shrewdoc

TF Legend

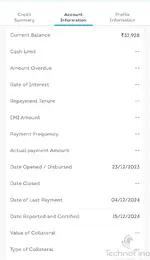

I have noticed for the last 20-25 days, HDFC has been reporting to CIBIL every week starting from:

23 Nov → 30 Nov → 7 Dec

Previously HDFC used to report ONCE on month-end ie. on 30/31 of every month.

This is even faster and earlier than the RBI new guidelines of biweekly reporting w.e.f. 1 Jan, 2025:

My CIBIL is going all over the place ±10-12 points because of this as it deducts 10 points for any amount due in credit cards compared to Max Score when all dues are cleared.

So now, prepaying won't help much. It would be interesting to see if other banks follow suit, and it's implications on our credit score. I guess, CIBIL scoring mechanism would be needing a few tweaks now if this trend continues.

Is it the same for everyone? What are your thoughts on this?

23 Nov → 30 Nov → 7 Dec

Previously HDFC used to report ONCE on month-end ie. on 30/31 of every month.

This is even faster and earlier than the RBI new guidelines of biweekly reporting w.e.f. 1 Jan, 2025:

My CIBIL is going all over the place ±10-12 points because of this as it deducts 10 points for any amount due in credit cards compared to Max Score when all dues are cleared.

So now, prepaying won't help much. It would be interesting to see if other banks follow suit, and it's implications on our credit score. I guess, CIBIL scoring mechanism would be needing a few tweaks now if this trend continues.

Is it the same for everyone? What are your thoughts on this?