Nothing Exciting at all.....

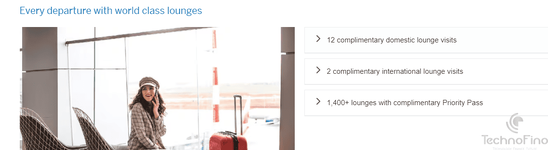

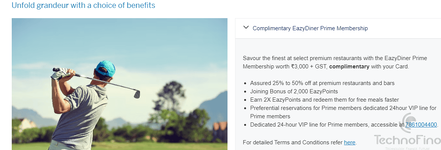

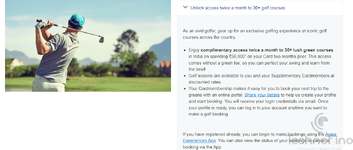

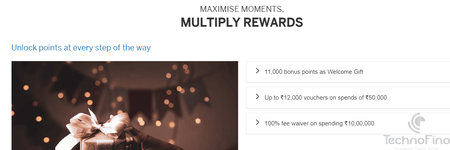

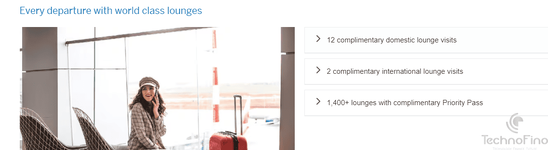

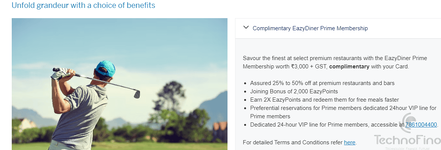

Platinum Reserve Credit Card Benefits | AMEX India

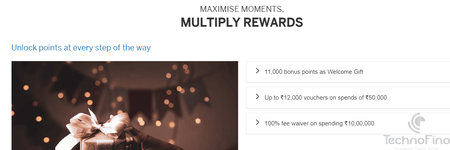

Platinum Reserve Credit Card comes with many benefits which makes life easy. Check out where you can use your card.

www.americanexpress.com

Last edited: