Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Joining Fee Charged Without Credit Card Activation - Query & Discussion

- Thread starter dungeonMaster

- Start date

- Replies 55

- Views 4K

Fini7777

TF Legend

I don't need vouchers and it totally comes under mis-selling & unfair practicesI think you will get the vouchers against the JFs.

As per the T&C they've to levy 5k and waive off if 50k spend condition is met

I'm waiting for their reply let's see if they do not honor the fee of 5k I'll escalate it further

yes, wait for the replyI'm waiting for their reply let's see if they do not honor the fee of 5k I'll escalate it further

Recently, I encountered the same issue while applying for the SBI Cashback Credit Card. Below is the timeline of events:

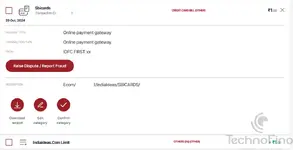

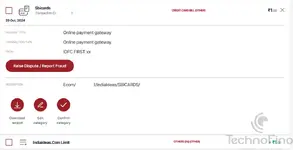

I argued that on 30/10/24, I did not even have full card details, so making a transaction was impossible. However, they insisted that the ₹1 transaction activated the card.

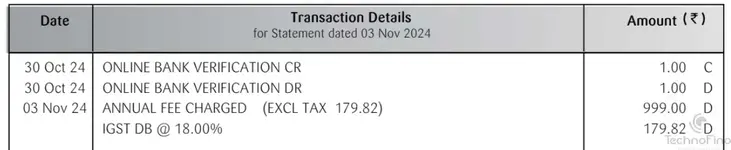

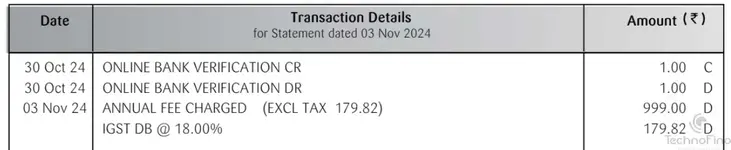

Upon reviewing the statement, I found that the ₹1 transaction made for KYC purposes on 29/10/24 was added to the card on 30/10/24, leading to its activation. Despite explaining this to them, they did not acknowledge my point.

Since I found the card useful, I did not escalate the issue further and started using it. I am attaching IDFC and SBI statements showing the transaction dates.

P.S. My card limit is still ₹20,000. Are there any methods to increase it? I have multiple credit cards with limits exceeding ₹10L.

- 29/10/24 – Applied for the SBI Cashback Credit Card via CashKaro. For KYC, there were two options: Video KYC & Bank Account KYC. I completed KYC using the bank account option with my IDFC Bank UPI ID. As part of the process, ₹1 was deducted and credited back on the same day. However, since I received a credit limit of only ₹20,000, I decided to wait and contact SBI customer care before activating the card.

- 03/11/24 – The card was delivered. I did not open the envelope as I wanted to first discuss the credit limit issue with SBI customer care.

- 04/11/24 – Received an email from SBI stating that my SBI Cashback Card statement was generated. Upon checking the statement, I noticed that a joining fee had already been levied, despite not activating the card.

I argued that on 30/10/24, I did not even have full card details, so making a transaction was impossible. However, they insisted that the ₹1 transaction activated the card.

Upon reviewing the statement, I found that the ₹1 transaction made for KYC purposes on 29/10/24 was added to the card on 30/10/24, leading to its activation. Despite explaining this to them, they did not acknowledge my point.

Since I found the card useful, I did not escalate the issue further and started using it. I am attaching IDFC and SBI statements showing the transaction dates.

P.S. My card limit is still ₹20,000. Are there any methods to increase it? I have multiple credit cards with limits exceeding ₹10L.

pradeepG

TF Premier

maybe thats the reason they are limiting the issued limit.have multiple credit cards with limits exceeding ₹10L.

Fini7777

TF Legend

He's very lucky that he atleast got the cashback card even after having more than 10 cardsmaybe thats the reason they are limiting the issued limit.

SBI usually rejects the apications with same reason

Send your income docs to SBI cards after 3 months, they will increase your limit but it will be 1x to 3x not more than that.My card limit is still ₹20,000. Are there any methods to increase it? I have multiple credit cards with limits exceeding ₹10L.

Yes, I would say the luckiest person.He's very lucky that he atleast got the cashback card even after having more than 10 cards

SBI usually rejects the apications with same reason

I don't have 10 cards, I have multiple cards with 10L limitHe's very lucky that he atleast got the cashback card even after having more than 10 cards

SBI usually rejects the apications with same reason

Fini7777

TF Legend

Ohh..Got it.I don't have 10 cards, I have multiple cards with 10L limit

Then send inc docs to sbi card and req for LE

Tried that, they are saying to wait for 6 monthsOhh..Got it.

Then send inc docs to sbi card and req for LE

shu_sha_

TF Legend

They'll not increase the limit on CB card that early.Tried that, they are saying to wait for 6 months

Get another SBI card, Simply Click or Simply Save card which will get you the enhanced limit and then transfer the limit to CB card

PriyaSaini

TF Buzz

Any update on this?I don't need vouchers and it totally comes under mis-selling & unfair practices

As per the T&C they've to levy 5k and waive off if 50k spend condition is met

I'm waiting for their reply let's see if they do not honor the fee of 5k I'll escalate it further

Fini7777

TF Legend

They charged me the membership fee of 15k plus GST todayAny update on this?

PNO asked me to write them back if JF of 15k is deducted from card

So, I've to reach out to them again

Last edited:

Fini7777

TF Legend

Update: received reply from PNO

Please accept my sincere apology on the experience you had with our Bank on occasions cited by you. I request you to view this experience as only an aberration and not a reflection of our service standards.

Please permit us to clarify as follows:

Basis your email, we wish to inform you that we have raised a request to reverse the Membership Fees of INR 15,000.00 + GST.

The request shall be processed within 2 working days.

We have also raised a request to change your Fee code from INR 15,000.00 + GST to INR 5,000.00 + GST.

The request for the same shall be processed within 7 working days.

We would also like to provide you with a confirmation that the Membership Fee of INR 5,000.00 + GST shall be waived of subject to the achievement of total spend-criteria of INR 50,000.00 within 90 days from the date of Card issuance.

Please accept my sincere apology on the experience you had with our Bank on occasions cited by you. I request you to view this experience as only an aberration and not a reflection of our service standards.

Please permit us to clarify as follows:

Basis your email, we wish to inform you that we have raised a request to reverse the Membership Fees of INR 15,000.00 + GST.

The request shall be processed within 2 working days.

We have also raised a request to change your Fee code from INR 15,000.00 + GST to INR 5,000.00 + GST.

The request for the same shall be processed within 7 working days.

We would also like to provide you with a confirmation that the Membership Fee of INR 5,000.00 + GST shall be waived of subject to the achievement of total spend-criteria of INR 50,000.00 within 90 days from the date of Card issuance.

sidp

TF Legend

Happy for you!. But where are you planning to spend 50k ?Update: received reply from PNO

Please accept my sincere apology on the experience you had with our Bank on occasions cited by you. I request you to view this experience as only an aberration and not a reflection of our service standards.

Please permit us to clarify as follows:

Basis your email, we wish to inform you that we have raised a request to reverse the Membership Fees of INR 15,000.00 + GST.

The request shall be processed within 2 working days.

We have also raised a request to change your Fee code from INR 15,000.00 + GST to INR 5,000.00 + GST.

The request for the same shall be processed within 7 working days.

We would also like to provide you with a confirmation that the Membership Fee of INR 5,000.00 + GST shall be waived of subject to the achievement of total spend-criteria of INR 50,000.00 within 90 days from the date of Card issuance.

Good to know. 👍Update: received reply from PNO

Please accept my sincere apology on the experience you had with our Bank on occasions cited by you. I request you to view this experience as only an aberration and not a reflection of our service standards.

Please permit us to clarify as follows:

Basis your email, we wish to inform you that we have raised a request to reverse the Membership Fees of INR 15,000.00 + GST.

The request shall be processed within 2 working days.

We have also raised a request to change your Fee code from INR 15,000.00 + GST to INR 5,000.00 + GST.

The request for the same shall be processed within 7 working days.

We would also like to provide you with a confirmation that the Membership Fee of INR 5,000.00 + GST shall be waived of subject to the achievement of total spend-criteria of INR 50,000.00 within 90 days from the date of Card issuance.

Fini7777

TF Legend

I already spent around 40k for my relative's university tution fee...Happy for you!. But where are you planning to spend 50k ?

Officially they did not mention any merchant restrictions on this 50k spend req so, any txn may count towards fee waiver.

Similar threads

Offer Fulfilled!

Axis bank privilege credit card joining benefit

- Replies

- 9

- Views

- 493

- Replies

- 3

- Views

- 663

- Replies

- 2

- Views

- 482

- Replies

- 14

- Views

- 520