22sumit

TF Select

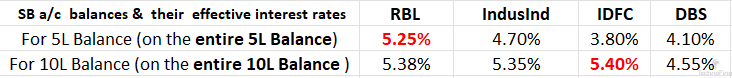

I need to park some emergency funds ranging from 3-4 L but not sure of which bank will provide best interest rate on savings account.

I already have HDFC salary acct, ICICI and IDFC Classic accounts but the interest isn' that good.

Any premium LTF cc would be icing on the cake but not mandatorily.

Please suggest.

I already have HDFC salary acct, ICICI and IDFC Classic accounts but the interest isn' that good.

Any premium LTF cc would be icing on the cake but not mandatorily.

Please suggest.