Batmanbaba

TF Legend

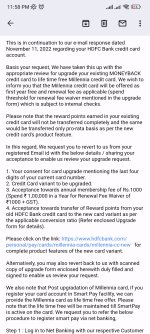

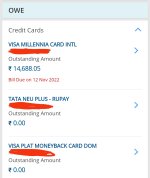

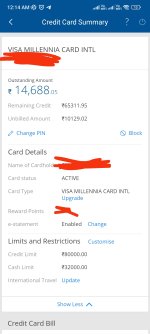

So I got my tata neu plus card last month with a limit of 70000. After getting my card I started my target of getting a core hdfc card. I requested for a Millenia card along with this tata neu plus card as many regular core hdfc card holders were getting tata neu card too. My first mail to customer care was not met with positive response. So I requested again to grievance redressal team. They also rejected to give two cards.

So I proposed them to downgrade/upgrade my card to millenia ltf. They are not ready to evn give that. They are only ready to give me MoneyBack plus first year free... Then chargeable from 2nd year. Fees reversal is at 50000 spends.

Considering the fact that only tata product I use is bigbasket and it gives 3.33% on MoneyBack card whereas on tata neu plus card I only get 2%..5% will ge given to all tata neu pass holders.

On other hand tata neu gives 1% on every other site except tata neu... Whereas moneyback only gives 2 points per 150...but it gives as a cashback points which we can get as statement credit for free whereas on tata cards we get it as neu coins. Also on swiggy, flipkart and amazon its giving 3.33% and annual fees waiver is only 50000 as compared to 1 lakh in tata neu card. Also on quaterly spends on 50000... 500 rs voucher will also be given.

Should I change my card to moneyback plus or keep tata neu card?? If I take this moneyback paid card are there chances of update in future to millenia!/ Regalia or above as ltf..?? Or should I mail once to nodal officer and see if they give it as ltf.. Millenia or moneyback plus card..!!? I am also a savings account holder in hdfc

So I proposed them to downgrade/upgrade my card to millenia ltf. They are not ready to evn give that. They are only ready to give me MoneyBack plus first year free... Then chargeable from 2nd year. Fees reversal is at 50000 spends.

Considering the fact that only tata product I use is bigbasket and it gives 3.33% on MoneyBack card whereas on tata neu plus card I only get 2%..5% will ge given to all tata neu pass holders.

On other hand tata neu gives 1% on every other site except tata neu... Whereas moneyback only gives 2 points per 150...but it gives as a cashback points which we can get as statement credit for free whereas on tata cards we get it as neu coins. Also on swiggy, flipkart and amazon its giving 3.33% and annual fees waiver is only 50000 as compared to 1 lakh in tata neu card. Also on quaterly spends on 50000... 500 rs voucher will also be given.

Should I change my card to moneyback plus or keep tata neu card?? If I take this moneyback paid card are there chances of update in future to millenia!/ Regalia or above as ltf..?? Or should I mail once to nodal officer and see if they give it as ltf.. Millenia or moneyback plus card..!!? I am also a savings account holder in hdfc