Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Cibil defaults wipe off?

- Thread starter cardex

- Start date

-

- Tags

- cibil cibil report

Likely never 😐When is this settlement likely to be erased from cibil? Or such defaults stay forever?

Shubham Yadav

TF Prestige

If you don't mind tell us what was happened?When is this settlement likely to be erased from cibil? Or such defaults stay forever?

cardex

TF Premier

cc settlementsIf you don't mind tell us what was happened?

It will not be removed, it only be changed to closed. You have to pay the full outstanding to get it closed. You will not get any other card until its closedWhen is this settlement likely to be erased from cibil? Or such defaults stay forever?

No it does not. I had the same issue, i had settled in 2009 and remained like that till 2018 when i finally closed as i was not getting any cardsI heard it gets wiped off after 7 years?

cardex

TF Premier

Well I seem to be lucky one, I am holding cards from same bank issued a year back , and other banks😆No it does not. I had the same issue, i had settled in 2009 and remained like that till 2018 when i finally closed as i was not getting any cards

In Transunion CIBIL it does NOT. In Experian & Equifax it will drop off after 6 years, i.e on the 7th year !I heard it gets wiped off after 7 years?

In Transunion-CIBIL yes it will stay forever, however on Experian & Equifax it will drop off (get deleted) after completing 6 years !When is this settlement likely to be erased from cibil? Or such defaults stay forever?

Closed as in ? Repaid back the balance amount from the total dues minus the settled amount ? If you do not mind which bank was it & how did you approach them after so many years ?No it does not. I had the same issue, i had settled in 2009 and remained like that till 2018 when i finally closed as i was not getting any cards

cardex

TF Premier

7ty year.from? Default report date or settlement date? Beside are not Experian and Equifax reports are useless as hardly any banks refers to them it seems? We don't get a hard enquiry notification from these, but CIBIL.In Transunion CIBIL it does NOT. In Experian & Equifax it will drop off after 6 years, i.e on the 7th year !

Yes, total amount (written off amount) - settled amount. HDFC bank, reached out to their branch and they gave me an address for their collection branch. Visited them and they gave a letter with payment details and made the payment and they issued NOC. Status changed to closed in CIBIL after 60 days.Closed as in ? Repaid back the balance amount from the total dues minus the settled amount ? If you do not mind which bank was it & how did you approach them after so many years ?

7th year from the settlement date, for sure. Yes, both are not as popular in India when compared to Transunion-CIBIL, however now a days more & more lenders are checking Experian too i.e HDFC, AXIS, YES, ABFL, RBL to name a few !7ty year.from? Default report date or settlement date? Beside are not Experian and Equifax reports are useless as hardly any banks refers to them it seems? We don't get a hard enquiry notification from these, but CIBIL.

Few banks check historic data too & will never issue you a card / loan if your DPD for any CC or loan shows a DPD of "90" or more irrespective of your "current" score & payment history ..

Last edited:

cardex

TF Premier

So any bank which offers cc on C2C basis, without income docs without physical verification just on the basis of card image and card statement, and on good cibil and excellent Experian?7th year from the settlement date, for sure. Yes, both are not as popular in India when compared to Transunion-CIBIL, however more & more lenders these days are checking Experian too these days i.e HDFC, AXIS, YES, ABFL, RBL to name a few !

Few banks check historic data too & will never issue you a card / loan if your DPD for any CC or loan shows a DPD of "90" or more irrespective of your "current" score & payment history ..

Thanks so much for the info. Did they correct the DPD too ?Yes, total amount (written off amount) - settled amount. HDFC bank, reached out to their branch and they gave me an address for their collection branch. Visited them and they gave a letter with payment details and made the payment and they issued NOC. Status changed to closed in CIBIL after 60 days.

Is it true that apparently HDFC never issues you a card again if you have previously defaulted on a HDFC CC or if your card has gone into collections with them, even if you pay the entire dues off ? HDFC apparently will just keep your card account in suspended / inactive for use status & never issue you a card again even after receiving the full payment on the defaulted card citing "irregular payments on previous card" ? Did HDFC issue you a card again after you paid the total amount ?

Any information in regards to this will be helpful. Thank you bro

Last edited:

Try Rbl, Sbi, Yes bank in that orderSo any bank which offers cc on C2C basis, without income docs without physical verification just on the basis of card image and card statement, and on good cibil and excellent Experian?

Up to 3 hard enquires in 3 months is acceptable. Also, hard enquiries drop off from CIBIL after 3 years. So, you can try if you didn't have too many enquiries in the recent past.SBI I have 2 cards, RBL yes yet to try Had a hard enquiry on cibil just yesterday afraid to generate one more so soon.

cardex

TF Premier

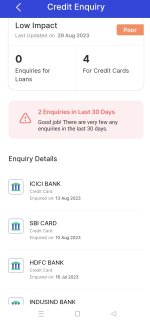

How to distinguish between hard and soft enquiry like I applied for card, got a enquiry mail from cibil, your status has changed after 10-15 minutes, that a soft or hard? The enquiries shown in reports of app like gpay, one score are they hard or soft?Up to 3 hard enquires in 3 months is acceptable. Also, hard enquiries drop off from CIBIL after 3 years. So, you can try if you didn't have too many enquiries in the recent past.

Attachments

Similar threads

- Question

- Replies

- 35

- Views

- 5K

- Question

- Replies

- 64

- Views

- 4K

- Replies

- 20

- Views

- 477

- Replies

- 16

- Views

- 982

- Replies

- 7

- Views

- 1K