Hi everyone,

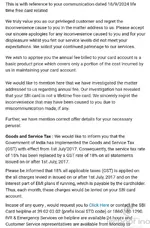

I have an SBI SimplyCLICK credit card, and I recently spent 86k in one year , but I missed the 1L fees wavier on simplyclick for the ₹590 annual fee waiver by 14k. In the past two I had spent 1L+ and got the fee waived without any issues.

Has anyone successfully called SBI and managed to get the fee waived despite not meeting the 1L spending requirement? If so, how was your experience?

I appreciate any help you can provide.

I have an SBI SimplyCLICK credit card, and I recently spent 86k in one year , but I missed the 1L fees wavier on simplyclick for the ₹590 annual fee waiver by 14k. In the past two I had spent 1L+ and got the fee waived without any issues.

Has anyone successfully called SBI and managed to get the fee waived despite not meeting the 1L spending requirement? If so, how was your experience?

I appreciate any help you can provide.