Axis Bank has finally decided to move Citibank credit card customers to its core credit card system. Axis Bank has already launched some new card variants to migrate Citibank credit card users to Axis Bank with almost the same benefits.

Here is the list of Axis Bank credit cards that will be migrated from Citibank:

This migration process will take place in phases. According to some reports, the first phase will be completed by 9th June 2024, and the entire process should be completed by the following month.

Reward points on your existing Citibank credit card will be transferred to the Axis EDGE reward system for free at the time of migration. Here is the list of transfer rates below:

Axis Bank's new credit card transfer rates to its partner programs:

Key Benefits Of New Axis bank Credit Cards:

Axis Bank Olympus Credit Card:

Annual Fees: Rs. 20,000 + GST

Welcome & Renewal Benefits:

1. Taj/ITC Hotel Voucher: Rs. 10,000

2. EDGE Miles: 2500

Main Benefits:

1. Unlimited airport lounge access worldwide for primary & add-on card holders plus 20 free guest visit per year.

2. 2 complimentary domestic airport transfer for primary card holder.

3. 8 complimentary domestic airport meet and greet service.

4. 8 complimentary golf lessons/rounds per year (primary card holder plus 1 guest); additional 1 golf game/lesson for every Rs. 50,000 spent per year.

5. BookMyShow buy one get one free offer on movie & non-movie tickets. Maximum discount: Rs. 650 (Movie) & Rs. 1000 (Non-Movie) per ticket; offer can be used maximum 2 times for movie & 2 times for non-movie tickets per month.

6. Discounted forex currency markup fees: 1.80%

Reward System:

Earn 1 EDGE Mile for every Rs. 100 spent in India.

Earn 2 EDGE Miles for every Rs. 100 spent outside India.

Excluded MCCs: (List of categories, you'll not earn reward points)

➢ Transportation & Tolls (4111, 4121, 4131,4784)

➢ Utilities (4814,4816,4899,4900)

➢ Insurance (6300,6381,5960,6012,6051)

➢ Educational Institutions (8211,8241,8244,8249,8299)

➢ Govt. Institutions (9211,9222,9311,9399,9402,9405,8220)

➢ Wallet (6540)

➢ Rent (6513)

➢ Fuel (5541,5542,5983)

Reward Redemption:

You can redeem your EDGE Miles to book flight or hotels directly from traveledge portal & you can transfer your reward points to various partner programs.

1 EDGE Mile = 4 Partner Points

Reward Rate:

Domestic: 4% Partner Points

International: 8% Partner Points [5.87% if we consider 1 Partner Point = Rs. 1 and deduct markup fees]

For detail review visit card review here: [link will be added]

Axis Bank Horizon Credit Card:

Annual Fees: Rs. 3,000 + GST

Welcome benefits:

EDGE Miles: 5000

Renewal Benefits:

EDGE Miles: 1500

Main Benefits:

1. Domestic Lounge Access: 6 Complimentary lounge access for Mastercard variant holders & 8 complimentary lounge access for Visa variant holders per calendar quarter.

2. International Lounge Access: 2 Complimentary lounge access per calendar quarter.

3. Dining Discount With EazyDiner: 25% discount up to Rs. 800 per month; minimum order value: Rs. 2500; Offer can be used once a month.

Reward System:

1. Earn 5 EDGE Miles for every INR 100 spent on Axis Traveledge portal and airline websites.

2. Earn 2 EDGE Miles for every INR 100 spent on other categories.

Excluded MCCs: (List of categories, you'll not earn reward points)

➢ Transportation & Tolls (4111, 4121, 4131,4784)

➢ Utilities (4814,4816,4899,4900)

➢ Insurance (6300,6381,5960,6012,6051)

➢ Educational Institutions (8211,8241,8244,8249,8299)

➢ Govt. Institutions (9211,9222,9311,9399,9402,9405,8220)

➢ Wallet (6540)

➢ Rent (6513)

➢ Fuel (5541,5542,5983)

Reward Redemption:

You can redeem your EDGE Miles to book flight or hotels directly from traveledge portal & you can transfer your reward points to various partner programs.

1 EDGE Mile = 1 Partner Points

Reward Rate:

Traveledge & Airlines: 5% Partner Points

Other: 2% Partner Points

For detail review visit card review here: [link will be added]

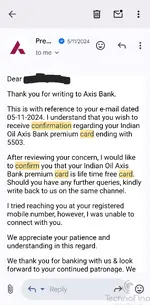

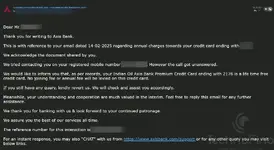

The new Axis Bank credit cards look good if we consider their benefits. However, in terms of rewards, even the Axis Olympus card has many exclusions. Despite this, it is still a good card for international spending. In terms of reliability, Axis Bank doesn't come close to Citibank. This is the main reason almost all Citibank customers were very unhappy with the Citibank and Axis Bank deal earlier last year. Unfortunately, we cannot do anything but accept this migration. If you don't want to continue with your Citibank cards, you can close them; you will not be charged any renewal or migration fees at this time. Renewal fees will be levied at the usual time of your card renewal. The Citi PremierMiles and Citi Prestige cards were some of the best and most reliable for accumulating air miles. Personally, I will never rely on Axis Bank, as they can send you notices and ask for transaction clarifications from the past year, even for very small amounts.

This is the end of an era.

Here is the list of Axis Bank credit cards that will be migrated from Citibank:

Citi Bank Existing Credit Card | New Axis Bank Credit Card | |

|---|---|---|

| Citi Rewards Credit Card | Axis Bank Rewards Credit Card | |

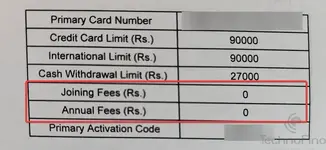

| IndianOil Citi Credit Card | Indian Oil Axis Bank Premium Credit Card (New Card) | |

| Citi IKEA Credit Card | IKEA Family Credit Card By Axis Bank (New Card) | |

| Citi Cashback Credit Card |

| |

| Citi PremierMiles Credit Card | Axis Bank Horizon Credit Card (New Card) | |

| Citi Prestige Credit Card | Axis Bank Olympus Credit Card (New Card) | |

| First Citizen Citi Credit Card | Axis Bank Shoppers Stop Credit Card (New Card) |

This migration process will take place in phases. According to some reports, the first phase will be completed by 9th June 2024, and the entire process should be completed by the following month.

Reward points on your existing Citibank credit card will be transferred to the Axis EDGE reward system for free at the time of migration. Here is the list of transfer rates below:

Citi Bank Credit Card | Axis Bank Credit Card | Reward Transfer Rate | ||

|---|---|---|---|---|

| Citi Rewards Credit Card | Axis Bank Rewards Credit Card | 1 Reward Point = 1.75 EDGE Rewards | ||

| IndianOil Citi Bank Credit Card | IndianOil Premium Axis Bank Credit Card | 1 Turbo Point = 1 EDGE Miles | ||

| Citi IKEA Credit Card | IKEA Family Credit Card By Axis Bank | |||

| Citi Cashback Credit Card |

| |||

| Citi PremierMiles Credit Card | Axis Bank Horizon Credit Card | 1 Premier Mile = 0.45 EDGE Miles | ||

| Citi Prestige Credit Card | Axis Bank Olympus Credit Card | 1 Prestige Mile = 1 EDGE Miles |

Axis Bank's new credit card transfer rates to its partner programs:

| Credit Card Name | Transfer Rate | Capping |

|---|---|---|

| Axis Bank Rewards Credit Card | 10 EDGE Reward Points = 1 Partner Point (Vistara, AirAsia, ITC, and SpiceJet: 5 EDGE Reward Points = 1 Partner Point) | Overall Transfer Capping: 5,00,000 Group A: 1,00,000 Group B: 4,00,000 |

| IndianOil Premium Axis Bank Credit Card | 2 EDGE Miles = 1 Partner Point (IOCL XTRAREWARDS: 3 EDGE Miles = 10 Partner Points) | Overall Transfer Capping: 5,00,000 Group A: 1,00,000 Group B: 4,00,000 |

| IKEA Family Credit Card By Axis Bank | 20 EDGE Reward Points = 1 Partner Point (Vistara, AirAsia, ITC, and SpiceJet: 10 EDGE Reward Points = 1 Partner Point) | Overall Transfer Capping: 5,00,000 Group A: 1,00,000 Group B: 4,00,000 |

| Axis Bank Horizon Credit Card | 1 EDGE Mile = 1 Partner Point | Overall Transfer Capping: 5,00,000 Group A: 1,00,000 Group B: 4,00,000 |

| Axis Bank Olympus Credit Card | 1 EDGE Mile = 4 Partner Points | Overall Transfer Capping: 7,50,000 Group A: 1,50,000 Group B: 6,00,000 |

Key Benefits Of New Axis bank Credit Cards:

Axis Bank Olympus Credit Card:

Annual Fees: Rs. 20,000 + GST

Welcome & Renewal Benefits:

1. Taj/ITC Hotel Voucher: Rs. 10,000

2. EDGE Miles: 2500

Main Benefits:

1. Unlimited airport lounge access worldwide for primary & add-on card holders plus 20 free guest visit per year.

2. 2 complimentary domestic airport transfer for primary card holder.

3. 8 complimentary domestic airport meet and greet service.

4. 8 complimentary golf lessons/rounds per year (primary card holder plus 1 guest); additional 1 golf game/lesson for every Rs. 50,000 spent per year.

5. BookMyShow buy one get one free offer on movie & non-movie tickets. Maximum discount: Rs. 650 (Movie) & Rs. 1000 (Non-Movie) per ticket; offer can be used maximum 2 times for movie & 2 times for non-movie tickets per month.

6. Discounted forex currency markup fees: 1.80%

Reward System:

Earn 1 EDGE Mile for every Rs. 100 spent in India.

Earn 2 EDGE Miles for every Rs. 100 spent outside India.

Excluded MCCs: (List of categories, you'll not earn reward points)

➢ Transportation & Tolls (4111, 4121, 4131,4784)

➢ Utilities (4814,4816,4899,4900)

➢ Insurance (6300,6381,5960,6012,6051)

➢ Educational Institutions (8211,8241,8244,8249,8299)

➢ Govt. Institutions (9211,9222,9311,9399,9402,9405,8220)

➢ Wallet (6540)

➢ Rent (6513)

➢ Fuel (5541,5542,5983)

Reward Redemption:

You can redeem your EDGE Miles to book flight or hotels directly from traveledge portal & you can transfer your reward points to various partner programs.

1 EDGE Mile = 4 Partner Points

Reward Rate:

Domestic: 4% Partner Points

International: 8% Partner Points [5.87% if we consider 1 Partner Point = Rs. 1 and deduct markup fees]

For detail review visit card review here: [link will be added]

Axis Bank Horizon Credit Card:

Annual Fees: Rs. 3,000 + GST

Welcome benefits:

EDGE Miles: 5000

Renewal Benefits:

EDGE Miles: 1500

Main Benefits:

1. Domestic Lounge Access: 6 Complimentary lounge access for Mastercard variant holders & 8 complimentary lounge access for Visa variant holders per calendar quarter.

2. International Lounge Access: 2 Complimentary lounge access per calendar quarter.

3. Dining Discount With EazyDiner: 25% discount up to Rs. 800 per month; minimum order value: Rs. 2500; Offer can be used once a month.

Reward System:

1. Earn 5 EDGE Miles for every INR 100 spent on Axis Traveledge portal and airline websites.

2. Earn 2 EDGE Miles for every INR 100 spent on other categories.

Excluded MCCs: (List of categories, you'll not earn reward points)

➢ Transportation & Tolls (4111, 4121, 4131,4784)

➢ Utilities (4814,4816,4899,4900)

➢ Insurance (6300,6381,5960,6012,6051)

➢ Educational Institutions (8211,8241,8244,8249,8299)

➢ Govt. Institutions (9211,9222,9311,9399,9402,9405,8220)

➢ Wallet (6540)

➢ Rent (6513)

➢ Fuel (5541,5542,5983)

Reward Redemption:

You can redeem your EDGE Miles to book flight or hotels directly from traveledge portal & you can transfer your reward points to various partner programs.

1 EDGE Mile = 1 Partner Points

Reward Rate:

Traveledge & Airlines: 5% Partner Points

Other: 2% Partner Points

For detail review visit card review here: [link will be added]

The new Axis Bank credit cards look good if we consider their benefits. However, in terms of rewards, even the Axis Olympus card has many exclusions. Despite this, it is still a good card for international spending. In terms of reliability, Axis Bank doesn't come close to Citibank. This is the main reason almost all Citibank customers were very unhappy with the Citibank and Axis Bank deal earlier last year. Unfortunately, we cannot do anything but accept this migration. If you don't want to continue with your Citibank cards, you can close them; you will not be charged any renewal or migration fees at this time. Renewal fees will be levied at the usual time of your card renewal. The Citi PremierMiles and Citi Prestige cards were some of the best and most reliable for accumulating air miles. Personally, I will never rely on Axis Bank, as they can send you notices and ask for transaction clarifications from the past year, even for very small amounts.

This is the end of an era.

Last edited: