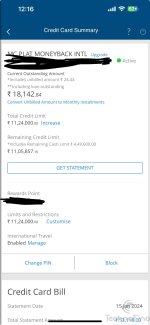

I am an Imperia Customer with a monthly net salary of 3.78L. Currently, I use the Money Back card (MasterCard variant) with a credit limit of 11.24L (Wrongly posted as 11.28L initally). Additionally, I hold the Axis Magnus (non-burgundy Visa variant) with a limit of 9.2L, Amex MRCC with 13.25L, and Amazon Pay card with a limit of 5.6L.

Despite multiple requests and discussions with the bank, including interactions with priority redressal, nodal officers, and principal node officers, I received the final response. I sought clarification on the internal criteria the bank employs for card offerings, especially since some of my coworkers with lower salaries were granted the card. In the course of exploring a credit card upgrade, I have been offered the Millenia card as part of credit card upgrade portal

Uncertain about the reason behind my card rejection, I ponder whether it was due to the MasterCard variant, given that Infinia is currently offered in the Visa platform. The bank has not provided clear reasons for the rejection.

Considering my options, I am contemplating the following:

1. Relocating my salary account to Axis and upgrading to burgundy, which may make me eligible for the Magnus card with burgundy.

2. Opting for the Amex Platinum Charge card, leaving aside my existing cards and exploring new benefits.

3. Exploring alternatives like HSBC Premier or ICICI Emerald Metal, understanding that this might require a move of my salary accounts.

Need suggestion in planning the best option.

Update 1 : Spends were 6.2L in last 6 months (including one international travel swipes)

2022 - Spent more than 18L . Was declined for upgrade

Out of frustration, Moved all my spends to magnus from early 2023 as it was reaping 5:4 rewards at that time.

Responses from the bank -

"

This is with reference to your e-mail dated December 21, 2023 and our subsequent interim response sent on the same date regarding your request for card upgrade on your HDFC Bank credit card account.

Below upgrade offer -

We are fully sensitized to your concerns expressed and taking complete note of the same, we have once again taken a detailed review of your card account. We wish to reiterate that the outcome of our review is consistent with our earlier observation sent to you in this regard.

On receipt of your query, our service manager <> had contacted you on December 22, 2023 to address your query personally. Further to conversation , we wish to reaffirm that your request for limit enhancement and card upgrade has been reviewed subject to various internal parameters and guidelines which are wide ranging. The same is also based on usage and payment patterns on the card account. Hence, we regret our inability to accommodate your request to upgrade your current card to Infinia Metal Card at this point in time.

Based on your earlier representation, we had offered credit limit enhancement for an additional amount of Rs.72,000.00 from your existing credit limit, subject to credit bureau verification and internal review. However, we infer from the recent e-mail that you are not in acceptance towards the same. In the event, you wish to avail the said limit enhancement offered by us, we request you to revert to us with your consent from your registered e-mail address mentioning the last 4 digits of your card number by December January 02, 2024 for us to review further.

We also wish to assure you that the upgrade/limit enhancement offer shall be reviewed periodically based on usage and payment pattern on the card account. Hence, we urge you to continue usage of your credit card providing us with more opportunities to serve you.

Having detailed above, we are disappointed to understand that you intend to discontinue your banking/credit card relationship with us. Your relationship is important to us and we request you to reconsider your decision to close the banking/card account giving us an opportunity to be of continuous service to you.

In the event, you still intend to close your credit card, you may place your request through My cards using the below link post effecting complete payment towards the credit card dues. The total outstanding payable on your credit card account is Rs.<> (including remaining principal loan dues) as on date.

We also wish to clarify that on pre-closure of the EMI facility, pre-closure charges of 3% on the remaining principle outstanding amount as on date, along with interest and GST (Goods and Service Tax) were billed to your credit card account. Further, applicable interest gets billed from the date of loan pre-closure until complete repayment towards the same. We request you to contact our phone banker at 1800 202 6161 / 1860 267 6161 to know about the pre-closure charges and place the request on call.

Our Bank’s stand has been communicated distinctly and this response may be treated as final. We also wish to inform you that any further communication from yourself would not elicit a response from us. In light of this we request you to accept the decision in good faith.

Specific to your query raised on closure of your bank account, we request you to write to support@hdfcbank.com or contact your relationship manager <> on <> for further assistance in this regard.

In line with our focus and commitment to Customer Service, we trust we have addressed your grievance in a fair and equitable manner and the issue has been resolved to your satisfaction. In accordance with regulatory guidelines, we are also required to mention that you may approach the Banking Ombudsman (appointed by the Reserve Bank of India); in the event you are not satisfied with our handling of your complaint. Should you wish to exercise this option, please log on to our website www.hdfcbank.com for details of the Banking Ombudsman Scheme – 2006.

"

Despite multiple requests and discussions with the bank, including interactions with priority redressal, nodal officers, and principal node officers, I received the final response. I sought clarification on the internal criteria the bank employs for card offerings, especially since some of my coworkers with lower salaries were granted the card. In the course of exploring a credit card upgrade, I have been offered the Millenia card as part of credit card upgrade portal

Uncertain about the reason behind my card rejection, I ponder whether it was due to the MasterCard variant, given that Infinia is currently offered in the Visa platform. The bank has not provided clear reasons for the rejection.

Considering my options, I am contemplating the following:

1. Relocating my salary account to Axis and upgrading to burgundy, which may make me eligible for the Magnus card with burgundy.

2. Opting for the Amex Platinum Charge card, leaving aside my existing cards and exploring new benefits.

3. Exploring alternatives like HSBC Premier or ICICI Emerald Metal, understanding that this might require a move of my salary accounts.

Need suggestion in planning the best option.

Update 1 : Spends were 6.2L in last 6 months (including one international travel swipes)

2022 - Spent more than 18L . Was declined for upgrade

Out of frustration, Moved all my spends to magnus from early 2023 as it was reaping 5:4 rewards at that time.

Responses from the bank -

"

This is with reference to your e-mail dated December 21, 2023 and our subsequent interim response sent on the same date regarding your request for card upgrade on your HDFC Bank credit card account.

Below upgrade offer -

We are fully sensitized to your concerns expressed and taking complete note of the same, we have once again taken a detailed review of your card account. We wish to reiterate that the outcome of our review is consistent with our earlier observation sent to you in this regard.

On receipt of your query, our service manager <> had contacted you on December 22, 2023 to address your query personally. Further to conversation , we wish to reaffirm that your request for limit enhancement and card upgrade has been reviewed subject to various internal parameters and guidelines which are wide ranging. The same is also based on usage and payment patterns on the card account. Hence, we regret our inability to accommodate your request to upgrade your current card to Infinia Metal Card at this point in time.

Based on your earlier representation, we had offered credit limit enhancement for an additional amount of Rs.72,000.00 from your existing credit limit, subject to credit bureau verification and internal review. However, we infer from the recent e-mail that you are not in acceptance towards the same. In the event, you wish to avail the said limit enhancement offered by us, we request you to revert to us with your consent from your registered e-mail address mentioning the last 4 digits of your card number by December January 02, 2024 for us to review further.

We also wish to assure you that the upgrade/limit enhancement offer shall be reviewed periodically based on usage and payment pattern on the card account. Hence, we urge you to continue usage of your credit card providing us with more opportunities to serve you.

Having detailed above, we are disappointed to understand that you intend to discontinue your banking/credit card relationship with us. Your relationship is important to us and we request you to reconsider your decision to close the banking/card account giving us an opportunity to be of continuous service to you.

In the event, you still intend to close your credit card, you may place your request through My cards using the below link post effecting complete payment towards the credit card dues. The total outstanding payable on your credit card account is Rs.<> (including remaining principal loan dues) as on date.

We also wish to clarify that on pre-closure of the EMI facility, pre-closure charges of 3% on the remaining principle outstanding amount as on date, along with interest and GST (Goods and Service Tax) were billed to your credit card account. Further, applicable interest gets billed from the date of loan pre-closure until complete repayment towards the same. We request you to contact our phone banker at 1800 202 6161 / 1860 267 6161 to know about the pre-closure charges and place the request on call.

Our Bank’s stand has been communicated distinctly and this response may be treated as final. We also wish to inform you that any further communication from yourself would not elicit a response from us. In light of this we request you to accept the decision in good faith.

Specific to your query raised on closure of your bank account, we request you to write to support@hdfcbank.com or contact your relationship manager <> on <> for further assistance in this regard.

In line with our focus and commitment to Customer Service, we trust we have addressed your grievance in a fair and equitable manner and the issue has been resolved to your satisfaction. In accordance with regulatory guidelines, we are also required to mention that you may approach the Banking Ombudsman (appointed by the Reserve Bank of India); in the event you are not satisfied with our handling of your complaint. Should you wish to exercise this option, please log on to our website www.hdfcbank.com for details of the Banking Ombudsman Scheme – 2006.

"

Attachments

Last edited: