Axis Bank has listed a Super Premium card, silently to their updated MITC, and they’re calling it Axis Primus.

What do we know as of now?

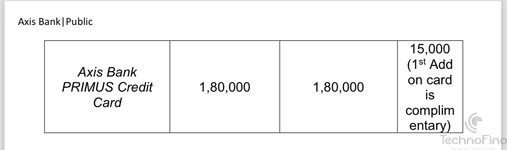

1. 1.8L fee

2. No DCC markup

3. No Forex markup

4. No cash withdrawals fee

5. Lowest finance charges, starting from 1%

6. No over limit fee

7. Add-on card: first one is free, from next one ₹15,000

8. No 1% rent payment fee

Except these as there’s no mention of any exclusion in reward points earning and milestone exclusion. So we can assume, there’s no exclusion. Good old Axis days for a price?

Added the MITC doc in the attachment.

What do you think of this card? Surely it’s not going to be easily available like other Axis cards in golden days, but does ₹1.8L fee justified as of now? Let us know below

What do we know as of now?

1. 1.8L fee

2. No DCC markup

3. No Forex markup

4. No cash withdrawals fee

5. Lowest finance charges, starting from 1%

6. No over limit fee

7. Add-on card: first one is free, from next one ₹15,000

8. No 1% rent payment fee

Except these as there’s no mention of any exclusion in reward points earning and milestone exclusion. So we can assume, there’s no exclusion. Good old Axis days for a price?

Added the MITC doc in the attachment.

What do you think of this card? Surely it’s not going to be easily available like other Axis cards in golden days, but does ₹1.8L fee justified as of now? Let us know below