing my experience & tricks to get ICICI Sapphiro LTF easily based on your Salary.

I am a Central Govt employee (Gazetted officer), recently I opened a new ICICI Wealth Management Salary Account. Previously I had a salary account with SBI. I was NTB to ICICI Bank before Jan 2024. I first got the Coral Visa LTF CC in Jan 2024 then last month received Rupay Coral LTF Pre-Approved and also opened my ICICI Wealth Management Salary Account with them.

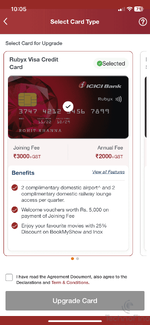

I opened the account(Salary WM Acc) on 29th May 2024. But no salary has been credited till now will start receiving from this month. I think having a Salary Acc with them gives you more leverage. In my case, I was eligible for Rubyx LTF but asked for the Sapphiro Duet LTF version they applied the Sapphiro paid variant on 10th June and said it will convert into LTF automatically as the approval was already taken from the Regional Head by BM. I was short of 15K in salary criteria for Sapphiro.

In my case, my gross salary(1.35L) was taken into consideration, my in-hand is around 80K p.m rest I save in GPF, and I don't have any EMI or Loan. But most of the cases in hand will be taken into consideration as per my RM.

Card Application Timeline: Application Date 10 June, Finally Processed 11th June, Card Generated 13th June, Delivered 16th June. Verified with Customer Care It's LTF.

Sharing Few points based on my experience:

! Having a Salary Account with them makes negotiating easier and faster as not much verification is needed.

!! Also, it depends on the branch BM, RM, or CC agent how much they want to assist you regarding this for example in my case without even crediting a single month's salary or using my coral cc once they helped me to get the card within 10-15 days of account opening. Also, try different branches if they are not helping you.

!!! As per my RM if you want a higher variant card from ICICI like Sapphiro/Emerald try avoiding Rubyx if you already have other options. Try to negotiate for the higher variant only, after that it's very easy to get the lower variant LTF if you need it. Upgrading to LTF variant is hard without good spending or TRV.

!!!! In my case, it was very easy to get the card, it might not be easy for others to get it. Sharing my general view is it worth the hassle if you are not getting LTF? No, ICICI bank cards have very basic reward rates except Apay.

!!!!! If you already meet/just around the Salary Criteria and want to upgrade to these cards visit the branch. CC will not help you regarding this they always say the paid variant is available for you.

!!!!!! Why I got this card?

It's LTF, only useful during ICICI Bank Offers, BMS offer, Lounge Access INT. & Domestic, looks good & easily they agreed to issue me the card based on my Employer and salary.

Note: In my iMobile app I was getting Rubyx Rupay Paid under Pre-approved Offer before applying Sapphiro. Documents required during my application Salary Slip for the last month & Last 6 months' statement(I submitted my SBI one).

Applied for an Add-on Card for my wife not sure if she will receive the Dragon Pass or not. My one will be delivered separately.

Now I will close my Coral Visa and after few months I will get the Rubyx Rupay LTF and close my Coral Rupay.

Read this thread for Salary Criteria details:

https://www.technofino.in/community...ry-criteria-for-sapphiro-ltf-rubyx-ltf.27588/

I am a Central Govt employee (Gazetted officer), recently I opened a new ICICI Wealth Management Salary Account. Previously I had a salary account with SBI. I was NTB to ICICI Bank before Jan 2024. I first got the Coral Visa LTF CC in Jan 2024 then last month received Rupay Coral LTF Pre-Approved and also opened my ICICI Wealth Management Salary Account with them.

I opened the account(Salary WM Acc) on 29th May 2024. But no salary has been credited till now will start receiving from this month. I think having a Salary Acc with them gives you more leverage. In my case, I was eligible for Rubyx LTF but asked for the Sapphiro Duet LTF version they applied the Sapphiro paid variant on 10th June and said it will convert into LTF automatically as the approval was already taken from the Regional Head by BM. I was short of 15K in salary criteria for Sapphiro.

In my case, my gross salary(1.35L) was taken into consideration, my in-hand is around 80K p.m rest I save in GPF, and I don't have any EMI or Loan. But most of the cases in hand will be taken into consideration as per my RM.

Card Application Timeline: Application Date 10 June, Finally Processed 11th June, Card Generated 13th June, Delivered 16th June. Verified with Customer Care It's LTF.

Sharing Few points based on my experience:

! Having a Salary Account with them makes negotiating easier and faster as not much verification is needed.

!! Also, it depends on the branch BM, RM, or CC agent how much they want to assist you regarding this for example in my case without even crediting a single month's salary or using my coral cc once they helped me to get the card within 10-15 days of account opening. Also, try different branches if they are not helping you.

!!! As per my RM if you want a higher variant card from ICICI like Sapphiro/Emerald try avoiding Rubyx if you already have other options. Try to negotiate for the higher variant only, after that it's very easy to get the lower variant LTF if you need it. Upgrading to LTF variant is hard without good spending or TRV.

!!!! In my case, it was very easy to get the card, it might not be easy for others to get it. Sharing my general view is it worth the hassle if you are not getting LTF? No, ICICI bank cards have very basic reward rates except Apay.

!!!!! If you already meet/just around the Salary Criteria and want to upgrade to these cards visit the branch. CC will not help you regarding this they always say the paid variant is available for you.

!!!!!! Why I got this card?

It's LTF, only useful during ICICI Bank Offers, BMS offer, Lounge Access INT. & Domestic, looks good & easily they agreed to issue me the card based on my Employer and salary.

Note: In my iMobile app I was getting Rubyx Rupay Paid under Pre-approved Offer before applying Sapphiro. Documents required during my application Salary Slip for the last month & Last 6 months' statement(I submitted my SBI one).

Applied for an Add-on Card for my wife not sure if she will receive the Dragon Pass or not. My one will be delivered separately.

Now I will close my Coral Visa and after few months I will get the Rubyx Rupay LTF and close my Coral Rupay.

Read this thread for Salary Criteria details:

https://www.technofino.in/community...ry-criteria-for-sapphiro-ltf-rubyx-ltf.27588/

Last edited: