Hello All

Please Guide

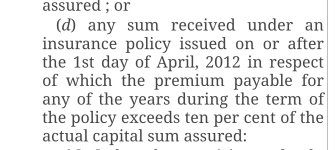

As per IT Rule, Insurance Maturity is taxable in hands of premium is more than 10% of Insurance Amount, Posting Screenshot of Rule...

Please guide if Premium refers to Total/Cumulative Premium for whole FY or Monthly Premium ? Like if monthly premium of policy of 10 lacs is 10000 then total premium of an year is 120000(exceeds 10% of maturity), so it's maturity is taxable?

Please Guide

As per IT Rule, Insurance Maturity is taxable in hands of premium is more than 10% of Insurance Amount, Posting Screenshot of Rule...

Please guide if Premium refers to Total/Cumulative Premium for whole FY or Monthly Premium ? Like if monthly premium of policy of 10 lacs is 10000 then total premium of an year is 120000(exceeds 10% of maturity), so it's maturity is taxable?