Karan.

TF Legend

A little help is needed, friends.

I have four savings accounts under family banking with HDFC so 40k is struck, currently all in Preferred, each maintaining a balance of 10k with no extra funds, as all my money is invested in mutual funds.

Although I used to be a preferred customer, the bank recently sent me a mail notifying that they will downgrade all my accounts. I assume it to a standard category.

Right now no charges were being deducted as all accounts were Preferred category customer.

Now, they will downgrade so I have some Qs.

Purpose: Want to pay minimum to maintain these accounts in charges. I don't need anything from the Bank but hate unnecessary charges. Will be keeping 10k in each account.

I have four savings accounts under family banking with HDFC so 40k is struck, currently all in Preferred, each maintaining a balance of 10k with no extra funds, as all my money is invested in mutual funds.

Although I used to be a preferred customer, the bank recently sent me a mail notifying that they will downgrade all my accounts. I assume it to a standard category.

Right now no charges were being deducted as all accounts were Preferred category customer.

Now, they will downgrade so I have some Qs.

Purpose: Want to pay minimum to maintain these accounts in charges. I don't need anything from the Bank but hate unnecessary charges. Will be keeping 10k in each account.

- What all charges will start applying after downgrade to Standard Account, other than Insta Alerts and AMB non-fulfilment, i'll close the account which is not essential?

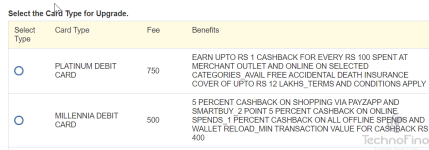

- If I opt for the popular EasyShop Visa Platinum Debit card or Millenia Debit card now, should I issue it now as the charges are reversed from Preferred Category and save the the annual fee, which is around 850/600 something for 1 year, or will they charge no matter what? Right now have a Easyshop Rupay card(The 200 one).

Attachments

Last edited: