Hi, This morning I made a payment of Rs.1900 through the Tata Neu app using TATA NEU Inf cc

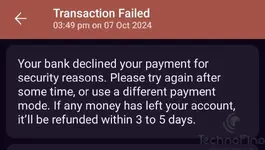

It was successful but after that payment, I tried to pay again to the same merchant but it's not working

I tried all my Rupay cards and none of them worked

I tried many upi apps and tried paying for different merchants: Not working

I am a medium user and don't pay huge amounts regularly (maybe 3-4 payments a day or less than that and ranges 10-400)

I know sometimes it happens due to tech issues from bank end but for all cards????

I don't know why, but all of a sudden all the cards stopped working.

I paid the remaining amount through my father's Rupay cc and it's working fine

Need ur thoughts on this...

It was successful but after that payment, I tried to pay again to the same merchant but it's not working

I tried all my Rupay cards and none of them worked

I tried many upi apps and tried paying for different merchants: Not working

I am a medium user and don't pay huge amounts regularly (maybe 3-4 payments a day or less than that and ranges 10-400)

I know sometimes it happens due to tech issues from bank end but for all cards????

I don't know why, but all of a sudden all the cards stopped working.

I paid the remaining amount through my father's Rupay cc and it's working fine

Need ur thoughts on this...