Hello all,

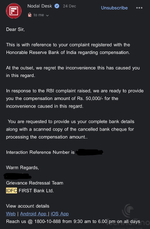

Sharing here the instance where i got a compensation of 50K from Idfc first bank for credit card misselling.

Here is the timeline --

I needed the Wealth Credit Card as it was being issued LTF. I tried applying for it three times in the first half of the year, but I had no luck.

I gave it some time and applied again via the mobile app in August, but the application didn't complete—possibly because it was still within the cooling period. However, an application number was generated.

I received a call from a bank employee who mentioned that my application was still pending and offered assistance in completing it. I explained my previous rejections, but they assured me that the card was showing as pre-approved in their system and would likely get approved. At their request, I sent income documents so they could submit them on my behalf. This seemed odd, as pre-approved cards typically don't require income documents or CIBIL inquiries. Despite completing the process, the application was rejected.

In September, I tried a similar approach: I initiated the application and aborted midway, anticipating that someone from the bank would contact me. As expected, I received a call from the bank's sales team about completing the application. Again, they claimed the card was pre-approved and would be dispatched after completing formalities. I suspected another rejection but allowed them to proceed with the application submission. Unsurprisingly, it was rejected again.

I raised the issue with the bank's PNO (Principal Nodal Officer). They cited internal policies. On the same day, I escalated the matter to the RBI Ombudsman (RBIO), providing all the details and proof.

My main points were:

1. CIBIL inquiries were being conducted for a card the bank claimed was pre-approved.

2. Unethical promotion and sale of credit cards under the guise of pre-approved offers.

The bank's PNO responded via email, stating the application was rejected because they couldn’t verify the income documents. They also mentioned that there was no pre-approved offer for me at that time. I replied, pointing out that I had telephonic recordings of conversations with their employee who assisted with the application and that those recordings had been shared with the regulators.

I didn't even follow up with RBIO or the bank after this, but to my surprise, they sent a compensation mail after 3 month. I had initially requested ₹80,000 in my RBIO complaint. I would have been more than happy if they had simply reconsidered the application, approved it, or removed the CIBIL inquiries. This outcome, however, was entirely unexpected!

Sharing here the instance where i got a compensation of 50K from Idfc first bank for credit card misselling.

Here is the timeline --

I needed the Wealth Credit Card as it was being issued LTF. I tried applying for it three times in the first half of the year, but I had no luck.

I gave it some time and applied again via the mobile app in August, but the application didn't complete—possibly because it was still within the cooling period. However, an application number was generated.

I received a call from a bank employee who mentioned that my application was still pending and offered assistance in completing it. I explained my previous rejections, but they assured me that the card was showing as pre-approved in their system and would likely get approved. At their request, I sent income documents so they could submit them on my behalf. This seemed odd, as pre-approved cards typically don't require income documents or CIBIL inquiries. Despite completing the process, the application was rejected.

In September, I tried a similar approach: I initiated the application and aborted midway, anticipating that someone from the bank would contact me. As expected, I received a call from the bank's sales team about completing the application. Again, they claimed the card was pre-approved and would be dispatched after completing formalities. I suspected another rejection but allowed them to proceed with the application submission. Unsurprisingly, it was rejected again.

I raised the issue with the bank's PNO (Principal Nodal Officer). They cited internal policies. On the same day, I escalated the matter to the RBI Ombudsman (RBIO), providing all the details and proof.

My main points were:

1. CIBIL inquiries were being conducted for a card the bank claimed was pre-approved.

2. Unethical promotion and sale of credit cards under the guise of pre-approved offers.

The bank's PNO responded via email, stating the application was rejected because they couldn’t verify the income documents. They also mentioned that there was no pre-approved offer for me at that time. I replied, pointing out that I had telephonic recordings of conversations with their employee who assisted with the application and that those recordings had been shared with the regulators.

I didn't even follow up with RBIO or the bank after this, but to my surprise, they sent a compensation mail after 3 month. I had initially requested ₹80,000 in my RBIO complaint. I would have been more than happy if they had simply reconsidered the application, approved it, or removed the CIBIL inquiries. This outcome, however, was entirely unexpected!

Attachments

Last edited: