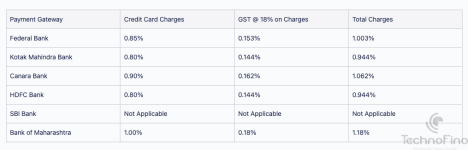

Yes, the amount I see in my "unbilled transactions" is the exact same amount I entered in the challan.The PG charges for HDFC cards on HDFC PG is 0.75%. Are you sure it wasn't charged ?

So either HDFC doesn't charge this or they will charge it later at the time of statement generation.