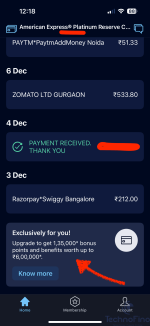

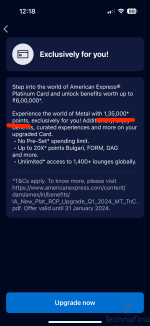

Amex plans to start 2024 with a grand reward of 1,35,000 MR points when upgrading to a Platinum Charge card.

Users currently holding Amex Platinum Travel, Amex Platinum Reserve and Amex Gold Charge card are getting these offers.

You can see it in the app, refer to the screenshots attached below.

For the heavy spenders, this is a great deal since you get multiple loyal hotel loyal memberships and do anything concierge service.

If you don't spend a lot of money but feel the points can help, you can still upgrade for the points.

If you don't need the points, you can get the Amex Platinum Travel or the Amex MRCC card which remains the best card for monthly spends between 6K-40K.

T&C: https://www.americanexpress.com/con...ts/IA_New_Plat_RCP_Upgrade_Q1_2024_MT_TnC.pdf

Users currently holding Amex Platinum Travel, Amex Platinum Reserve and Amex Gold Charge card are getting these offers.

You can see it in the app, refer to the screenshots attached below.

For the heavy spenders, this is a great deal since you get multiple loyal hotel loyal memberships and do anything concierge service.

If you don't spend a lot of money but feel the points can help, you can still upgrade for the points.

If you don't need the points, you can get the Amex Platinum Travel or the Amex MRCC card which remains the best card for monthly spends between 6K-40K.

T&C: https://www.americanexpress.com/con...ts/IA_New_Plat_RCP_Upgrade_Q1_2024_MT_TnC.pdf