Are you paying your credit card bill via 3rd party app or directly from your bank portal? then you are probably losing 1% cashback.

If you pay your credit card bill via HDFC Bank bill payment portal using your HDFC Bank debit card then you can earn 1% cashback, maximum Cashback capping depends on your debit card type.

Maximum Cashback Capping-

If you have HDFC Easyshop Platinum debit card then you can earn 1% upto Rs. 750 per month, just pay Rs. 75,000 bill & get Rs. 750 cashback.

If you have HDFC Millennia debit card then you can earn 1% upto Rs. 400 per month, just pay Rs. 40,000 bill & get Rs. 400 cashback.

Not only credit card bill, you can pay any utility bill you want (must be available on Hdfc bank bill payment portal) & get 1% cashback.

To Pay Bill Follow These Steps-

1. Login to your HDFC Bank Netbaning

2. Click on "BillPay & Recharge" tab -> Click on Continue

3. Now click on Add Biller

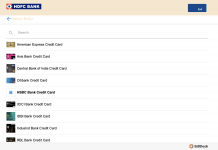

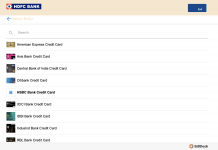

4. Select Credit Card

5. Now select your card provider name

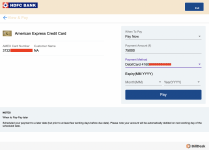

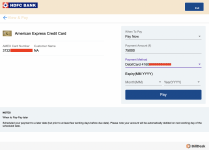

6. Enter your credit card detail

7. Enter amount you want to pay

8. Select your debit card from drop down menu

9. Click on pay

10. Enter OTP & Done!

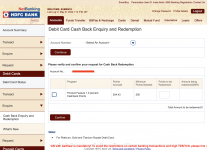

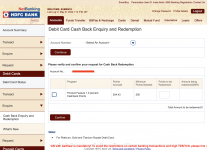

You'll receive 1% Cashback for the transaction, you can check & redeem your debit card Cashback from "Card Tab -> Debit Card -> Enquiry -> Cashback Enquiry & Redemption"

If you pay your credit card bill via HDFC Bank bill payment portal using your HDFC Bank debit card then you can earn 1% cashback, maximum Cashback capping depends on your debit card type.

Maximum Cashback Capping-

If you have HDFC Easyshop Platinum debit card then you can earn 1% upto Rs. 750 per month, just pay Rs. 75,000 bill & get Rs. 750 cashback.

If you have HDFC Millennia debit card then you can earn 1% upto Rs. 400 per month, just pay Rs. 40,000 bill & get Rs. 400 cashback.

Not only credit card bill, you can pay any utility bill you want (must be available on Hdfc bank bill payment portal) & get 1% cashback.

To Pay Bill Follow These Steps-

1. Login to your HDFC Bank Netbaning

2. Click on "BillPay & Recharge" tab -> Click on Continue

3. Now click on Add Biller

4. Select Credit Card

5. Now select your card provider name

6. Enter your credit card detail

7. Enter amount you want to pay

8. Select your debit card from drop down menu

9. Click on pay

10. Enter OTP & Done!

You'll receive 1% Cashback for the transaction, you can check & redeem your debit card Cashback from "Card Tab -> Debit Card -> Enquiry -> Cashback Enquiry & Redemption"