Dear TFC members,

I would like to inform you that Axis Bank has begun sending commercial use notifications to their HNI cardholders as well. As you may already know, Axis Bank has a history of cancelling their customers' cashback cards such as Axis Ace and Axis Flipkart Card if they are used for business purposes.

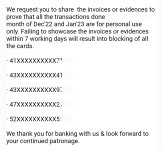

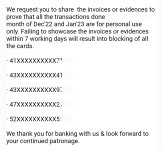

Recently, Axis Bank has sent suspected commercial use notifications to their HNI cardholders such as Axis Magnus, Axis Reserve, etc. Unfortunately, I have also received a notification from Axis Bank and they are requesting spending justification within the next seven working days.

In case a customer is unable to justify their spending as personal, the bank will close all their credit cards.

During that time frame (Dec 2022 and Jan 2023), all of my spending was personal. I am currently in the process of submitting all the necessary documents to Axis Bank for spending justification.

The primary reason for this post is to advise our members that even if you are using a high-end credit card from a bank, they may still flag your transactions if they are related to business expenses.

If you intend to charge anything other than personal expenses to your personal credit card, please exercise caution.

Edit:- many people are asking for subject line of the email, Here it is- "Commercial Usage on your Axis Bank Credit Card Accounts"

Update - Axis Bank has already sent notifications to more than 200 accounts on March 4, 2023. Now they have sent such a cancellation notice to more than 500 credit card accounts yesterday. and they are also filtering more accounts. (S.N.)

I would like to inform you that Axis Bank has begun sending commercial use notifications to their HNI cardholders as well. As you may already know, Axis Bank has a history of cancelling their customers' cashback cards such as Axis Ace and Axis Flipkart Card if they are used for business purposes.

Recently, Axis Bank has sent suspected commercial use notifications to their HNI cardholders such as Axis Magnus, Axis Reserve, etc. Unfortunately, I have also received a notification from Axis Bank and they are requesting spending justification within the next seven working days.

In case a customer is unable to justify their spending as personal, the bank will close all their credit cards.

During that time frame (Dec 2022 and Jan 2023), all of my spending was personal. I am currently in the process of submitting all the necessary documents to Axis Bank for spending justification.

The primary reason for this post is to advise our members that even if you are using a high-end credit card from a bank, they may still flag your transactions if they are related to business expenses.

If you intend to charge anything other than personal expenses to your personal credit card, please exercise caution.

Edit:- many people are asking for subject line of the email, Here it is- "Commercial Usage on your Axis Bank Credit Card Accounts"

Update - Axis Bank has already sent notifications to more than 200 accounts on March 4, 2023. Now they have sent such a cancellation notice to more than 500 credit card accounts yesterday. and they are also filtering more accounts. (S.N.)

Last edited: