RBL Bank launch RuPay Credit Cards with UPI & NCMC capabilities into RuPay Credit Cards:

First Private Sector Bank to integrate both UPI and NCMC capabilities into RuPay Credit Cards.

View attachment 63570

Mumbai: RBL Bank, one of India’s leading private sector banks, announced a significant milestone with the integration of Unified Payments Interface (UPI) and National Common Mobility Card (NCMC) features on RuPay Credit Cards. This integration makes RBL Bank the first private sector bank in India to offer such a comprehensive suite of payment capabilities in a single card.

Thanks to the NCMC function, Users can now enjoy seamless, secure, and instant payments through UPI, along with hassle-free travel facilitated by the NCMC feature. The extensive acceptance of the RuPay network further amplifies the benefits of these cards, ensuring wide usability across various platforms and services.

Highlighting the significance of this capability,

Bikram Yadav, Business Head – Credit Cards at RBL Bank, stated, “We are thrilled to launch our Credit Cards on the RuPay platform, reflecting our commitment to providing convenience and value addition to our customers. This milestone not only revolutionises transaction management but also sets a new benchmark for the digital payments industry. Our customers can now experience the ultimate flexibility and ease of making payments, be it for daily expenses or during travel, all consolidated in one card.”

Rajeeth Pillai, Chief Relationship Management, NPCI, said, “We are pleased to support RBL Bank in launching RuPay Credit Cards integrated with UPI and NCMC capabilities. This integration embodies the spirit of innovation and convenience that NPCI strives to bring in the digital payment ecosystem. Combining UPI’s secure, instant payment capabilities with NCMC’s travel convenience will offer users a holistic payment solution. We believe this initiative will significantly enhance the digital payment experience for consumers across India.”

View attachment 63569

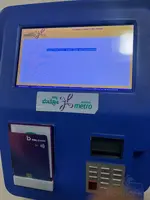

NCMC : Your Gateway to Hassle-Free Travel

- Designed to unlock the potential of contactless travel, RBL Bank RuPay Credit Card is equipped with National Common Mobility Card (NCMC) feature.

- It enables card members to make On-the-Go payments across Metro stations, bus terminals etc. in a fraction of second, just by tapping the card on the card reader.

- The NCMC feature comes with an inbuilt offline wallet (up to a maximum limit of INR 2,000 and is subject to change as per RBI guideline).

Enjoy the benefits of NCMC Credit Card at Delhi Metro (DMRC), Bangalore Metro (BMRCL), Mumbai Metro (MMRDA) & many more. View complete list of NCMC enabled terminals here.

Key Benefits:

- Simplified everyday commute

- Contactless travel via metro/bus/train

- Easy & Secure transits with Tap & Go

- Works in low network areas like underground metro stations, parking lots etc.

- Wide acceptance across the country

How to use:

NCMC Credit Card's offline wallet comes in Activated Mode. Initial Wallet balance will be INR 0.

- Upon receiving the credit card, Cardmember can recharge the card by visiting nearest metro terminal (Maximum Limit of INR 2,000)

- Once balance is updated, cardmember can start making cashless and contactless payments across different travel modes directly with their new RBL Bank Credit Card

- Login to RBL MyCard Mobile App > Go to Exclusive Facilities > NCMC > Select NCMC & Recharge

Click here to View Most Important Terms & conditions

Frequently Asked Questions:

Cardmember will earn reward points as defined in respective product terms & conditions. However, offline UPI transactions under INR 2,000 done at small merchants on RBL Bank RuPay Credit Card will not be eligible for rewards points, voucher benefits, milestone benefits or any other product benefits, unless stated otherwise. For clarity, small merchants in this case means merchants with turnover of not more than INR 20 lakh during the previous financial year.