Hello TFC Members,

Today i want to share a banking kissa with you guys.

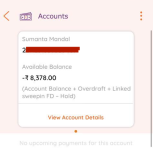

I have a royal savings account with AU Small Finance Bank, but I failed to maintain the minimum balance requirement of 1 lakh rupees after February 2022. As a result, the bank deducted around 900 rupees from my account as a non-maintenance fee, and my account balance became zero. Despite this, the bank continued to charge me non-maintenance fees, leaving me with a negative balance of 8400 rupees.

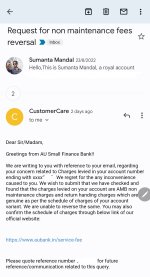

I brought this issue to the attention of AU Small Finance Bank and cited the RBI guidelines, which state that a bank cannot impose non-maintenance fees on a customer whose account balance is zero.

However, the bank refused to comply with my request and even asked me to pay the negative balance before closing my account.

However, the bank refused to comply with my request and even asked me to pay the negative balance before closing my account.

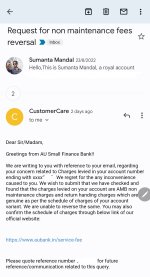

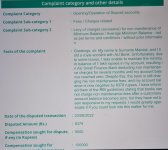

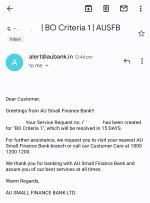

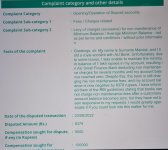

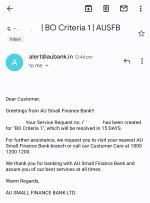

Frustrated by this, I decided to file a complaint with the RBI banking ombudsman. Surprisingly, I received an email from AU Bank the following day (attached screenshot), indicating that they are willing to close my account without any deposit.

I am impressed by the swift action taken by the RBI banking ombudsman, and I now have a 15-day window for AU Small Finance Bank to resolve this issue.

Hopefully, this experience will serve as a lesson for the bank to comply with the RBI guidelines and treat their customers fairly.

Hopefully, this experience will serve as a lesson for the bank to comply with the RBI guidelines and treat their customers fairly.

If you want to know about "How to file a complaint against a bank on the RBI banking ombudsman portal" visit this link - https://www.technofino.in/community...ank-on-the-rbi-banking-ombudsman-portal.3130/

Here is the RBI guidelines regarding non maintenance penalty screenshot [link- https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9343&Mode=0 ]

Today i want to share a banking kissa with you guys.

I have a royal savings account with AU Small Finance Bank, but I failed to maintain the minimum balance requirement of 1 lakh rupees after February 2022. As a result, the bank deducted around 900 rupees from my account as a non-maintenance fee, and my account balance became zero. Despite this, the bank continued to charge me non-maintenance fees, leaving me with a negative balance of 8400 rupees.

I brought this issue to the attention of AU Small Finance Bank and cited the RBI guidelines, which state that a bank cannot impose non-maintenance fees on a customer whose account balance is zero.

However, the bank refused to comply with my request and even asked me to pay the negative balance before closing my account.

However, the bank refused to comply with my request and even asked me to pay the negative balance before closing my account.

Frustrated by this, I decided to file a complaint with the RBI banking ombudsman. Surprisingly, I received an email from AU Bank the following day (attached screenshot), indicating that they are willing to close my account without any deposit.

I am impressed by the swift action taken by the RBI banking ombudsman, and I now have a 15-day window for AU Small Finance Bank to resolve this issue.

Hopefully, this experience will serve as a lesson for the bank to comply with the RBI guidelines and treat their customers fairly.

Hopefully, this experience will serve as a lesson for the bank to comply with the RBI guidelines and treat their customers fairly.If you want to know about "How to file a complaint against a bank on the RBI banking ombudsman portal" visit this link - https://www.technofino.in/community...ank-on-the-rbi-banking-ombudsman-portal.3130/

Here is the RBI guidelines regarding non maintenance penalty screenshot [link- https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=9343&Mode=0 ]

Last edited: