Because they have devalued Zenith to hell and continue to do so every month. Would rather jump ship to Zenith plus and take advantage of the monthly milestones on the card before they devalue that too

If they devalue that too, is it worth the fee paid?

Note: To recover 900Rs. we need to spend atleast 40k on normal 1% category with milestone. Or 90k without milestone.

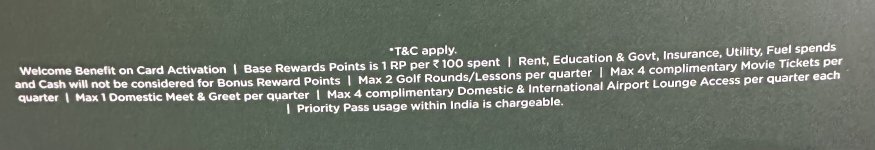

M&G is only 1 per quarter. Problem: Additional person charged (if not travelled solo) at 3000-5000 depends on airport (extra purchase, which may not go if we paid directly).

with milestone max it offers 2.3% or 3.3% (for some categories).

Anyway, hope you find the good value with zenith+. Drop a mail (mail ids in monthly statement) and request for switch/upgrade.