gaman809

TF Buzz

hey

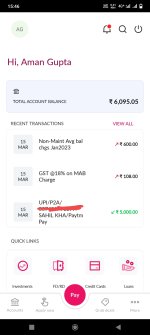

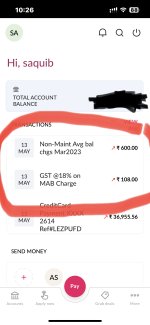

when i opened account someone from axis bank told me that if i created a fd of 25k I don't need to maintain the balance. i confirmed this when i did kyc with their agent.

but today i got charged 700 (600+18%gst) for not maintaining the balance. axis is such a worst bank ever. now what should i do?

can someone help me !!!

when i opened account someone from axis bank told me that if i created a fd of 25k I don't need to maintain the balance. i confirmed this when i did kyc with their agent.

but today i got charged 700 (600+18%gst) for not maintaining the balance. axis is such a worst bank ever. now what should i do?

can someone help me !!!