Spends: 72000

Renewal fee: 1770

Assumed value of reward points: 7440

Approach 1

ROI = 7440/(72000+1770)*100 = 10.09%

Here you are considering your renewal fee as an expense also

Approach 2

ROI = (7440-1770)/72000*100 = 7.88%

Here you are subtracting the renewal fee from the value of rewards and calculating the actual reward on spend of 72k

Is approach 2 a more realistic representation of ROI?

Here is what I do,

Annual Rx % = =([@Cashback]+[@Discounts]-[@[Annual Fee.]])/([@Spent]+[@Discounts])

Cashback = Cashback we received in statement or some form like as Amzn voucher (over and above to compliment your purchase). Ex: monthly cashback or quarterly milestones.

Discounts (optional and can be clubbed with cashback) = Where we availed those 10% offers or easydiner benefits etc. (benefits for holding that card and using at those purchases). This some people included in cashback as per their convinience it helps which cards are better for sales and which are for general purpose. If you're considering this then have to add same with spend amount because without this your total bill amount will be increased.

Annual Fee = Fee that we paid after waiver or joining benefits (at any time, if I paid then it is an expense for me).

Spent = actual amount billed to the statement (available in statement)

Similar calculation can be applied to Lifetime Rx % = combination of multiple years of spends, fee and cashbacks.

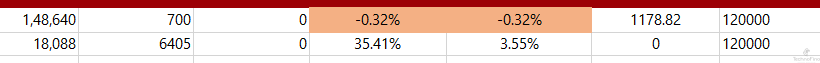

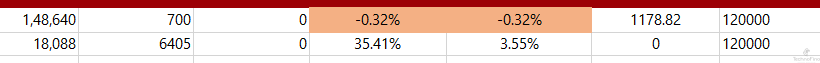

In above image it is 2 years spends, and if you see first year I got negative returns with payment and even with joining benefits but after redeeming some points in 2nd year, I got some positive returns. This is old card helped me to analyze my spends and cancelled because not satisfied with its rewards at that time - and also it gave me '0' discounts in 2 years means never availed any offer, instant discounts etc. so its completely useless to me.

Few more points:

- Unless you received them in statement or redeemed as some voucher, never include them in your returns. When time comes, things may change and value may decrease.

- Always include annual fee in your calculation and with that you have to get positive return (same for any service).

- Like

@Martius mentioned, if you can't redeem in 1st year then return for that year is still 0% or negative if joining fee paid but not availed any discounts/cashback to get that amount. 2nd year when you redeem actually then you have to include in your calculation.

Again, this is my process may vary and needs constant understanding of statement spends (not buy and forget).

Do let me know if you see any flaw in it..