Hello everyone,

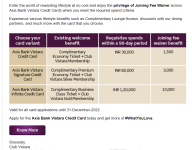

Axis bank is back with it's joining fees reversal offer for its all three vistara co-branded credit cards.

It's a spend based joining fees reversal offer. You have to spend X amount of money within first 90 days of card setup.

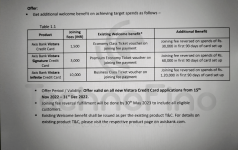

For Axis Vistara Credit Card- You have to spend ₹30,000 within 90 days.

Axis Vistara Signature- Spend ₹60,000 within first 90 days.

Axis Vistara Infinite- Spend ₹1,20,000 within 90 first days.

Offer fulfilment date - by 30th May, 2023.

You'll get welcome benefits as per card features.

It's the best time if you were planning to get axis vistara co-branded credit card. Apply early to get extra time for spends.

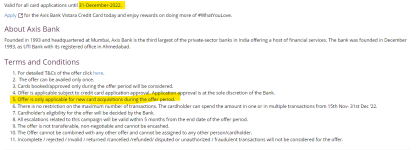

Here is the terms and conditions of this offer-

Official t&c pdf attached.

Offer link- https://www.airvistara.com/in/en/club-vistara/about-cv/current-offers/axis-fee-waiver

Axis bank is back with it's joining fees reversal offer for its all three vistara co-branded credit cards.

It's a spend based joining fees reversal offer. You have to spend X amount of money within first 90 days of card setup.

For Axis Vistara Credit Card- You have to spend ₹30,000 within 90 days.

Axis Vistara Signature- Spend ₹60,000 within first 90 days.

Axis Vistara Infinite- Spend ₹1,20,000 within 90 first days.

Offer fulfilment date - by 30th May, 2023.

You'll get welcome benefits as per card features.

It's the best time if you were planning to get axis vistara co-branded credit card. Apply early to get extra time for spends.

Here is the terms and conditions of this offer-

Official t&c pdf attached.

Offer link- https://www.airvistara.com/in/en/club-vistara/about-cv/current-offers/axis-fee-waiver

Attachments

Last edited: