Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Style variation

-

Hey there! Welcome to TFC! View fewer ads on the website just by signing up on TF Community.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BOB Eterna ltf card

- Thread starter Ram1

- Start date

- Replies 74

- Views 7K

Reduce limits on your card to get personal loan ??60% of TF community falls in this.

Students wants 4L limit to get premium cards, everyone wants to get limit within 3 or 4 months, I mean someone in share your card list said just joined job but got 7 cards combinedly 14L.

Here, I'm When I asked HDFC for personal loan, they asked me to reduce limits otherwise can't provide requested amount as loan.

Free limit is not considered as liability , if you have used the amount then it would be counted towards your liability .

That’s why it’s said to keep utilisation ratio low

Another reason for that would be bad balance between secured and unsecured loan , as both credit card and personal loan falls under unsecured category , secured loans like home loan car loan can be issued easily with high credit limit, infact I have even heard that having a high credit limit would give lower interest ratesReduce limits on your card to get personal loan ??

Free limit is not considered as liability , if you have used the amount then it would be counted towards your liability .

That’s why it’s said to keep utilisation ratio low

I won’t agree to this , first of fall your total credit limit is never your debt , it’s your credit exposure , debt is always the amount you utilise . Someone having a total credit limit of say 1cr , but has not utilised any amount in it , his debt is taken as 0 and not 1 cr .no, so much discussion happened at that time even Citi said same.

CIBIL with discipline, I followed throught all these years with one goal to get reduced interest rates on loans. That is one goal, I'm still maintaining but it keeps playing with me all these years.

During that year, I came to know one most important thing which is 'debt to income ratio'. I also thought higher limit helps me to keep utilization 30%, so whenever a bank offer limit enhancement I usually opt for it be it lower or higher.

I checked upto MD level why they're offering lower loan amount instead of asked price, even though income and debt properly managed (at that time my credit card utilization is not much, only use whenever online offers otherwise mostly cash, so outstanding for all credits is very less), after multiple enquiries that leads to MD they said that during loan application they'll verify whole CIBIL data which includes available credit limit of all cards.

I used to think these 3L or 5L limits not a liability but it puts us in risk zone by CIBIL, even Citi being associated with that bank (without telling all these just to know the actual reason because HDFC maybe bluff like that), checked and surprisingly somewhat similar analysis said by them.

They said that at any point of time, you're allowed to utilize this 3L/5L limit, if that is the case you have to pay using your income. Normally loans provide upto 30% income as EMI but they further analyze and see if this situation happens whether customer able to pay EMI or left. Because that is not free limit, that is like Overdraft ready to withdraw at any time and has to pay within time.

They said this debt to income ratio must maintain so that CIBIL considers us somewhat low risk category instead of high risk.

Also, found various articles where people usually suggested that if one going for home loan, don't apply any credit atleast 6 months so that CIBIL cools and allow us to apply higher limit.

Further , personal loan itself is a unsecured loan , banks almost always will scrutiny more heavily on a unsecure loan than a secured loan . More than the total credit limit they are focused on understanding your payment patterns.

Credit card application does trigger a Cibil enquiry , so to keep safety people don’t do any extra Cibil hits before opting for a high loan like home loan.

Also debt to income is the ratio of all payments you make against debt vs your incomeno, so much discussion happened at that time even Citi said same.

CIBIL with discipline, I followed throught all these years with one goal to get reduced interest rates on loans. That is one goal, I'm still maintaining but it keeps playing with me all these years.

During that year, I came to know one most important thing which is 'debt to income ratio'. I also thought higher limit helps me to keep utilization 30%, so whenever a bank offer limit enhancement I usually opt for it be it lower or higher.

I checked upto MD level why they're offering lower loan amount instead of asked price, even though income and debt properly managed (at that time my credit card utilization is not much, only use whenever online offers otherwise mostly cash, so outstanding for all credits is very less), after multiple enquiries that leads to MD they said that during loan application they'll verify whole CIBIL data which includes available credit limit of all cards.

I used to think these 3L or 5L limits not a liability but it puts us in risk zone by CIBIL, even Citi being associated with that bank (without telling all these just to know the actual reason because HDFC maybe bluff like that), checked and surprisingly somewhat similar analysis said by them.

They said that at any point of time, you're allowed to utilize this 3L/5L limit, if that is the case you have to pay using your income. Normally loans provide upto 30% income as EMI but they further analyze and see if this situation happens whether customer able to pay EMI or left. Because that is not free limit, that is like Overdraft ready to withdraw at any time and has to pay within time.

They said this debt to income ratio must maintain so that CIBIL considers us somewhat low risk category instead of high risk.

Also, found various articles where people usually suggested that if one going for home loan, don't apply any credit atleast 6 months so that CIBIL cools and allow us to apply higher limit.

So that can never include your total credit limit , it would be the amount you pay as emi for loans vs your total income

Debt to credit is the ratio which is the ratio of your total usage ( spend ) against your total revolving credit aka credit utilisation

See credit limit cannnot be a debt , debt is something which you have used .I might be wrong or might be applicable only to me or if one has solid income none of these applicable but just sharing what I experience with two most prominent banks.

View attachment 13018View attachment 13019

I believe maximum potential loss here is maximum credit limit. I maybe wrong and Unexpected financial problems can lead us to utilize credit temporarily.

https://www.investopedia.com/terms/c/credit-exposure.asp

Agree.

Whatever active accounts exist in CIBIL those all are liability, according to me. I might be wrong.

Credit limit = we may not use today, but tomorrow if we use that becomes debt which we have to clear within due time.

My observation on this (again might be applicable only to me just my thoughts): https://www.technofino.in/community/threads/consequences-of-denying-physical-kyc.6496/post-104563

Many of us have high credit limit , that doesn’t mean we are in debt , once you use the card and don’t pay back the amount in due date , technically the debt starts then because that’s when you start paying the interest.

Somone might have any credit limit , and if the credit utilisation ratio is within limit that’s actually good and builds up credit score . High credit limit would never cause any issue in processing loans especially secured loans, if your utilisation ratio is low , payments are in time .

Ask them for snapdeal card and pay that 250 per annum. It is worth it. Eterna LTF is ok but otherwise it is very average card now.

i have Bob eterna paid version, when i requested them to make it ltf...they offered me rupay premier ltf card...should i accept it or not?

I have decided to keep doing it again and again. If they ask justification, I can easily show as my Fastag load expenses are high due to fuel. I also have electricity bill of 20k bimonthly which will definitely get blocked. I plan to ask compensation too although I doubt if I can get any.Bob will allow you to load eterna to payzapp for amounts only less than 100rs which don't earn any rewards 🤣

First they blocked my card for wallet load. Now they blocked rewards from being redeemed. I have escalated it to PNO. Next I plan to complain to RBI ombudsman

They've blocked my addon also which i was earlier loading till 5k per day. It has become a totally useless card now. Would have closed it if it was not LTF

I plan to extract value with lounge access. I have weekly travel. So 2 lounge access per week. I was using Magnus till now.

They've blocked my addon also which i was earlier loading till 5k per day. It has become a totally useless card now. Would have closed it if it was not LTF

Do the lounge people honour eterna for access?

Good question. Will test it out. Chennai and HYD are usually included in all lounge programs.Do the lounge people honour eterna for access?

Can someone from BOB throw some light on whether they are going to bring back LTF Eterna offer anytime soon?

I can see an offer for LTF Premier on the application page - wondering whether I should go for it, or wait.

Reason for chasing Eterna - only LTF-able card with unlimited dom lounge access for primary and add-on. (Will cover my parents and sibling)

I can see an offer for LTF Premier on the application page - wondering whether I should go for it, or wait.

Reason for chasing Eterna - only LTF-able card with unlimited dom lounge access for primary and add-on. (Will cover my parents and sibling)

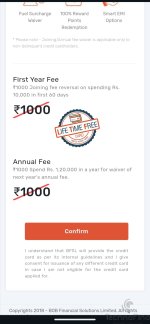

Attachments

sharma

TF Premier

Mostly it'll not be offered as ltf, since this is the only best card in bob....Can someone from BOB throw some light on whether they are going to bring back LTF Eterna offer anytime soon?

I can see an offer for LTF Premier on the application page - wondering whether I should go for it, or wait.

Reason for chasing Eterna - only LTF-able card with unlimited dom lounge access for primary and add-on. (Will cover my parents and sibling)

Maybe try getting paid card and negotiate with them for ltf, but risk is high in this case.

Else take ltf premier and spend some good amount regularly and then ask for upgrade.

you can get it LTF if you have an Income on the higher side like 36 LPA.Can someone from BOB throw some light on whether they are going to bring back LTF Eterna offer anytime soon?

I can see an offer for LTF Premier on the application page - wondering whether I should go for it, or wait.

Reason for chasing Eterna - only LTF-able card with unlimited dom lounge access for primary and add-on. (Will cover my parents and sibling)

No, I pinged eterna dept, they said the ITR criteria is not valid anymore. Read somewhere else that they will bring new offers in Jan, so wondering if I should wait.you can get it LTF if you have an Income on the higher side like 36 LPA.

Thanks, let's see...Mostly it'll not be offered as ltf, since this is the only best card in bob....

Maybe try getting paid card and negotiate with them for ltf, but risk is high in this case.

Else take ltf premier and spend some good amount regularly and then ask for upgrade.

@vaibhav111 Sir, kindly merge this with @TechnoFino's BoB LTF offer thread.

as far today, Eterna LTF isn't being Issued on ITR Basis. Try Paid BOB Eterna or through Upgrade after 1 year depending on Premier Limit of Equal or Above 2 lakhs.Can someone from BOB throw some light on whether they are going to bring back LTF Eterna offer anytime soon?

I can see an offer for LTF Premier on the application page - wondering whether I should go for it, or wait.

Reason for chasing Eterna - only LTF-able card with unlimited dom lounge access for primary and add-on. (Will cover my parents and sibling)

Similar threads

- Question

- Replies

- 152

- Views

- 9K