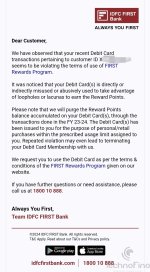

On April 22, 2024, IDFC First Bank sent an email notification to many of their debit card users, indicating that the customers seemed to have violated the bank's terms of use of the First Reward program, and as a result, reward points earned in FY 23-24 would be purged. The bank also mentioned, "The Debit Card(s) have been issued to you for the purpose of personal/retail purchases within the prescribed usage limit assigned to you. Repeated violations may even lead to the termination of your Debit Card Membership with us."

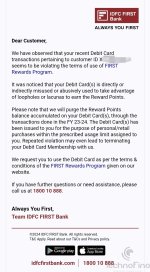

Copy of the notice :

Wow! It seems IDFC First Bank is the first bank to introduce limits for debit cards. I used to think that banks only assign limits to credit cards. To clarify, I would say that the bank doesn't assign any limit to debit card usage; the debit card has a daily limit, and that's it. One can spend unlimited money using their debit card as long as they have money in their linked bank account.

Let's clarify the problem for everyone.

IDFC First Bank introduced their debit card reward system back in July 2023, almost one year ago. Initially, they were offering reward points on all spends, with no restrictions on any MCC and category, and no capping on the maximum reward points one can earn.

Now, what happened is that people tried to find ways to spend money. Some people paid their factory electricity bills and other business-related expenses with credit cards and paid the card bill using the IDFC First Bank debit card. Some people loaded Paytm wallets (their own, family members', and maybe friends' wallets) using the IDFC First Bank debit card and transferred that money to their bank account.

Now, IDFC First Bank can question those customers about their spends, money trail, etc., but purging last FY reward points just by saying they have used loopholes or lacunas to take advantage of the bank's reward system is something I strongly oppose.

A few questions to IDFC First Bank:

Now, the main question is, what action should affected customers take?

I suggest affected customers send an email to IDFC First Bank addressing the questions I have mentioned above. Let them provide answers, and if the issue is not resolved in your favor, file a complaint with the RBI ombudsman. Let the RBI ombudsman department decide what's wrong and what's right.

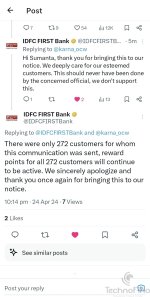

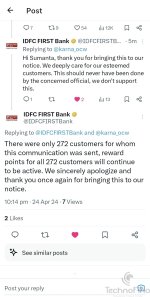

Update on 24th april, 2024:

IDFC First Bank replied to my tweet and apologized. They also shared that only 272 customers were affected, but they will not purge reward points from their account. I'm really impressed with IDFC First Bank for listening to customer feedback.

Update:

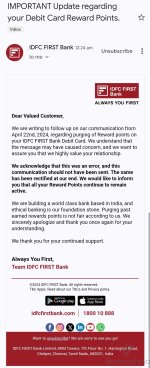

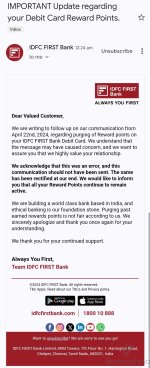

IDFC First Bank has started sending emails to affected customers, informing them that the last action was taken in error.

Copy of the notice :

Wow! It seems IDFC First Bank is the first bank to introduce limits for debit cards. I used to think that banks only assign limits to credit cards. To clarify, I would say that the bank doesn't assign any limit to debit card usage; the debit card has a daily limit, and that's it. One can spend unlimited money using their debit card as long as they have money in their linked bank account.

Let's clarify the problem for everyone.

IDFC First Bank introduced their debit card reward system back in July 2023, almost one year ago. Initially, they were offering reward points on all spends, with no restrictions on any MCC and category, and no capping on the maximum reward points one can earn.

Now, what happened is that people tried to find ways to spend money. Some people paid their factory electricity bills and other business-related expenses with credit cards and paid the card bill using the IDFC First Bank debit card. Some people loaded Paytm wallets (their own, family members', and maybe friends' wallets) using the IDFC First Bank debit card and transferred that money to their bank account.

Now, IDFC First Bank can question those customers about their spends, money trail, etc., but purging last FY reward points just by saying they have used loopholes or lacunas to take advantage of the bank's reward system is something I strongly oppose.

A few questions to IDFC First Bank:

- Why didn't you restrict some MCC or categories from your reward system?

- Why didn't you introduce a fair use policy at the start?

- Why are you calling this "misused or abusively used to take advantage of loopholes or lacunas"? When does loading Paytm become abuse? When does paying a credit card bill become abuse?

- What do you mean by "usage limit assigned to you"? Have you mentioned the assigned limit for each debit card on your website? As far as I know, this term is invalid for a debit card, as the bank doesn't assign any maximum fair use limit to a debit card. And no one can use their debit card to spend more than the daily limit the card has in a day.

Now, the main question is, what action should affected customers take?

I suggest affected customers send an email to IDFC First Bank addressing the questions I have mentioned above. Let them provide answers, and if the issue is not resolved in your favor, file a complaint with the RBI ombudsman. Let the RBI ombudsman department decide what's wrong and what's right.

Update on 24th april, 2024:

IDFC First Bank replied to my tweet and apologized. They also shared that only 272 customers were affected, but they will not purge reward points from their account. I'm really impressed with IDFC First Bank for listening to customer feedback.

Update:

IDFC First Bank has started sending emails to affected customers, informing them that the last action was taken in error.

Last edited: