Hello TFians 🙋🏻♂️

Rupay Select Debit Card Available at "0" Issuance / Annual Fee.

100% Online Account Opening - No Branch Visit.

Note: Always refer bank website for updated and exact charges details

(Following details won't be updated)

Indian Overseas Bank SB-HNI Account (Features) :

Rupay Select DC: No Issuance / Annual Fee

Initial funding: 50000*

AMB: 50000

Card replacement: 350 + GST*

*Card will be processed after Initial funding.

*Card replacement can be requested through Mobile Banking.

Account Opening Procedure:

1) Visit VKYC Page

2) In Branch Selection choose your nearby branch.

3) Select scheme as SB-HNI only.

4) Rupay Select is shown under Debit Card options, select the same.

5) VKYC verification will be done and account will be opened in 2-3 days.

6) Add Initial funding of 50000 and your card will be Auto-Generated and sent to your Registered address by bank.

Rupay Select Debit Card Available at "0" Issuance / Annual Fee.

100% Online Account Opening - No Branch Visit.

Note: Always refer bank website for updated and exact charges details

(Following details won't be updated)

Indian Overseas Bank SB-HNI Account (Features) :

Rupay Select DC: No Issuance / Annual Fee

Initial funding: 50000*

AMB: 50000

Card replacement: 350 + GST*

*Card will be processed after Initial funding.

*Card replacement can be requested through Mobile Banking.

Account Opening Procedure:

1) Visit VKYC Page

2) In Branch Selection choose your nearby branch.

3) Select scheme as SB-HNI only.

4) Rupay Select is shown under Debit Card options, select the same.

5) VKYC verification will be done and account will be opened in 2-3 days.

6) Add Initial funding of 50000 and your card will be Auto-Generated and sent to your Registered address by bank.

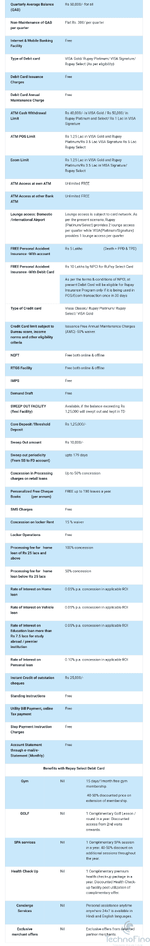

| Feature | Description | ||

|---|---|---|---|

| Eligibility | Accounts can be opened by all those who are eligible to open savings bank accounts. | ||

| Quarterly Average Balance (QAB) | Rs 50,000/- for all | ||

| Non-Maintenance of QAB per quarter | Flat Rs. 300/ per quarter | ||

| Internet & Mobile Banking Facility | Free | ||

| Type of Debit card | VISA Gold/ Rupay Platinum/ VISA Signature/ Rupay Select | ||

| Debit Card Issuance Charges | Free | ||

| Debit Card Annual Maintenance Charge | Free | ||

| ATM Cash Withdrawal Limit | Rs 40,000/- in VISA Gold / Rs 50,000/ in Rupay Platinum and Select/ Rs 1 Lac in VISA Signature | ||

| ATM POS Limit | Rs 1.25 Lac in VISA Gold and Rupay Platinum/Rs 3.5 Lac VISA Signature Rs 5 Lac Rupay Select | ||

| Ecom Limit | Rs 1.25 Lac in VISA Gold and Rupay Platinum/Rs 3.5 Lac in VISA Signature/ Rupay Select | ||

| ATM Access at own ATM | Unlimited FREE | ||

| ATM Access at other Bank ATM | Unlimited FREE | ||

| Lounge access: Domestic /International Airport | Lounge access is subject to card network. As per the present scenario, Rupay (Platinum/Select) provides 2 lounge access per quarter while VISA(Platinum/Signature) provides 1 lounge access per quarter | ||

| FREE Personal Accident Insurance -With account | Rs 5 Lakhs (Death + PPD & TPD) | ||

| FREE Personal Accident Insurance -With Debit Card | Rs 10 Lakhs by NPCI for RuPay Select Card | ||

| As per the terms & conditions of NPCI, at present Debit Card will be eligible for Rupay Insurance Program only if it is being used in POS/Ecom transaction once in 30 days | |||

| Type of Credit card | Vissa Classic/ Rupay Platinum/ Rupay Select/ VISA Gold | ||

| Credit Card limit subject to Bureau score, income norms and other eligibility criteria | Issuance Free Annual Maintenance Charges (AMC) -50% waiver. | ||

| NEFT | Free both online & offline | ||

| RTGS Facility | Free both online & offline | ||

| IMPS | Free | ||

| Demand Draft | Free | ||

| SWEEP OUT FACILITY (flexi Facility) | Available, if the balance exceeding Rs 1,25,000 will swept out and kept in TD | ||

| Core Deposit /Threshold Deposit | Rs 1,25,000/- | ||

| Sweep Out amount | Rs 10,000/- | ||

| Sweep out periodicity (From SB to FD account) | upto 179 days | ||

| Concession in Processing charges on retail loans | Up to 50% concession | ||

| Personalized Free Cheque Books (per annum) | FREE up to 100 leaves a year. | ||

| SMS Charges | Free | ||

| Concession on locker Rent | 15 % waiver | ||

| Locker Operations | Free | ||

| Processing fee for home loan of Rs 25 lacs and above | 100% concession | ||

| Processing fee for home loan below Rs 25 lacs | 50% concession | ||

| Rate of Interest on Home loan | 0.05% p.a. concession in applicable ROI | ||

| Rate of Interest on Vehicle loan | 0.05% p.a. concession in applicable ROI | ||

| Rate of Interest on Education loan more than Rs 7.5 lacs for study abroad / premier institution | 0.05% p.a. concession in applicable ROI | ||

| Rate of Interest on Personal loan | 0.10% p.a. concession in applicable ROI | ||

| Instant Credit of outstation cheques | Rs 25,000/- | ||

| Standing Instructions | Free | ||

| Utility Bill Payment, online Tax payment | Free | ||

| Stop Payment Instruction Charges | Free | ||

| Account Statement through e-mail/e-Statement (Monthly) | Free | ||

Benefits with Repay Select Debit Card | |||

Gym | Nil | 15 days/1month free gym membership. 40-50% discounted price on extension of membership. | |

GOLF | Nil | 1 Complimentary Golf Lesson / round in a year. Discounted access from 2nd visits onwards. | |

SPA services | Nil | 1 Complimentary SPA session in a year. 40-50% discount on additional sessions throughout the year. | |

Health Check Up | Nil | 1 Complimentary premium health check-up package in a year. Discounted Health Check-up facility post utilization of complimentary offer. | |

Concierge Services | Nil | Personal assistance anytime anywhere 24x7 is available in Hindi and English languages. | |

Exclusive merchant offers | Nil | Exclusive offers from selected partner merchants. |

Attachments

Last edited: