Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HDFC not reporting credit limit to CIBIL

- Thread starter CC_Fetish

- Start date

- Replies 125

- Views 14K

Solution

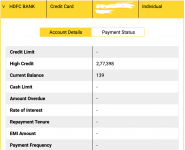

No, actually. High credit is the highest amount of credit limit has been used. The primary measurement factor, which is the credit limit provided by the bank, will not be present.

It'll help on one thing only, when banks will pull out credit report, they'll be able to estimate your credit limit provided to your card

It'll help on one thing only, when banks will pull out credit report, they'll be able to estimate your credit limit provided to your card

Thanks Subhankar for sharing this. One more evidence has been added 🥲.They don't. It only reports the high credit (the max which has been utilised so far)

View attachment 330

This is what I understand.

Yes, they don't report full limit, just the max utilisation. And that is used to calculate % utilisation.

Also, %utilisation for individual card doesn't matter, but overall utilisation total spends on all cards/total limit on all cards.

So, if someone has only hdfc card with say 50k limit and max he ever used is 10k, it will consider 10k as total limit. And when you spend even 5k in a subsequent month, u will reach 50% utilisation ratio and credit score will be negatively affected. And this is a disadvantage.

On a contrary, many banks like axis give shared limit across multiple cards, but report separate limits. So, even for 5L shared limit on 3 cards, cibil thinks it as 15L total limit and helps in reducing utilisation factor.

So, for hdfc spends, it is good if you have some other cards with good limit already that can bring down ur utilisation ratio. HDFC as a first card will not be good from credit score point.

One alternative is to use HDFC card for full limit for Firat month so that it is captured by cibil. It will negatively impact for that month, but for subsequent month, it will reduce utilisation and score will improve in long run.

Yes, they don't report full limit, just the max utilisation. And that is used to calculate % utilisation.

Also, %utilisation for individual card doesn't matter, but overall utilisation total spends on all cards/total limit on all cards.

So, if someone has only hdfc card with say 50k limit and max he ever used is 10k, it will consider 10k as total limit. And when you spend even 5k in a subsequent month, u will reach 50% utilisation ratio and credit score will be negatively affected. And this is a disadvantage.

On a contrary, many banks like axis give shared limit across multiple cards, but report separate limits. So, even for 5L shared limit on 3 cards, cibil thinks it as 15L total limit and helps in reducing utilisation factor.

So, for hdfc spends, it is good if you have some other cards with good limit already that can bring down ur utilisation ratio. HDFC as a first card will not be good from credit score point.

One alternative is to use HDFC card for full limit for Firat month so that it is captured by cibil. It will negatively impact for that month, but for subsequent month, it will reduce utilisation and score will improve in long run.

Thank You Harry for such detailed explanation along with illustrations. With your analysis, now I can peacefully opt for a HDFC card as I have other CCs to tackle it.This is what I understand.

Yes, they don't report full limit, just the max utilisation. And that is used to calculate % utilisation.

Also, %utilisation for individual card doesn't matter, but overall utilisation total spends on all cards/total limit on all cards.

So, if someone has only hdfc card with say 50k limit and max he ever used is 10k, it will consider 10k as total limit. And when you spend even 5k in a subsequent month, u will reach 50% utilisation ratio and credit score will be negatively affected. And this is a disadvantage.

On a contrary, many banks like axis give shared limit across multiple cards, but report separate limits. So, even for 5L shared limit on 3 cards, cibil thinks it as 15L total limit and helps in reducing utilisation factor.

So, for hdfc spends, it is good if you have some other cards with good limit already that can bring down ur utilisation ratio. HDFC as a first card will not be good from credit score point.

One alternative is to use HDFC card for full limit for Firat month so that it is captured by cibil. It will negatively impact for that month, but for subsequent month, it will reduce utilisation and score will improve in long run.

Your last point also seems to be very insightful and makes perfect sense to me.

Thank you again for such expert advices. Keep sharing your knowledge and thoughts.

High Five!

Vivek

TF Buzz

Hdfc doesn't report credit limit to the cibil sometime it has positive benefit sometimes negative. Positive is it keeps your total exposure low when you have high limit in hdfc cards.

Negative is now days banks relying on cibil only ai does all the checks automatically and decides the limit when then hdfc limit is not reported it takes highest usage of your card and you get lesser limit.

Negative is now days banks relying on cibil only ai does all the checks automatically and decides the limit when then hdfc limit is not reported it takes highest usage of your card and you get lesser limit.

My HDFC cards limit doesn't show up either, so I assume its true that they don't report it.

So, if you think logically any thing you use will be always considered as utilized max (going by SS posted by anirbanm) on last page.

Which is bad for your overall credit health. Especially if it's the only card you have.

I feel one work around could be using HDFC but paying it off before they report it to CIBIL, in that case we need to know when HDFC reports it to CIBIL? Any experienced people can tell?

So, if you think logically any thing you use will be always considered as utilized max (going by SS posted by anirbanm) on last page.

Which is bad for your overall credit health. Especially if it's the only card you have.

I feel one work around could be using HDFC but paying it off before they report it to CIBIL, in that case we need to know when HDFC reports it to CIBIL? Any experienced people can tell?

Hdfc reports month end so pay on 29th or 30th, use max and keep small balance at end of monthMy HDFC cards limit doesn't show up either, so I assume its true that they don't report it.

So, if you think logically any thing you use will be always considered as utilized max (going by SS posted by anirbanm) on last page.

Which is bad for your overall credit health. Especially if it's the only card you have.

I feel one work around could be using HDFC but paying it off before they report it to CIBIL, in that case we need to know when HDFC reports it to CIBIL? Any experienced people can tell?

Thank you, that was exactly what I needed!Hdfc reports month end so pay on 29th or 30th, use max and keep small balance at end of month

Can you please clarify this?My HDFC cards limit doesn't show up either, so I assume its true that they don't report it.

So, if you think logically any thing you use will be always considered as utilized max (going by SS posted by anirbanm) on last page.

Which is bad for your overall credit health. Especially if it's the only card you have.

I feel one work around could be using HDFC but paying it off before they report it to CIBIL, in that case we need to know when HDFC reports it to CIBIL? Any experienced people can tell?

If the highest ever utilized amount is reported to the credit bureaus, anyways it would be reported irrespective of if you pay bill prior or post to bank's reporting date, then how can an early payment be helpful to customer? Sorry if I am missing anything here but just wanted to understand it more clearly.

It's not highest ever utilized amount, it's the amount utilized on the day of the banks reporting date to the CIBIL. This is different from spending all your limit or over limit, that will have different set of problems, like exceeding your total reported yearly income.Can you please clarify this?

If the highest ever utilized amount is reported to the credit bureaus, anyways it would be reported irrespective of if you pay bill prior or post to bank's reporting date, then how can an early payment be helpful to customer? Sorry if I am missing anything here but just wanted to understand it more clearly.

As long as we can manage this well, its fine, especially in case of HDFC since it doesn't report your card limit.

Sorry I still didn't understand your explanation. Ok let's take an example and try to understand it.It's not highest ever utilized amount, it's the amount utilized on the day of the banks reporting date to the CIBIL. This is different from spending all your limit or over limit, that will have different set of problems, like exceeding your total reported yearly income.

As long as we can manage this well, its fine, especially in case of HDFC since it doesn't report your card limit.

Let's see my card limit is 100K and I spent 25K on Month1 and 28K on Month2

So at the end of Month1, reported utilized amount would be 25K which would get replaced by 28K at the end of Month2 (as 28K>25K)

So max. utilized limit will continue to be reported as 28K unless the spend crosses 28K in any of the subsequent months.

Isn't it the right understanding? If yes, then how can an early payment here be helpful as all it matters is max. utilized amount till date and not the outstanding balance till date?

No, u guys have confused a bit, u have 100k limit and u use 25k till month end, then 25k is reported as utilized. If u pay 24k month end, only 1k is shown as current balance. This is with respect to Hdfc . EVEN IF U SPEND 25K ON 1ST WEEK OF MONTH AND DONT USE CARD FOR THE MONTH, IT US REPORTED AS 25K USED ITSELF.For other banks it's different, if any particular bank needed I will tell.Sorry I still didn't understand your explanation. Ok let's take an example and try to understand it.

Let's see my card limit is 100K and I spent 25K on Month1 and 28K on Month2

So at the end of Month1, reported utilized amount would be 25K which would get replaced by 28K at the end of Month2 (as 28K>25K)

So max. utilized limit will continue to be reported as 28K unless the spend crosses 28K in any of the subsequent months.

Isn't it the right understanding? If yes, then how can an early payment here be helpful as all it matters is max. utilized amount till date and not the outstanding balance till date?

Thanks Akash!No, u guys have confused a bit, u have 100k limit and u use 25k till month end, then 25k is reported as utilized. If u pay 24k month end, only 1k is shown as current balance. This is with respect to Hdfc . EVEN IF U SPEND 25K ON 1ST WEEK OF MONTH AND DONT USE CARD FOR THE MONTH, IT US REPORTED AS 25K USED ITSELF.For other banks it's different, if any particular bank needed I will tell.

Just realised the fact that lesser the balance, lesser the utilization is. So early payment should definitely work here 🙂.

mukundstud

TF Select

Initially I did not care much about this non reporting of credit limit issue despite having an HDFC CC, since my CIBIL Score is perfectly fine even with an HDFC card. But seeing a lot of confusion on this thread, I decided to dig some details myself. Initially, I searched about this issue from Indian sources, but was not able to find any significant info on this. Then I thought of looking into foreign sources of information. Since HDFC does not issue its credit cards outside India(Maybe, but it would be very low in number), I decided to look for a card with similar credit reporting like HDFC Bank. And the cards which struck me instantly were the Amex Charge cards. I don't have an Amex charge card, but came to know from the Internet that it also does not report its credit limit to the rating agencies. On searching the internet for some time, I came across these videos and articles;

www.forbes.com

www.forbes.com

thepointsguy.com

thepointsguy.com

I do not know about the much about the YouTube channel of the video I shared, but the other 2 articles are from reputed sources. The last article by 'The Points Guy' in fact, showed a TransUnion (parent of CIBIL, India)credit report screenshot of an Amex Charge card. In the screenshot, it was shown that no credit limit was reported for the charge card and the credit utilisation ratio was 'N/A'. All the 3 sources I have claimed the same thing that Credit Utilisation Ratio is NOT considered in calculating your FICO score through your Charge Card account.

Now since TransUnion is the parent company of CIBIL and HDFC cards' reporting is quite similar to Charge Cards' reporting, I am pretty confident that Credit Card Utilisation Ratio is NOT considered in calculating your CIBIL score through your HDFC CC account. At least I have not seen anyone hurting his/her credit score solely because of an HDFC card.

Hope this clears all the doubts regarding this issue. Any corrections and suggestions are welcome.

How Do Charge Cards Affect Your Credit Score?

On the surface, charge cards and credit cards look almost the same. Both payment methods are around 3.37 by 2.125 inches and generally made of plastic or, in some cases, metal. You use charge cards and credit cards to pay for purchases and repay the card issuer at a later date. And either type may a

How Do Charge Cards Affect Your Credit Score? - The Points Guy

Many of Amex's best rewards cards are charge cards rather than credit cards. Learn about the implications for your credit score and credit utilization ratio.

I do not know about the much about the YouTube channel of the video I shared, but the other 2 articles are from reputed sources. The last article by 'The Points Guy' in fact, showed a TransUnion (parent of CIBIL, India)credit report screenshot of an Amex Charge card. In the screenshot, it was shown that no credit limit was reported for the charge card and the credit utilisation ratio was 'N/A'. All the 3 sources I have claimed the same thing that Credit Utilisation Ratio is NOT considered in calculating your FICO score through your Charge Card account.

Now since TransUnion is the parent company of CIBIL and HDFC cards' reporting is quite similar to Charge Cards' reporting, I am pretty confident that Credit Card Utilisation Ratio is NOT considered in calculating your CIBIL score through your HDFC CC account. At least I have not seen anyone hurting his/her credit score solely because of an HDFC card.

Hope this clears all the doubts regarding this issue. Any corrections and suggestions are welcome.

Naman Jain

TF Buzz

I personally have not many credit card and have highest limit in hdfc only with around 1.2 lac but never used more then 28k ever that make it very much difficult to mentain 30% below utilisation.

As other card have 20-50k limit only that make using 20-25k every month that should account for less then 18% be more then even 40%.

Any suggestions the cheapest way to have spend max in hdfc card as even if I do everything in my family with my card alone reaching 1lac+ would be hard.

Any suggestions as i have reported cibil,crif,Experian about it and they just say we will check with bank and after that no response from there side.

As other card have 20-50k limit only that make using 20-25k every month that should account for less then 18% be more then even 40%.

Any suggestions the cheapest way to have spend max in hdfc card as even if I do everything in my family with my card alone reaching 1lac+ would be hard.

Any suggestions as i have reported cibil,crif,Experian about it and they just say we will check with bank and after that no response from there side.

Hi Naman,I personally have not many credit card and have highest limit in hdfc only with around 1.2 lac but never used more then 28k ever that make it very much difficult to mentain 30% below utilisation.

As other card have 20-50k limit only that make using 20-25k every month that should account for less then 18% be more then even 40%.

Any suggestions the cheapest way to have spend max in hdfc card as even if I do everything in my family with my card alone reaching 1lac+ would be hard.

Any suggestions as i have reported cibil,crif,Experian about it and they just say we will check with bank and after that no response from there side.

Not sure if I understood your question correctly, but if you have other card which reports credit limits to credit bureaus, along with HDFC then please try to maintain overall (all cards together) credit utilization below 30% to avoid hurting your C-score.

But as you said since you have HDFC and other cards with very low limits then it will be very difficult for you to draw an utilization ratio line below 30%.

That's why in my opinion, it's not wise to go for a credit card with less limits even if you get it as LTF as you wouldn't have that much freedom to use your cards but again credit limit is something which is beyond our control.

Initially I did not care much about this non reporting of credit limit issue despite having an HDFC CC, since my CIBIL Score is perfectly fine even with an HDFC card. But seeing a lot of confusion on this thread, I decided to dig some details myself. Initially, I searched about this issue from Indian sources, but was not able to find any significant info on this. Then I thought of looking into foreign sources of information. Since HDFC does not issue its credit cards outside India(Maybe, but it would be very low in number), I decided to look for a card with similar credit reporting like HDFC Bank. And the cards which struck me instantly were the Amex Charge cards. I don't have an Amex charge card, but came to know from the Internet that it also does not report its credit limit to the rating agencies. On searching the internet for some time, I came across these videos and articles;

How Do Charge Cards Affect Your Credit Score?

On the surface, charge cards and credit cards look almost the same. Both payment methods are around 3.37 by 2.125 inches and generally made of plastic or, in some cases, metal. You use charge cards and credit cards to pay for purchases and repay the card issuer at a later date. And either type may awww.forbes.com

How Do Charge Cards Affect Your Credit Score? - The Points Guy

Many of Amex's best rewards cards are charge cards rather than credit cards. Learn about the implications for your credit score and credit utilization ratio.thepointsguy.com

I do not know about the much about the YouTube channel of the video I shared, but the other 2 articles are from reputed sources. The last article by 'The Points Guy' in fact, showed a TransUnion (parent of CIBIL, India)credit report screenshot of an Amex Charge card. In the screenshot, it was shown that no credit limit was reported for the charge card and the credit utilisation ratio was 'N/A'. All the 3 sources I have claimed the same thing that Credit Utilisation Ratio is NOT considered in calculating your FICO score through your Charge Card account.

Now since TransUnion is the parent company of CIBIL and HDFC cards' reporting is quite similar to Charge Cards' reporting, I am pretty confident that Credit Card Utilisation Ratio is NOT considered in calculating your CIBIL score through your HDFC CC account. At least I have not seen anyone hurting his/her credit score solely because of an HDFC card.

Hope this clears all the doubts regarding this issue. Any corrections and suggestions are welcome.

Hi Mukund,

Appreciate your detailed study on this however, somewhere I read that "N/A" utilization ratio is considered as "HIGH" by default. I'm not sure how much true is this but I think rather believe different credit bureaus interprets it in different way based on the underlying logic/algorithm being used in their system.

I think there is ground here for people like us to come together and write to RBI regarding this, this is fairly confusing and can be easily avoided if HDFC starts reporting CC limits. I can't fathom any reason for them not willing to when other banks do. I think It's possible to put pressure on them for this.

They justify it by outlining "Per their internal policies" 🥲.I think there is ground here for people like us to come together and write to RBI regarding this, this is fairly confusing and can be easily avoided if HDFC starts reporting CC limits. I can't fathom any reason for them not willing to when other banks do. I think It's possible to put pressure on them for this.

mukundstud

TF Select

If N/A would be considered high, then the CIBIL score of HDFC CC users would have gone down. But I have not heard anyone blaming HDFC reporting for his/her score decrease. Maybe N/A could be interpreted differently by different agencies. But atleast TransUnion i.e. CIBIL does not take 'N/A' into its calculation of CIBIL score(according to the articles). I really think that cards with no declared limit are not considered in credit utilisation calculation. Else the concept of Charge cards would not have become so popular in US. In fact, charge cards are also gaining traction in India. Does anyone here with a charge card tell whether its limit is reported in CIBIL report or not?Hi Mukund,

Appreciate your detailed study on this however, somewhere I read that "N/A" utilization ratio is considered as "HIGH" by default. I'm not sure how much true is this but I think rather believe different credit bureaus interprets it in different way based on the underlying logic/algorithm being used in their system.

Similar threads

- Replies

- 508

- Views

- 27K

- Replies

- 136

- Views

- 8K

- Question

- Replies

- 10

- Views

- 339

- Replies

- 6

- Views

- 159