Deleted member 26954

TF Premier

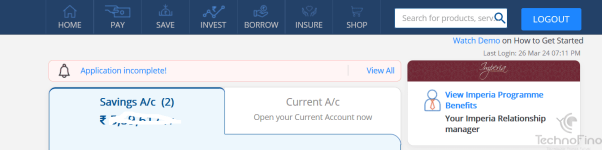

My personal opinion, It is useless until unless you are getting specific benefit like discounted locker, premium CC LTF etc ...You will BLOCK your money to maintain the useless status of preferred/imperia.....You will be KING without Kingdom....I am waiting for downgrade from Imperia to classic 🙂