ICICI Bank is soon launching its top-tier super-premium credit card: the ICICI Bank Times Black Credit Card.

Expected launch time: Mid December 2024

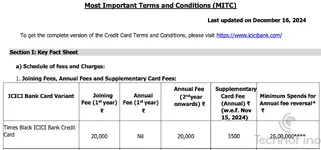

Fees:

However, ICICI is known for some tricky wording around card fees and waiver conditions in their MITC. For instance, I was charged an annual fee on my Emeralde Credit Card a few years back, and my consumer court case on this is still pending. (More details on that here: https://www.technofino.in/community...d-even-after-meeting-reversal-criteria.11061/)

Related Update (20th Dec, 2024):

ICICI Bank updated their MITC once again on 16th December 2024. As per the latest MITC, the first-year fee (Rs. 20,000 + GST) for the Times Black Credit Card has been removed. Customers now only need to pay Rs. 20,000 + GST at the time of joining.

MITC Link: https://www.icicibank.com/managed-assets/docs/personal/cards/mitc_cc.pdf

This new ICICI Bank Times Black Credit Card will reportedly have a sleek design, exclusive to a select group of customers. According to some sources, it’s expected to offer lifestyle perks unavailable on any other credit card in India so far.

ICICI Bank Unveils Its New Card Benefits: Here's the Breakdown

Welcome Benefits:

Annual Fee Reversal Criteria:

Main Benefits:

For domestic spends of ₹20L per annum, the total reward rate, including milestone benefits worth ₹50,000 and a 2% base reward point rate, comes to 4.5%.

My Opinion:

When ICICI Bank first announced the Times Black Credit Card, it was positioned as a competitor to premium cards like the Axis Primus and even the Amex Centurion. According to some ICICI Bank and Times Internet Group officials, this card was intended to challenge the dominance of the Amex Centurion in its category in India.

However, after reviewing the benefits, it is clear that this card falls short. While it does offer a few exclusive perks, such as airport transfers via helicopter, this benefit is limited to Bengaluru, making it impractical for most users. Similarly, the doorstep visa service is restricted to select locations, which diminishes its overall appeal.

As consumers, we must evaluate the real-world usability of a product's benefits. Most of the features offered by this card are inaccessible to people living outside metropolitan cities.

In terms of rewards, the card is average, offering just 2% rewards with a cap of 5,000 reward points per month on categories like utility, insurance, education, and government payments—this is a major drawback. Additionally, it does not provide rewards on fuel or rent payments, and the 1% fee on rent transactions (with only the first rent payment of the month being fee-free) further reduces its value.

But... ICICI Bank iShop Portal makes all the difference. Using this card, you can earn up to 24% rewards on iShop for flight & hotel bookings and gift voucher purchases, which significantly enhances this card’s value.

When compared to the Emeralde Private Metal Credit Card, which is available at a far lower price point, the Times Black Credit Card is noticeably inferior. It is unclear why ICICI Bank launched a product like the Times Black and placed it above Emeralde Private Metal in its lineup.

The card’s markup fee is another downside—at 1.49% + GST, it is higher than other cards in the same category, making it less competitive for international transactions.

Premium cardholders often expect a comprehensive concierge service, but ICICI Bank has imposed limits on the number of concierge services one can avail.

Despite being marketed as one of the most exclusive credit cards in India, the reality is far different. Almost everyone who already has a credit card with ICICI Bank seems to be getting approved for this card on a shared limit basis, which diminishes its exclusivity.

Overall, the Times Black Credit Card fails to deliver on the hype created by ICICI Bank and the Times Internet Group. It lacks exclusivity and practical benefits, which are expected from a premium credit card.

If you are purely looking at iShop portal spends, then you can earn significant value back using this credit card. Otherwise, this card is not at all lucrative.

You must keep in mind that you can only book flights, hotels, and buy some gift vouchers from iShop, so evaluate how much you'll spend on that before deciding whether this card makes sense for you or not.

And one major downside of ICICI Bank Credit Cards is that they don't offer airline miles transfer partners. With a few airline miles transfer partners, this card would look much better.

Expected launch time: Mid December 2024

Fees:

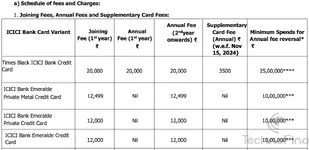

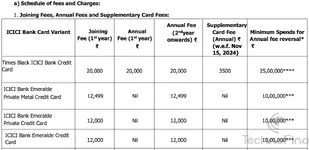

- Joining Fee: Rs. 20,000 + GST

- Annual Fee: Rs. 20,000 + GST

However, ICICI is known for some tricky wording around card fees and waiver conditions in their MITC. For instance, I was charged an annual fee on my Emeralde Credit Card a few years back, and my consumer court case on this is still pending. (More details on that here: https://www.technofino.in/community...d-even-after-meeting-reversal-criteria.11061/)

Related Update (20th Dec, 2024):

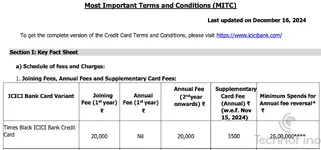

ICICI Bank updated their MITC once again on 16th December 2024. As per the latest MITC, the first-year fee (Rs. 20,000 + GST) for the Times Black Credit Card has been removed. Customers now only need to pay Rs. 20,000 + GST at the time of joining.

MITC Link: https://www.icicibank.com/managed-assets/docs/personal/cards/mitc_cc.pdf

This new ICICI Bank Times Black Credit Card will reportedly have a sleek design, exclusive to a select group of customers. According to some sources, it’s expected to offer lifestyle perks unavailable on any other credit card in India so far.

ICICI Bank Unveils Its New Card Benefits: Here's the Breakdown

Welcome Benefits:

- ₹10,000 EaseMyTrip Hotel Voucher

- ₹10,000 Onevasco & More Visa Services Premium Lounge Voucher

- ₹1,000 Interflora Floral Gift Voucher

- ₹3,000 Toni & Guy Voucher

- Annual Complimentary Zomato Gold Membership

- Joining Fee (Introductory Offer): ₹20,000 + GST

- Annual Fee: ₹20,000 + GST

- Foreign Currency Markup Fee: 1.49% + GST

- DCC Fee: If a transaction (in-store or online) is conducted in Indian currency at an international location or with a merchant registered overseas but located in India, a dynamic and static conversion markup fee of 1.49% will be charged.

Annual Fee Reversal Criteria:

- The annual fee will be charged at the beginning of your card anniversary year.

- If you spend ₹25L or more within the anniversary year, the fee will be reversed.

Main Benefits:

- Unlimited Complimentary Access: International and Domestic Airport Lounges

- Art Gallery Access: Unlimited access to partner art galleries

- Fuel Surcharge Waiver: Up to ₹1,000 per statement cycle

- Exclusive Invitations: To premium events

- Discounts on:

- The Quorum Club

- District150

- Apple

- Tumi Travel Accessories

- Interflora

- Kaya Skin Clinic

- Ixigo

- Avis Chauffeur Drive Luxury Cars

- Exclusive Swipe Offers: Special deals at premium retailers, luxury brands, and fine dining outlets, both online and offline.

- Comprehensive Insurance Coverage:

- Personal Accident Insurance

- Purchase Protection for damaged or stolen items

- Credit Shield in unforeseen circumstances

- Loss of Checked Baggage

- Card Liability Cover for unauthorized transactions

- Loss of Passport & Travel Documents

- Flight Delay and Missed Connections Coverage

- Earn Points:

- 2 Reward Points per ₹100 spent in India (Reward Rate: 2%)

- 2.5 Reward Points per ₹100 spent outside India (Reward Rate: 2.5%)

- 6 Reward Points per ₹100 spent on Flights & Hotels (Reward Rate: 6%)

- iShop Portal:

ICICI Bank has launched its accelerated rewards portal, iShop. You can book flights, hotels, or purchase gift vouchers on the iShop portal and get up to 24% value back.

Read more about the iShop Portal here: https://www.technofino.in/community...ts-portal-launched-upto-36-reward-rate.37913/

Flights: Earn 6X Reward Points – that’s 12 Reward Points for every ₹100 spent on flight bookings. (Reward Rate: 12%)

Gift Vouchers: Earn 6X Reward Points – that’s 12 Reward Points for every ₹100 spent on gift voucher purchases. (Reward Rate: 12%)

Hotels: Earn 12X Reward Points – that’s 24 Reward Points for every ₹100 spent on hotel bookings. (Reward Rate: 24%)

- Exclusions:

- No points on fuel and rent payments.

- No points on educational fee payments via third-party platforms like Mobikwik or CRED. However, payments made directly through school/college websites or POS machines qualify for points.

- Maximum of 5,000 Reward Points can be earned per month on Utility, Insurance, Education, and Government Payments.

- For rent payments via third-party merchants, a 1% fee is charged from the second rental transaction each month.

- Reward Points earned on iShop Portal transaction will be capped at 15,000 Bonus Reward Points per statement cycle.

- Reward Points Expiry: Points never expire, but if the card remains inactive for 365+ days, all points will be forfeited.

- Redeem points for:

- Statement credit

- Against Transactions

- Gift vouchers

- Travel bookings

- iShop Portal

You can redeem your ICICI Bank Reward Points on the iShop portal for booking flights, hotels, and gift vouchers. For flight bookings, you can use 100% reward points of the order value. For hotel bookings, you can use 90% reward points of the order, and for gift vouchers, you can use 50% reward points. - Air miles (partners not disclosed yet)

- Conversion Rates:

- 1 Reward Point = ₹1 for most redemptions, including iShop portal.

- 1 Reward Point = ₹0.40 for statement credit

- Spend ₹2,00,000: Get ₹10,000 Klook Voucher

- Spend ₹5,00,000: Get ₹10,000 worth of airport transfers in a luxury sedan (₹5,000 x 2) or helicopter service (₹10,000 x 1) by BLADE/AVIS (available only from Bangalore Airport to select destinations).

- Spend ₹10,00,000: Get ₹10,000 Tata Cliq Luxury Voucher

- Spend ₹20,00,000: Get ₹20,000 complimentary stay voucher at Avanta Resorts

For domestic spends of ₹20L per annum, the total reward rate, including milestone benefits worth ₹50,000 and a 2% base reward point rate, comes to 4.5%.

My Opinion:

When ICICI Bank first announced the Times Black Credit Card, it was positioned as a competitor to premium cards like the Axis Primus and even the Amex Centurion. According to some ICICI Bank and Times Internet Group officials, this card was intended to challenge the dominance of the Amex Centurion in its category in India.

However, after reviewing the benefits, it is clear that this card falls short. While it does offer a few exclusive perks, such as airport transfers via helicopter, this benefit is limited to Bengaluru, making it impractical for most users. Similarly, the doorstep visa service is restricted to select locations, which diminishes its overall appeal.

As consumers, we must evaluate the real-world usability of a product's benefits. Most of the features offered by this card are inaccessible to people living outside metropolitan cities.

In terms of rewards, the card is average, offering just 2% rewards with a cap of 5,000 reward points per month on categories like utility, insurance, education, and government payments—this is a major drawback. Additionally, it does not provide rewards on fuel or rent payments, and the 1% fee on rent transactions (with only the first rent payment of the month being fee-free) further reduces its value.

But... ICICI Bank iShop Portal makes all the difference. Using this card, you can earn up to 24% rewards on iShop for flight & hotel bookings and gift voucher purchases, which significantly enhances this card’s value.

When compared to the Emeralde Private Metal Credit Card, which is available at a far lower price point, the Times Black Credit Card is noticeably inferior. It is unclear why ICICI Bank launched a product like the Times Black and placed it above Emeralde Private Metal in its lineup.

The card’s markup fee is another downside—at 1.49% + GST, it is higher than other cards in the same category, making it less competitive for international transactions.

Premium cardholders often expect a comprehensive concierge service, but ICICI Bank has imposed limits on the number of concierge services one can avail.

Despite being marketed as one of the most exclusive credit cards in India, the reality is far different. Almost everyone who already has a credit card with ICICI Bank seems to be getting approved for this card on a shared limit basis, which diminishes its exclusivity.

Overall, the Times Black Credit Card fails to deliver on the hype created by ICICI Bank and the Times Internet Group. It lacks exclusivity and practical benefits, which are expected from a premium credit card.

If you are purely looking at iShop portal spends, then you can earn significant value back using this credit card. Otherwise, this card is not at all lucrative.

You must keep in mind that you can only book flights, hotels, and buy some gift vouchers from iShop, so evaluate how much you'll spend on that before deciding whether this card makes sense for you or not.

And one major downside of ICICI Bank Credit Cards is that they don't offer airline miles transfer partners. With a few airline miles transfer partners, this card would look much better.

Last edited: