CIBIL Score - A Practical Guide

Discalimer: This is mainly for regular Credt Card users who pay all their dues before due date and wondering why their score is not increasing..

Here we dont discuss the cases where there were defaults and / or delayed payments..that is for another day..

Discalimer: This is mainly for regular Credt Card users who pay all their dues before due date and wondering why their score is not increasing..

Here we dont discuss the cases where there were defaults and / or delayed payments..that is for another day..

Ladies and Gentelmen,

Here is the much awaited post on CIBIL Score and how it works and what we should do to improve it over the period of the time..

Here I won't go in detail about how the score is constructed as there were numerous posts on the internet in explaining the CIBIL score in an academic way..

Here we will concentrate more on practical things..

Lets get started..

CIBIL Score's main constituents:

1) Payment History

2) Utilisation

3) Number of Enquiries in the recent past

4) Credit age..

5) Credit Mix

1) Payment History

We should pay all dues before the due date in order to have an excellent score and minimum fainancial burden on us.. This many of us do anyway..

TIP: we should atleast pay Minimum Amount Due( MAD) before the due date atleast - this will safeguard the score,

but will impact us financially if we pay only MAD and leave the rest...

Best practice:

1) Pay MAD immediately after the bill is generated - This will protect the score, in case you failed to pay the full before due date.

2) Pay the full amount due at least 5 days before due date. - ideal case scenario.

3) Pay the full amount even before the bill generations / month end- the best case scenario- will discuss this in detail at the end..

2) Utilisation

There is a notion that if we have <30% overall utilisation then it is good..

Lets dig deep into this..

The prinicple is : the higher the utilisation ratio, the lower the score.. and vice versa ...Period..

So, the aim should be the utilisation ratio should be as minimal as possible. ( it can even go into -ve, this is the best case scenario)..

How this works practically:

It works in range bound basis: like 0 to 10 % , 10 - 20 % and 20 - 30% etc.

Note: these exact range numbers are hypothitical.. trying to explain the logic...

For example: 0- 10% utilisation ratio will have better score than 10- 20% and

10- 20% utilisation ratio will have better score than 20- 30% ratio..

Once it crosses 30% utilisation ratio it will have big negative impact on the score.. hence need to maitain less than 30% ratio to have a decent score.

Tip:

This uitlisation ratio is calculated both on

1) overall basis ( on all accounts together) and

2) Individual account level basis..

Both of the above ratios will have their weightage in the score construction.

Example:

You have 10 accounts with a total of 10 Lakhs sanctioned limit and total utilisation of 2 Lakhs

Here the overall utilisation is: 20%, which is okay as it is under 30%..

But if one of the accounts has 50% utilisation ( ie, one account which has 1L limit and utilsation with 50K).

In this case , score will have big negative impact even though your overall is less than 30%...

BEST practice:

Make sure each and every account utilisation is less than 30% to start with

and as low as possible to have as better score as possible.. ( It can go to negative as well .. this is the best possible scenario)...

3) Number of Enquiries

This is where a lot of people have confusion..

The basic rule:

The longer the credit history , the lesser the impact of number of enquiries on the Credit score...

In practical terms:

Once your credit history crosses the age of 5 years, the no. of enquiries' negative impact diminishes..

Say if you have 6 years of credit history, then 5 or 10 enquireis in the past 1 to 3 months will not have any impact on the score.

If your credit history crosses 10 - 15 years , you can safely forget about the concept of number of enquiries...

TIP:

Even if your credit score is impacted because of no of enquiries, the score will recover pretty fast ie. within 2 to 3 months.

Only people with less than 5 years of credit history should be careful about the no of enquiries..

Update added on 11/01/2025

Note: There are two types of Enquiries (aka credit report pulls).

1) Soft Pulls

2) Hard Pulls

Detailed discussion was added as an Annexure 1, at the end. Please check for it at the end of this article.

4) Credit age

The longer the Credit age the better the score and score's stability...

For a person who has a credit age of 15 to 20 years, the fluctuation in his/ her score is very minimal...

Again, after the age of 5 years , the score will get a bit of the boost and started to get stabilised..

Obviously the more older the credit profile the better.

when you are trying to close your oldest credit card account, please check what is the second oldest account's age, if it is more than 5 years, no need to worry..

TIP:

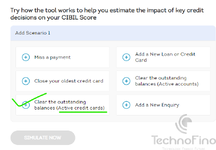

Check score predictor in the offical CIBIL app and predict your score by selecting the oldest card's closure.. this will give a very accurate prediction in my experience.

5) Credit Mix

Obviously, a mix of sceured and unsecured loans is a better indicator rather than having only unsecured loans...

However, what I observed in practice, except for Home loan all other Secured loans have no / minimal postive impact on the score..

Home Loan- will definitely improve your score by around 10 points.

Gold Loan and Loan against FD - have no positive impact on the score in my experience. in fact it had a negative impact as it is carrying some current balances..

Auto Loan - also may not have a positive impact..

Now coming to some other interesting bits:

SSV's Pro Tip:

1) Make current balances <=0 on each and every account as on Reporting Date ..

Maitain 0 or negative current balances on all accounts to get a boost of about 10 points to your score

Then you may ask what is the purpose of having 45 /50 days of free credit period..

Correct. this may not be useful for those who want to utilise full free credit days, but for those who want to boost their credit score for any other purposes temporarily this is one of the great tools which is in our hand..

I will also tell how to get this 0 utlisation along with availing free credit period to some extent for some bank credit cards..

We all know that different banks report balances on different dates.

We classify them as banks reporting balances as on

1) month end

2) bill generation date

The KEY here is current balances as on REPORTING Date ...

This Reproting date can be month end or bill generation date depending upon the bank.

1) For those that report balances as on month end ie.

AXIS, BOB, HDFC, HSBC, IndusInd, IDFC, Kotak, RBL , Stan C, YES ........

For these banks, make sure your due date falls on 1st of every month, so that means, your statement generation datee should be around 14th of every month so that bill DUE date is around 1st or 2nd of the following month...

In this case, you can have your full amount outstanding as on 14 th, but pay the full amount by 30th of every month..

So at the end, your current oustanding balances should <= 0 as on 30th.. this solves the issue.

2) For those banks who report on bill generation date, there is no escape: you have to pay just before bill generation date and make sure bill amount is <= 0,,,

2) HIGH Credit in CIBIL report:

There is one data item called " HIGH credit " in CIBIL report..

what it means : the highest amount used / billed in any credit account during the life time of that account...

This generally doesn't have any direct impact on the credit score except in the cases of charge cards like amex Gold, Platinum cards etc where there is no set sanctioned limit..

This was applicable until recentlty on HDFC cards as well, but HFDC now reports sanctioned limits to credit bureaus..

However, this data item potentially will be useful for lenders to know more about us with regard to

1) Potential high spender

2) giving better credit limits at the time of application..

I am not sure if the Indian lenders are incorporating this in their credit card application evaluation as of now.. I am sure in future they may use this..

How this should work:

Total amount used ie. debited duiring a staetment period should reprorted as HIGH Credit to the bureaus..

Scenario 1:

Take a case of what I generally do:

I have a card with sanctioned limit of 5L and I use it for 2L in one month and pay in full before the bill generation date.

This is how it will be reprted in this case:

Sanctioned Limit: 5L

High Limit : 2L

Current Balance : 0

This stat should WOW a potential lender towards me.. Why?

I am using 40% of sanctioned limit and paying in full back to account before the bill generation.

Means I am a high spender and very obedient in paying back before bill generation date..

and hence they should love to give me their card with generous limits..

Scenario 2:

Take another example of oppostie side:

Sacntioned limit: 5L

High limit :20K

current balance: 20K

In this case, Bank is wasting sanctioned limit on this person, as he is only using 4% of sacntioned limit ..

So , in this case this customer is not a high spender ( hence not much income to the Bank) and there is no point in giving him higher limits as well ..

As per my observation only SBI and Amex is reprortng this HIGH limit correctly in true sense.

(--EDIT: YES bank is also doing the same as per @reach2dpg )

ie.

same example:

spends of 2L , paying full before bill generation:

SBI and AMEX reported

as CL :5L

High Limit 2L and

Curre balance : 0

where as all other banks reported as

CL :5L

High Limit : 0 and

Curr Balance :0..

For other banks to report correct high limit ,we need to have full balance outstanindg as on bill generation date at least for one statement period....

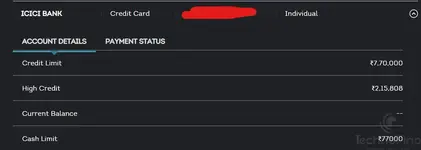

Look at the example of my ICICI account

In the above example, my highest bill oustanding duirng one statement period was 2.15 L out of 7.7L sanctioned amount ..and current balance is Zero..

Means I am a good boy. A high spender who pays bills before bill generation.. Banks would love persons like these...

So, with regard to HIGH limit:

My TIP:

Use your card just once for a very big amount and get it reported as HIGH limit , and from then on-wards use as per your normal usage...

This post became too big..but I wanted to share all my knowledge as far as CIBIL score is concerned..

All the best guys...

Have fun

Enjoy.....

Annexure 1: (updated on 11/01/2025)

Soft Pull vs Hard pull..

any Credit bureau database is like a restricted repository in the sense that every entry / update of any data item and reading of any data must be done with set procedures and all the db transactions will be recorded else where ( ig) ..

and hence if we ask them to correct any wrongful data , the credit bureau agency can't do it themselves and it has to come from the source only..

Likewise , any reading of the data also will follow certain rules..

that is why any pull of the data will also be recorded elsewhere..

then here comes the soft pull and hard pull..

Hard pull:

When a borrower / applicant lodges any application about any credit product, then all the relvant data ( comoplete data set) will be retrieved by the lender in order to make a decision .. ( approval / rejection).. this hard pull will be recorded as an enquiry in the customer's profile..

so the characteristics are :

1) specific application need to be made

2) an explicit permission should be decalred by the applicant to allow the lender to pull all credit data

3) will be stored in the customer's profile as an enquiry.

4) all data set will be pulled by the lender and will be used to make a decision of approval / rejection by the lender

5) As this hard pull is recorded in one's profile, it will play its limited role in determining the credit score of the customer

6)

Soft Pull:

The puropse of this soft pull is entirely different.. It is to know the basic credit data of the customer ( ie. high level data, not the entire data items in one's credit profile ) for example: credit score, no of accounts, etc...

It will be mainly used to profiling the customer for their internal purposes ... not used for any decision with regard to any application ..

Characteristcs are:

1) No applcaiton need to be made by the applicant

2) no permission need to be given to the lender

3) will be generally used for providing pre-approved offers , like ( card upgrade, LE , offering any other products etc).

4) It will not be stored in the db as no specific application / request was made by the customer and hence no impact on the score..

5) when we refresh our score in any app/ cibil app/ wbesite , it is also considered as softpull.. in this case we are using this to understand our score / proifle..

6)When we refresh our report . It is considered as a soft pulll, you won’t see any enquiry in the enquiries section for our refresh.

You can refresh every day.. nothing happens to the score..

Last edited: