5X Reward Points Offer

Make every online load and reload on your HDFC Bank ForexPlus Card more rewarding! Use your HDFC Bank Credit Card and activate the power of 5X Reward Points Multiplier on every transaction.

5X Reward points offer details

Issuance Fee Waiver Offer

There is another offer running on the issuance of an HDFC ForexPlus card where the joining fees get waived if you load a minimum of 1,000 USD or equivalent value of another currency. Check this out.

My Experience

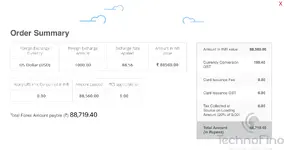

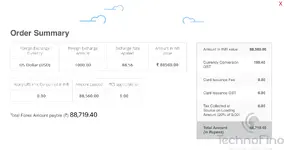

Since I have an international trip planned next month to Japan I tried to apply HDFC ForexPlus Card (multicurrency card) and load some 2,00,000 Yen to the card to compare the actual reward rate. While Google is showing the exchange rate of 2L Yen equal to 112150 INR, HDFC is charging me some 1,16,695 INR including loading charges of around 195. It equates to a direct loss of approximately 4.01% since HDFC has higher Forex rates. But with a 16.66% (5X) reward rate on my Diners Club Black credit card, this deal is too good since it would leave me a net reward rate of 12.65% which handsomely beats even the reward rates of Axis Olympus and Axis Reserve. This is a good offer especially if you hold Diners Black or above credit cards.

Loading in USD is proving to be much cheaper since only approximately 2% charge is being applied so if you want to get a card then go for Regalia Plus Forex card since although it can be loaded only in USD but can be used to pay in any currency worldwide since it has zero cross currency markup charges.

Make every online load and reload on your HDFC Bank ForexPlus Card more rewarding! Use your HDFC Bank Credit Card and activate the power of 5X Reward Points Multiplier on every transaction.

5X Reward points offer details

- Customers can earn 5X Reward Points for every Forex Card load/reload transaction made using eligible HDFC Bank Credit Cards.

- Minimum Transaction Value: Rs15,000 per transaction.

- Maximum Reward Points (RP): Customers can earn a maximum of 15,000 Reward Points per calendar month during the offer period.

Offer Period:

The 5X Reward Points Offer is valid for load / reload transactions settled between 1st January 2025 and 31st March 2025.

- Card TypeBase Earn Rate (1X)Additional 4XRP Capped at

15,000 RPsTotal: 5X RPMax Spends for 5XHDFC Bank Regalia First3RP/Rs.15012RP/Rs. 15015 RP/ Rs. 150187500HDFC Bank Regalia4RP/Rs.15016RP/Rs. 15020 RP/ Rs. 150140625HDFC Bank Regalia Activ4RP/Rs.15016RP/Rs. 15020 RP/ Rs. 150140625HDFC Bank Regalia Gold4RP/Rs.15016RP/Rs. 15020 RP/ Rs. 150140625HDFC Bank Diners Privilege/ HDFC Biz Power4RP/Rs.15016RP/Rs. 15020 RP/ Rs. 150140625HDFC Bank Diners Black5RP/Rs.15020RP/Rs. 15025 RP/ Rs. 150112500HDFC Bank Diners Black Metal/HDFC Biz Black Metal5RP/Rs.15020RP/Rs. 15025 RP/ Rs. 150112500HDFC Bank Infinia5RP/Rs.15020RP/Rs. 15025 RP/ Rs. 150112500HDFC Bank Infinia Metal5RP/Rs.15020RP/Rs. 15025 RP/ Rs. 150112500

- The offer is applicable exclusively for load / reload of HDFC ForexPlus Cards done using an HDFC Bank Credit Cards: HDFC Bank Regalia First, HDFC Bank Regalia, HDFC Bank Regalia Activ, HDFC Bank Regalia Gold, HDFC Bank Diners Privilege, HDFC Bank Diners Black, HDFC Bank Diners Black Metal, HDFC Bank Infinia and HDFC Bank Infinia Metal Credit Card

- 5X reward points will be credited as: 1X reward points + additional 4X Reward Points. Additional 4X reward points are capped at 15,000 reward points per calendar month. 1X reward points will continue as is without any capping

- A minimum spend of Rs. 15,000 per transaction is required to be eligible for additional 4X reward points

- The limits are over and above the limits of HDFC SmartBuy

Issuance Fee Waiver Offer

There is another offer running on the issuance of an HDFC ForexPlus card where the joining fees get waived if you load a minimum of 1,000 USD or equivalent value of another currency. Check this out.

My Experience

Since I have an international trip planned next month to Japan I tried to apply HDFC ForexPlus Card (multicurrency card) and load some 2,00,000 Yen to the card to compare the actual reward rate. While Google is showing the exchange rate of 2L Yen equal to 112150 INR, HDFC is charging me some 1,16,695 INR including loading charges of around 195. It equates to a direct loss of approximately 4.01% since HDFC has higher Forex rates. But with a 16.66% (5X) reward rate on my Diners Club Black credit card, this deal is too good since it would leave me a net reward rate of 12.65% which handsomely beats even the reward rates of Axis Olympus and Axis Reserve. This is a good offer especially if you hold Diners Black or above credit cards.

Loading in USD is proving to be much cheaper since only approximately 2% charge is being applied so if you want to get a card then go for Regalia Plus Forex card since although it can be loaded only in USD but can be used to pay in any currency worldwide since it has zero cross currency markup charges.

Last edited: