BACKGROUND STORY:

I had no credit card till June 2021 because of bad credit. I had defaulted on a couple of credit cards about a decade ago and had decided to stick to debit cards and real money for my needs. All of this was going good - I was paying full money for amazon, Flipkart shopping, full money for Zomato, Swiggy, Uber and for anything that you can think of. Life was simple.

But I always wished if I had a credit card - especially the Amazon ICICI credit card - I was a moderate user of Amazon and having the luxury of 5% cash back on everything was nothing short of a dream for me. This thought pushed me to apply for it and it got rejected, obviously. I approached the bank - visited the branch nearby, something that I hadn't done for 5 years. ICICI bank was good and friendly - helped me close my old credit card and issued me a credit card against an FD. Well, they also took 2L cheque for opening some premium account. I didn't need all that but the excitement of getting a CC was worth that stupid 2L FD (that FD is still running with them) and I was issued a Coral credit card. I was happy. 6 months later, after many applications and requests, I was issued an Amazon ICICI Pay credit card and then, after some time, I got Flipkart Axis.

I was on cloud 9 - all my credit card dreams were fulfilled, I was saving 5% flat from FK and Amazon plus some sundry 4% cashback from other apps and a flat 1.5% cashback on all the spends for FK Axis. I moved all my expenses to CC and migrated to cred for bill payments. I also got my hands on Zomato RBL card (which became shoprite card), IndusInd Legend and SBI BPCL card. All of this was good for some 10 months. Then in one of my persuasive conversations with my HDFC RM, the bank I have the longest and heaviest relationship with, but also the one refusing to issue me a credit card, sprang a surprise. Guess I had bothered her to death saying how can you not give me a credit card when I am your classic customer and ICICI and Axis can. RM, utterly fed-up with me, apologized again and threw a last straw towards me - "sir, are you from IIT/IIM or any premier institute?" I was like, "What do you mean, I am from IIM."

I was issued Diners Club Black - which introduced me to 3.3% cashback and the luxuries of credit cards. I was elated and boasted about it to my wife. Hell, I got her an add-on card for lounge visits. Life was all good for another 10 months.

Then in June - I was introduced to GYFTR - those reward multipliers of 2x, and 3x were insane. I was like - why on earth I am not using these? Then in GYFTR, I saw Infinia listed with better reward points. I went to the HDFC portal and saw that I couldn't apply for it - it was an invitation only. This led me to do more research then I came across sites like TechnoFino, Cardinsider etc and I was totally blown away. I felt how novice of me to be happy with DCB when Magnus was killing it. I tried for Magnus in July and I was issued one. But then, I got the update of devaluation and in a panic state, I cancelled the card when it was issued. The card was still delivered to me though but it is cancelled now.

Now - I was greedy, I wanted Infinia! Spoke to RM, and being the amazing lady she is, she said I can get the paid one - and I have the paid one with me now, using it for the last 1 week. But I have understood that 3.3% is all I have except SmartBuy and GYFTR. So I have been looking for ways to find the ideal card combination for me. Hence the research.

WHY COMPARING THESE?

I have 4 main categories of expenses. The expenses that can be covered with GYFTR, second the direct hotel and flights, 3rd normal hotel and flights and 4 other expenses like insurance, fees (can't use Apay) etc. I feel stupid to have cancelled the Magnus, but I guess that may have been a blessing in disguise. Had it stayed with me, I would have tried for Burgundy status and that is not something I'd like to do with Axis bank.

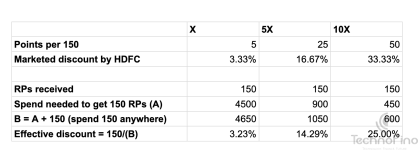

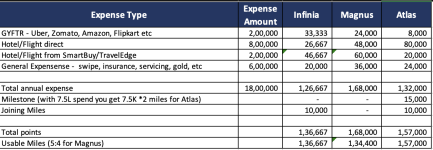

Below table runs a sample point calculation for my annualized expenses. The three cards in question (Infinia, Magnus and Atlas) has a very acceptable annual charge, so I am ignoring that totally.

Magnus is considered with Burgundy benefits. For Smartbuy considering it is 5x and 10x, I have taken 7x and Traveledge is 5x. It is clear that Atlas is a very strong card but then, I thought, what if I have Atlas+Infinia combination?

So if I use Infinia for GYFTR and SmartBuy I get 33333+46667 = 80000 and Atlas for direct and general, it is 80000+24000=104000, total 184000. Add 15K milestone of Atlas and 20K joining miles from Infinia and Atlas, I have a total of 2,19,000 miles. 12% return against total expense.

Atlas expense can only be used for flight and hotel, whereas Infinia can be routed to Apple and Tanishq and trains as well. This does look like a good main 2 driver cards to use. What do you all think?

I was slightly tempted by Magnus+Burgundy, but I don't want to shift to premium banking of Axis - and as you see from the table, I am not loosing much. What other cards would you recommend?

P.S - I have applied for Atlas, the card is coming in a week!

Thank you for reading.

I had no credit card till June 2021 because of bad credit. I had defaulted on a couple of credit cards about a decade ago and had decided to stick to debit cards and real money for my needs. All of this was going good - I was paying full money for amazon, Flipkart shopping, full money for Zomato, Swiggy, Uber and for anything that you can think of. Life was simple.

But I always wished if I had a credit card - especially the Amazon ICICI credit card - I was a moderate user of Amazon and having the luxury of 5% cash back on everything was nothing short of a dream for me. This thought pushed me to apply for it and it got rejected, obviously. I approached the bank - visited the branch nearby, something that I hadn't done for 5 years. ICICI bank was good and friendly - helped me close my old credit card and issued me a credit card against an FD. Well, they also took 2L cheque for opening some premium account. I didn't need all that but the excitement of getting a CC was worth that stupid 2L FD (that FD is still running with them) and I was issued a Coral credit card. I was happy. 6 months later, after many applications and requests, I was issued an Amazon ICICI Pay credit card and then, after some time, I got Flipkart Axis.

I was on cloud 9 - all my credit card dreams were fulfilled, I was saving 5% flat from FK and Amazon plus some sundry 4% cashback from other apps and a flat 1.5% cashback on all the spends for FK Axis. I moved all my expenses to CC and migrated to cred for bill payments. I also got my hands on Zomato RBL card (which became shoprite card), IndusInd Legend and SBI BPCL card. All of this was good for some 10 months. Then in one of my persuasive conversations with my HDFC RM, the bank I have the longest and heaviest relationship with, but also the one refusing to issue me a credit card, sprang a surprise. Guess I had bothered her to death saying how can you not give me a credit card when I am your classic customer and ICICI and Axis can. RM, utterly fed-up with me, apologized again and threw a last straw towards me - "sir, are you from IIT/IIM or any premier institute?" I was like, "What do you mean, I am from IIM."

I was issued Diners Club Black - which introduced me to 3.3% cashback and the luxuries of credit cards. I was elated and boasted about it to my wife. Hell, I got her an add-on card for lounge visits. Life was all good for another 10 months.

Then in June - I was introduced to GYFTR - those reward multipliers of 2x, and 3x were insane. I was like - why on earth I am not using these? Then in GYFTR, I saw Infinia listed with better reward points. I went to the HDFC portal and saw that I couldn't apply for it - it was an invitation only. This led me to do more research then I came across sites like TechnoFino, Cardinsider etc and I was totally blown away. I felt how novice of me to be happy with DCB when Magnus was killing it. I tried for Magnus in July and I was issued one. But then, I got the update of devaluation and in a panic state, I cancelled the card when it was issued. The card was still delivered to me though but it is cancelled now.

Now - I was greedy, I wanted Infinia! Spoke to RM, and being the amazing lady she is, she said I can get the paid one - and I have the paid one with me now, using it for the last 1 week. But I have understood that 3.3% is all I have except SmartBuy and GYFTR. So I have been looking for ways to find the ideal card combination for me. Hence the research.

WHY COMPARING THESE?

I have 4 main categories of expenses. The expenses that can be covered with GYFTR, second the direct hotel and flights, 3rd normal hotel and flights and 4 other expenses like insurance, fees (can't use Apay) etc. I feel stupid to have cancelled the Magnus, but I guess that may have been a blessing in disguise. Had it stayed with me, I would have tried for Burgundy status and that is not something I'd like to do with Axis bank.

Below table runs a sample point calculation for my annualized expenses. The three cards in question (Infinia, Magnus and Atlas) has a very acceptable annual charge, so I am ignoring that totally.

Magnus is considered with Burgundy benefits. For Smartbuy considering it is 5x and 10x, I have taken 7x and Traveledge is 5x. It is clear that Atlas is a very strong card but then, I thought, what if I have Atlas+Infinia combination?

So if I use Infinia for GYFTR and SmartBuy I get 33333+46667 = 80000 and Atlas for direct and general, it is 80000+24000=104000, total 184000. Add 15K milestone of Atlas and 20K joining miles from Infinia and Atlas, I have a total of 2,19,000 miles. 12% return against total expense.

Atlas expense can only be used for flight and hotel, whereas Infinia can be routed to Apple and Tanishq and trains as well. This does look like a good main 2 driver cards to use. What do you all think?

I was slightly tempted by Magnus+Burgundy, but I don't want to shift to premium banking of Axis - and as you see from the table, I am not loosing much. What other cards would you recommend?

P.S - I have applied for Atlas, the card is coming in a week!

Thank you for reading.