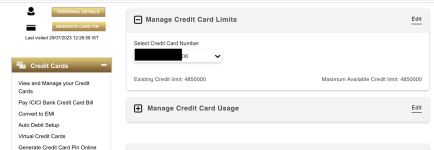

Update: Here's my updated cc portfolio ‼️

We can't really have a forum without allowing members to share their credit card portfolios and talk about their favourite credit card. 😎

---

I will go first, here's my collection, from least used to most used.

We can't really have a forum without allowing members to share their credit card portfolios and talk about their favourite credit card. 😎

---

I will go first, here's my collection, from least used to most used.

| Slice Pay card |

| Amazon Pay ICICI bank card |

| Citi Cashback card |

| IDFC First Select card |

| AMEX Membership Rewards card |

| HDFC Diners Club Black card |

| Onecard Metal card |

| Axis Magnus card |

Last edited: