Thank you. The matter is clearer now. I don't know whether I will go in for Burgundy a/c now if primary member has to maintain 30L worth FDs. My idea was to have FDs in my mother's name as she is a senior citizen to benefit from the extra 0.5% interest.

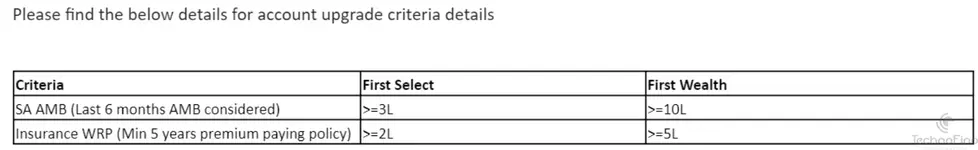

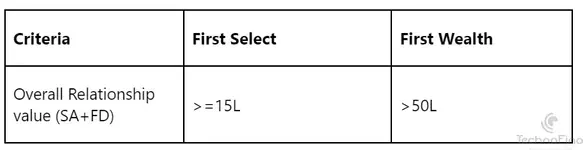

I checked the pdf you shared. It says this about eligibility criteria.

"On going eligibility criteria, calculated at a Customer ID level or Family ID level:" So it is still possible that 30L TRV is at family level. No where it is mentioned that it has the primary member. Just my feeling only.

But I take your word for eligibility criteria more than my RM's as you seem to have good experience with Axis. I will go in for a lower variant of banking program. It is useless to maintain such a TRV when the benefits are almost nil except for the BMS BOGO offer.

If not Burgundy, which other banking program do you suggest where the charges for ATM withdrawals, DC charges, cheque charges etc are nil or minimal? I will not be holding Axis salary account soon. So I need to plan quickly.

@SSV, if possible pls advice.

I am open to move away from Axis too. But will be tied to Axis for a year as I already have an FD. So will need continue with a SB a/c in Axis too.