View attachment 53994

Based on my last fiscal year purchases, I have created this estimate, now I need help in planning out which cards & platforms I should use to maximize the cashback & rewards on my transactions. I have already gone through a lot of posts here on forum & videos on TF youtube channel and have created a basic plan, need feedback from you guys to improve my plan & maximize rewards

Cards I own:

Credit Cards

- ICICI Amazon

- HDFC Millennia

- HDFC Tata Nue Plus

- OneCard

- ICICI Platinum

- Axis Neo

- IDFC First Select

- Indusand Legend

- RBL paisa bazaar Duet card

- ICICI Coral Rupay card

Debit Cards

- Kotak Visa Debit card

- Indusand Mastercard Debit card

- ICICI Visa Debit card

- SBI Rupay Debit card

- Canara Rupay Debit card

Plan:

| Category | Payment Method | Expected Rewards, paid through platform & comments |

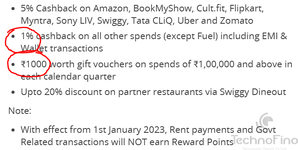

| Online shopping (Amazon, myntra, Flipkart & Ajio) | HDFC Millennia | 5%, direct on ecommerce website |

| Life & Health Insurance | ICICI Amazon | 1%, Insurance company website |

| Other | Nue Plus or normal UPI | 1.5% or nil, direct purchase |

| Miscellaneous Visa/master (Kirana, cafe, any offline purchase) | ICICI Amazon | 1%, direct purchase |

| Food (online) (zomato, swiggy, eatsure, MacD App, Lapinoz App, Dominos App) | HDFC Millennia(select patner) or Amazon ICICI (other third party apps) | 5% (select patner) or 1% (direct purchase) |

| Food (offline) | ICICI Amazon or Nue Plus | 1% or 1.5% |

| Dmart, Relience Fresh | ICICI Amazon | 1% |

| Elecricity Bill | Amazon giftcard | 5%, purchased on amazon using HDFC milennia |

| Hotel Booking | ICICI amazon | 1%, using makeMyTrip & other platforms |

| Miscellaneous Rupay (Kirana, cafe, any offline purchase) | Nue Plus or ICICI Amazon | 1.5 or 1% |

| Train Booking | ICICI Amazon | 1%, IRCTC website |

| Gas Cylinder | Amazon giftcard | 5%, purchased on amazon using HDFC milennia |

| Online Services - Jio Fiber | ICICI Amazon | 1%, using Jio mobile app |

| Mobile Recharge (Jio & BSNL) | Amazon giftcard | 5%, purchased on amazon using HDFC milennia |

| Tax (property & water) | ICICI Amazon | 1%, directly through Govt website |

| Petrol | ICICI Amazon | 0% |

| Online Services - Chatgpt | OneCard | -1% (forex fee), openAI platform, Onecard has lowest forex I think |

| Flight Booking | ICICI Amazon | 1%, any flight booking platform |

| Airtel d2h | ICICI Amazon | 1%, using Airtel Thanks app |

| Online Services - Yt Premium | playstore gift card | 5%, purchased on amazon using HDFC milennia |

| | |

Please give me your feedback & help me improve my plan, All CC are LTF. All debit cards have their annual 200-300 maintenance fee.