Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

[Income Tax Payment] Card which provide benefit on Tax Payment

- Thread starter dealsense

- Start date

- Replies 216

- Views 29K

mojo_jojo123

TF Legend

what is value of one point of IDFC wealthIDFC wealth also gives reward points 6 per 100, 10 per 100 above 30k.

1 rp - 0.25, so 1.5% return per 100 upto 30k above that 2.5%what is value of one point of IDFC wealth

girish3456

TF Premier

Hi,

Can anyone please share credit cards which provide rewards on Income tax payment?

HDFC Infinia, SBI Cashback, AMEX MRCC, Axis Magnus, Yes first Exclusive == I have these cards but none of them provide anything in this category.

Thanks,

anant

Check for IDFC First Wealth credit card. It gives 3 reward points for every 100 rupees spent. However these government spends are not considered for 10x rewards though you pay 30,000 and above.expand...

3 reward points for 100 rupees will be 75 paise for every 100 spent. I personally paid for tax payment last year and again will use it next month. Some thing is better than nothing that's what I feel where maximum banks are excluded all types of government payments from giving the reward points.

Note: No expiry for reward points & it's a LTF card. Also IDFC First Wealth card can also be applied as c2c

Are you sure about 3x. I recently paid 5k tax, total was 5047rs and it shows 242 points which is 6x for idfc select.Check for IDFC First Wealth credit card. It gives 3 reward points for every 100 rupees spent. However these government spends are not considered for 10x rewards though you pay 30,000 and above.

3 reward points for 100 rupees will be 75 paise for every 100 spent. I personally paid for tax payment last year and again will use it next month. Some thing is better than nothing that's what I feel where maximum banks are excluded all types of government payments from giving the reward points.

Note: No expiry for reward points & it's a LTF card. Also IDFC First Wealth card can also be applied as c2c

5047/125*6 = 242

divyam_taparia

TF Select

but income tax portal takes like .91% so dosen't make any sense?Check for IDFC First Wealth credit card. It gives 3 reward points for every 100 rupees spent. However these government spends are not considered for 10x rewards though you pay 30,000 and above.

3 reward points for 100 rupees will be 75 paise for every 100 spent. I personally paid for tax payment last year and again will use it next month. Some thing is better than nothing that's what I feel where maximum banks are excluded all types of government payments from giving the reward points.

Note: No expiry for reward points & it's a LTF card. Also IDFC First Wealth card can also be applied as c2c

I recently paid advance tax using IDFC wealth cc. It gives cashback of 1.5% till 30k and 2.5% later on. PG is about 1%. Effectively 0.5% till 30k and 1.5% later on.but income tax portal takes like .91% so dosen't make any sense?

divyam_taparia

TF Select

What is Pg?I recently paid advance tax using IDFC wealth cc. It gives cashback of 1.5% till 30k and 2.5% later on. PG is about 1%. Effectively 0.5% till 30k and 1.5% later on.

Payment gateway chargesWhat is Pg?

Dad0h0j0

TF Premier

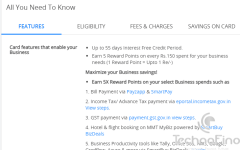

if you own a business account with HDFC bank they can provide you with BIZ CARD.

and their BizBlack Matel card gives 5x rewards for paying taxes. and GST. (but has joining and annual fee of 10k)

they have lower variants cards also which provide rewards and cashbacks for GST And it payment.

and their BizBlack Matel card gives 5x rewards for paying taxes. and GST. (but has joining and annual fee of 10k)

they have lower variants cards also which provide rewards and cashbacks for GST And it payment.

Dad0h0j0

TF Premier

if you own a business account with HDFC bank they can provide you with BIZ CARD.

and their BizBlack Matel card gives 5x rewards for paying taxes. and GST. (but has joining and annual fee of 10k)

they have lower variants cards also which provide rewards and cashbacks for GST And it payment.

You can learn more about that

HDFC Bank Launch 4 New Business Credit Card

Biz Black Metal Edition Credit Card (https://www.hdfcbank.com/personal/pay/cards/business-credit-cards/biz-black) 5 Reward Points for every ₹ 150 spent (1 RP is equal to upto ₹1) 5X Reward Points on Bill Payments via PayZapp/SmartPay, Income Tax, GST & vendor payments via Swifti & SmartHub...

Attachments

IDFC wealth card was my go-to for any tax or government payments like property tax etc. After the recent devaluation, IDFC Wealth gives only 0.75% rewards, which is not even enough to cover the payment gateway charges levied by such sites.

What is the alternative today - I have Infinia, Axis Magnus, Amex plat travel & IDFC wealth cards. Any help from the folks here is appreciated 🙂

What is the alternative today - I have Infinia, Axis Magnus, Amex plat travel & IDFC wealth cards. Any help from the folks here is appreciated 🙂

Last edited:

kapendra

TF Buzz

I used amex travel card for payment property tax it's comes under utility confirmed with customer care as well so no rewards only will be eligible for milestone benefitsIDFC wealth card was my go-to for any tax or government payments like property tax etc. After the recent evaluation, IDFC Wealth gives only 0.75% rewards, which is not even enough to cover the payment gateway charges levied by such sites.

What is the alternative today - I have Infinia, Axis Magnus, Amex plat travel & IDFC wealth cards. Any help from the folks here is appreciated 🙂

How come property tax utility? Shouldn't it be govt. spends?I used amex travel card for payment property tax it's comes under utility confirmed with customer care as well so no rewards only will be eligible for milestone benefits

Regrettably, there are not many options left. Yes Marquee gives 1.25% rewards, which is slightly more than the CC gateway charges. Yes bank, Reserv 3X gets you 2.25% for govt transactions.

I am not sure which other card gives any rewards on government payment

I am not sure which other card gives any rewards on government payment

kapendra

TF Buzz

Payment gateway portal is payubizHow come property tax utility? Shouldn't it be govt. spends?

And amex /PG don't know they consider certain government transactions into utility

Has anyone experience of using Yes Reserve for 3x points for tax payment?Regrettably, there are not many options left. Yes Marquee gives 1.25% rewards, which is slightly more than the CC gateway charges. Yes bank, Reserv 3X gets you 2.25% for govt transactions.

I am not sure which other card gives any rewards on government payment

Similar threads

- Replies

- 36

- Views

- 3K

- Replies

- 172

- Views

- 15K

- Replies

- 0

- Views

- 326

- Replies

- 8

- Views

- 1K

- Question

- Replies

- 14

- Views

- 2K