Patil007

TF Legend

😍

I am very happy today, As I got my dream card, Axis ACE.

I am normal spender, so I never dreamt for super premium cards, ACE was my dream card and got it today. All thanks to this wonderful @TechnoFino community 💕.

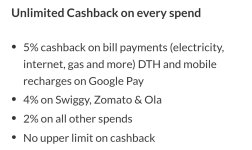

My other spend is more and Ace is perfect for that, also Utility bill payment is add on to that.

I am using GPay since very long but never got ACE banner or maybe it was there but I was not aware about credit card much before this community exist. but by reading ACE threads in this community, I come to know that we can apply from family members account as well.

My brother use only one UPI app i.e. GPay for all spend including utility bill payment. I checked his GPay and banner was there and applied from his account (His mobile number, email + my PAN card) and done. Instantly video Kyc done and on 7th day, I got card 👍🙂

I am very happy today, As I got my dream card, Axis ACE.

I am normal spender, so I never dreamt for super premium cards, ACE was my dream card and got it today. All thanks to this wonderful @TechnoFino community 💕.

My other spend is more and Ace is perfect for that, also Utility bill payment is add on to that.

I am using GPay since very long but never got ACE banner or maybe it was there but I was not aware about credit card much before this community exist. but by reading ACE threads in this community, I come to know that we can apply from family members account as well.

My brother use only one UPI app i.e. GPay for all spend including utility bill payment. I checked his GPay and banner was there and applied from his account (His mobile number, email + my PAN card) and done. Instantly video Kyc done and on 7th day, I got card 👍🙂