This is my first ever post in this community but I have been following TechnoFino team for long time so please pardon my mistakes if any and do correct me.

Banks spend a lot to gain a customer on their credit card portfolio. A lot of work goes behind Marketing, onboarding & maintaining a trustful customer who brings good revenue to the bank and most likely pay all the dues on time. But at times when customer want to break this relationship by closing the card, banks offer retention offers to make him stay with the bank. Though this sounds odd to few this is an ultimate trump card a credit card company plays to stop a leaving customer. Banks does this because it costs banks much less to offer incentives to leaving customer for their retention rather than the cost of accruing a new customer, that too in this competitive market. This also doesn't mean banks offer these offers to each and every customer that exploits this raw nerve.

Generally these offers are not published/discussed and further they vary from customer to customer based on their relationship with the lender. So I thought of initiating a thread to accumulate various credit card retention offers for long time so here we go please share your card retention offers of various banks credit cards under this thread so that we can better our portfolio further lets find out which bank goes a extra mile to retain their customer. Here's my retention offer.

YES BANK

**************

I have been with Yes Bank since 2017 and got Yes bank Unsecured credit card in the year 2018. Initially my card was Yes Rewards Credit card offered as a pre approved bases on my savings account and I had instantly accepted the offer as I was a student at that time. Yes Bank card being my first ever credit card, I got a credit limit of 20,000 and I was ok with it as my requirements were minimum.

By the time I graduated my usage and spends gradually increased and credit limit requirement started to rise. After the devaluation following the Yes Bank crisis the card offers and reward points were reduced to so low that it didn't made any sense to hold the Yes Bank Cards. In addition to that inspite of being loyal to bank and with absolute zero late payments Yes Bank used to offer poor credit limit enhancements of 3,000 - 5000 for every 8-12 months, but they offer credit card upgrades every 6 months so I was adjusted to it. last straw that broke the camels back was in the year 2021 I got my second credit card i.e Amazon Pay ICICI Credit card with the limit of 2,50,000 and instantly I called Yes bank to close my card as credit limit on my Yes Edge CC was 32,000 at the time of closure and I was hardly able to buy even a mid range phone with it under Bank offers (knowing card closure effects my credit score in bad way) they took the request and I thought card was closed.

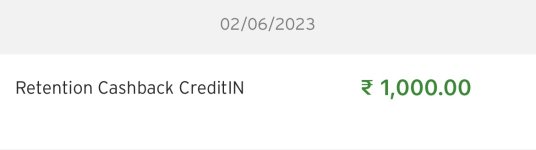

but after 15-20 days later I got a call from their Credit card retention team and they offered me direct upgrade from Yes Edge CC to Yes First Preferred CC with 1000 rupees worth reward points in statement with absolutely zero annual fee. I was amazed and decided to remain with them. But eventually after a year due to my other banks cards portfolio I hold by the mid of 2022 I finally closed my Yes Bank card and Yes they again called me and tried to persuaded me to at least stay on card to avail longe benefits, but as I travel near to nill I have denied their 2nd time card retention offer and closed the card. my card closure is solely regarding my poor Credit Limit offered by the bank inspite being with them for almost three years.

SBI

*****

Yes you heard it right, SBI...!!! Suprisingly I also had good retention offer experience on SBI. My father applied for SBI Cashback card via website and as he is salaried, during initial launch of Cashback card there was a glitch for salaried people so SBI agent came home to collect documents. After all formalities they issued Simply save card fraudulently and we have followed up with the SBI customer care but no action was taken.

As my father already holds SBI Elite which is 3 years old, we requested them to close this Simply save card. Immediately within 30 minutes of raising card closure request SBI Card retention team called us and reverted annual fee of 500+18%GST and told to retain card, after 30 min of persuasion I have accepted for the same but my father was unaware of this.

But the immediate next month my father has placed card closure request without my knowledge and again card retention team contacted him and enquired why did we again placed card closure request inspite of annual fee refund for which he also asked them to deduct the fees again and close the card due to bad onboarding experience and he also told about the mis-selling issue and also explained Simply save variant is not that useful in the current card portfolio which he holds, after enquiring about all cards he is holding and spend pattern (which is quite wierd from their end) immediately they have credited 20,000 reward points even without asking in SBI Elite Card rewards account on call and asked to Check the same in the app they also promised that after 6 months variant change option will be enabled for Cashback card too so that we can change the existing simplysave to Cashback.

Being infamous for their slack nature SBI Card retention team gave good offers inspite of placing back to back card closure requests.

they reverted 499+18% GST = 588 (Annual Fees) and 20000 reward points = 5000 Rupees total of 5588

It took a while to understand this is for real 😛 🙂 But this doesn't warrant that SBI does the same with every customer as my father card has spends of 12L almost every year on Elite since a couple of years so that history might have helped him getting a good retention offer for the other card of SBI.

So that it here's my experience of Card retention offer with Yes Bank and SBI do share yours if you have any in the thread below. Sorry for the long post in advance.

Banks spend a lot to gain a customer on their credit card portfolio. A lot of work goes behind Marketing, onboarding & maintaining a trustful customer who brings good revenue to the bank and most likely pay all the dues on time. But at times when customer want to break this relationship by closing the card, banks offer retention offers to make him stay with the bank. Though this sounds odd to few this is an ultimate trump card a credit card company plays to stop a leaving customer. Banks does this because it costs banks much less to offer incentives to leaving customer for their retention rather than the cost of accruing a new customer, that too in this competitive market. This also doesn't mean banks offer these offers to each and every customer that exploits this raw nerve.

Generally these offers are not published/discussed and further they vary from customer to customer based on their relationship with the lender. So I thought of initiating a thread to accumulate various credit card retention offers for long time so here we go please share your card retention offers of various banks credit cards under this thread so that we can better our portfolio further lets find out which bank goes a extra mile to retain their customer. Here's my retention offer.

YES BANK

**************

I have been with Yes Bank since 2017 and got Yes bank Unsecured credit card in the year 2018. Initially my card was Yes Rewards Credit card offered as a pre approved bases on my savings account and I had instantly accepted the offer as I was a student at that time. Yes Bank card being my first ever credit card, I got a credit limit of 20,000 and I was ok with it as my requirements were minimum.

By the time I graduated my usage and spends gradually increased and credit limit requirement started to rise. After the devaluation following the Yes Bank crisis the card offers and reward points were reduced to so low that it didn't made any sense to hold the Yes Bank Cards. In addition to that inspite of being loyal to bank and with absolute zero late payments Yes Bank used to offer poor credit limit enhancements of 3,000 - 5000 for every 8-12 months, but they offer credit card upgrades every 6 months so I was adjusted to it. last straw that broke the camels back was in the year 2021 I got my second credit card i.e Amazon Pay ICICI Credit card with the limit of 2,50,000 and instantly I called Yes bank to close my card as credit limit on my Yes Edge CC was 32,000 at the time of closure and I was hardly able to buy even a mid range phone with it under Bank offers (knowing card closure effects my credit score in bad way) they took the request and I thought card was closed.

but after 15-20 days later I got a call from their Credit card retention team and they offered me direct upgrade from Yes Edge CC to Yes First Preferred CC with 1000 rupees worth reward points in statement with absolutely zero annual fee. I was amazed and decided to remain with them. But eventually after a year due to my other banks cards portfolio I hold by the mid of 2022 I finally closed my Yes Bank card and Yes they again called me and tried to persuaded me to at least stay on card to avail longe benefits, but as I travel near to nill I have denied their 2nd time card retention offer and closed the card. my card closure is solely regarding my poor Credit Limit offered by the bank inspite being with them for almost three years.

SBI

*****

Yes you heard it right, SBI...!!! Suprisingly I also had good retention offer experience on SBI. My father applied for SBI Cashback card via website and as he is salaried, during initial launch of Cashback card there was a glitch for salaried people so SBI agent came home to collect documents. After all formalities they issued Simply save card fraudulently and we have followed up with the SBI customer care but no action was taken.

As my father already holds SBI Elite which is 3 years old, we requested them to close this Simply save card. Immediately within 30 minutes of raising card closure request SBI Card retention team called us and reverted annual fee of 500+18%GST and told to retain card, after 30 min of persuasion I have accepted for the same but my father was unaware of this.

But the immediate next month my father has placed card closure request without my knowledge and again card retention team contacted him and enquired why did we again placed card closure request inspite of annual fee refund for which he also asked them to deduct the fees again and close the card due to bad onboarding experience and he also told about the mis-selling issue and also explained Simply save variant is not that useful in the current card portfolio which he holds, after enquiring about all cards he is holding and spend pattern (which is quite wierd from their end) immediately they have credited 20,000 reward points even without asking in SBI Elite Card rewards account on call and asked to Check the same in the app they also promised that after 6 months variant change option will be enabled for Cashback card too so that we can change the existing simplysave to Cashback.

Being infamous for their slack nature SBI Card retention team gave good offers inspite of placing back to back card closure requests.

they reverted 499+18% GST = 588 (Annual Fees) and 20000 reward points = 5000 Rupees total of 5588

It took a while to understand this is for real 😛 🙂 But this doesn't warrant that SBI does the same with every customer as my father card has spends of 12L almost every year on Elite since a couple of years so that history might have helped him getting a good retention offer for the other card of SBI.

So that it here's my experience of Card retention offer with Yes Bank and SBI do share yours if you have any in the thread below. Sorry for the long post in advance.

Last edited: