Sorry for the long post 🙁

Hi TF mates. Sharing my union Bank credit card application experience, which is still in process. (UPDATE- CLOSED ALL RELATIONSHIPS WITH UNION BANK)

Like few people in the community I also like to have credit card collection.

So last week I thought of applying union Bank credit card. First I went to their website to apply the credit card but the website link is broken. After entering all the details in the website I got an error and it asked to visit the bank for further process completion.

Next day when I visited the branch, as usual like other PSU banks they ask me to open a bank account with them. I was fully prepared and took all the documents needed. Then I filled up the 5 page form and given documents. Told once my account gets activated I can apply the credit card.

Next day the account got activated and I took the credit card application form. Strange thing they told apart from KYC document they need my 3 years ITR and 3 years Form 16. As I had only 2 years of ITR and form 16, they agreed and I submitted the documents for credit card. One thing the manager told they only consider ITR for the credit card application and credit limit and don't consider card to card or salary slip income proofs.

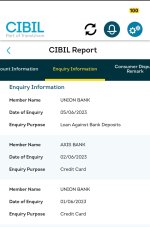

On the same day of application i.e. 1st June, I got a CIBIL enquiry from Union Bank for credit card. After 4 days on 5th May I got another enquiry from Union Bank, but this time the enquiry type is "Loan against fixed deposit".

I visited the branch again to enquiry. This time the manager told that the first CIBIL enquiry was not completed successfully due to some system crash, but second time CIBIL enquiry was done for only credit card. I showed her the enquiry type but she refuse to accept their fault.

Now the most irritating thing of the day when I heard from her that I need to submit all of my credit card's 16 digit numbers, issuer bank and credit limit in a blank paper, in order to process my Union Bank credit card application.

I told her I have more than 40 credit cards and hard ro fulfill this request for just a credit card application. Now she told with attitude if you want the credit card then you have to follow the banks process. When I asked is it safe to provide credit card number as RBI only advises that never share your card information to anyone, then the manager was like I don't know if it safe, but its in our process, if you want the card then you have to submitted the details.

Now I don't know I should really go for the card. But one thing for sure, majority of the PSU banks have worst application process and strange documents demands when it comes to credit card application process.

I have attached my CIBIL enquiry image also which I am thinking to raise a dispute first with bank and then CIBIL.

Hi TF mates. Sharing my union Bank credit card application experience, which is still in process. (UPDATE- CLOSED ALL RELATIONSHIPS WITH UNION BANK)

Like few people in the community I also like to have credit card collection.

So last week I thought of applying union Bank credit card. First I went to their website to apply the credit card but the website link is broken. After entering all the details in the website I got an error and it asked to visit the bank for further process completion.

Next day when I visited the branch, as usual like other PSU banks they ask me to open a bank account with them. I was fully prepared and took all the documents needed. Then I filled up the 5 page form and given documents. Told once my account gets activated I can apply the credit card.

Next day the account got activated and I took the credit card application form. Strange thing they told apart from KYC document they need my 3 years ITR and 3 years Form 16. As I had only 2 years of ITR and form 16, they agreed and I submitted the documents for credit card. One thing the manager told they only consider ITR for the credit card application and credit limit and don't consider card to card or salary slip income proofs.

On the same day of application i.e. 1st June, I got a CIBIL enquiry from Union Bank for credit card. After 4 days on 5th May I got another enquiry from Union Bank, but this time the enquiry type is "Loan against fixed deposit".

I visited the branch again to enquiry. This time the manager told that the first CIBIL enquiry was not completed successfully due to some system crash, but second time CIBIL enquiry was done for only credit card. I showed her the enquiry type but she refuse to accept their fault.

Now the most irritating thing of the day when I heard from her that I need to submit all of my credit card's 16 digit numbers, issuer bank and credit limit in a blank paper, in order to process my Union Bank credit card application.

I told her I have more than 40 credit cards and hard ro fulfill this request for just a credit card application. Now she told with attitude if you want the credit card then you have to follow the banks process. When I asked is it safe to provide credit card number as RBI only advises that never share your card information to anyone, then the manager was like I don't know if it safe, but its in our process, if you want the card then you have to submitted the details.

Now I don't know I should really go for the card. But one thing for sure, majority of the PSU banks have worst application process and strange documents demands when it comes to credit card application process.

I have attached my CIBIL enquiry image also which I am thinking to raise a dispute first with bank and then CIBIL.

Attachments

Last edited: