RewardsAlert

TF Legend

Dear TFC members,

I have been planning this from a long time, to have a constructive discussion regarding Credit score, factors affecting it, and the buzz around Credit Enquiries.

I have been using Credit cards from decades, and have realised that the severe panic regarding the lowering of Credit Score by:

1. No of credit enquiries

2. Closing an old card

3. Other silly reasons

These are simply not worth it. They make our life complicated unnecessarily and yield nothing.

By sharing my profile, I wish to enlighten some knowledge about these Myths, ultimately promoting peace of mind.

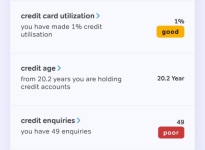

As you can see from the below attached screenshots, I am having around 40-49 credit enquiries in last 6 months.

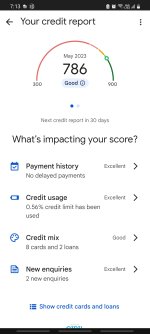

Still, my credit score has been intact like an elephant and hasn't dropped by an inch.

It keeps floating around 780-790 usually, come what may, it doesn't vary much.

Reasons:

1. Majority of people here fail to understand that they are quite new in their banking/credit journey.

The newer the CIBIL is, the faster it reacts with new changes.

So, the point of higher credit enquiries is only true, when you have just started out the journey, maybe after 4-5 years it won't matter.

2. No. of active loans/credit cards in your profile.

The more the number is, the more you're diversified, this means the algorithm considers you credit worthy, and you also you and up having a higher Credit Limit.

3. Credit Limit utilisation, this part is true in fact.

With fairly lesser no. of cards, lesser limits, you are in a risk to consume more of your credit limit.

Therefore, everyone advices to maintain a low utilisation only when the bank reports it to CIBIL.

The other days, you're free to use how much ever you want, just ensure to pay it before month end 28th or 29th, so that it doesn't gets reported.

As shown below, I have a record of only 2 missed payments in my entire history out of 884 payments till now with multiple cards.

The whole purpose is to inspire all, and ease their credit journey.

This is my personal experience that I would like to share.

Sometimes, I do have more than 10 enquires a month, sometimes my overall spends goes above 4/5 lakhs, still my credit score remains same.

This is solely due to the reasons listed above.

Now, let me share one more incident.

As you know, I have multiple cards, so in Jan, this year I had a missed payment of around 1 Rs for a verification purpose like Lounge etc.

I wasn't aware and missed it.

I got reported also next month by XYZ bank, but my credit score remained same, even it rose by 1/2 points.

See, now you can imagine the power of credit history and how Robust it can make your CIBIL.

Later on, I got that Late payment removed from that bank, and CIBIL further increased by 2 points.

Hope you all have gained some learning from my journey.

Waiting to see some ROBUST profiles here, which are even unique and interesting at the same time.

Do attach your app screenshots showcasing your creditworthiness.

I have used 2 apps: Gpay and Airtel.

I have been planning this from a long time, to have a constructive discussion regarding Credit score, factors affecting it, and the buzz around Credit Enquiries.

I have been using Credit cards from decades, and have realised that the severe panic regarding the lowering of Credit Score by:

1. No of credit enquiries

2. Closing an old card

3. Other silly reasons

These are simply not worth it. They make our life complicated unnecessarily and yield nothing.

By sharing my profile, I wish to enlighten some knowledge about these Myths, ultimately promoting peace of mind.

As you can see from the below attached screenshots, I am having around 40-49 credit enquiries in last 6 months.

Still, my credit score has been intact like an elephant and hasn't dropped by an inch.

It keeps floating around 780-790 usually, come what may, it doesn't vary much.

Reasons:

1. Majority of people here fail to understand that they are quite new in their banking/credit journey.

The newer the CIBIL is, the faster it reacts with new changes.

So, the point of higher credit enquiries is only true, when you have just started out the journey, maybe after 4-5 years it won't matter.

2. No. of active loans/credit cards in your profile.

The more the number is, the more you're diversified, this means the algorithm considers you credit worthy, and you also you and up having a higher Credit Limit.

3. Credit Limit utilisation, this part is true in fact.

With fairly lesser no. of cards, lesser limits, you are in a risk to consume more of your credit limit.

Therefore, everyone advices to maintain a low utilisation only when the bank reports it to CIBIL.

The other days, you're free to use how much ever you want, just ensure to pay it before month end 28th or 29th, so that it doesn't gets reported.

As shown below, I have a record of only 2 missed payments in my entire history out of 884 payments till now with multiple cards.

The whole purpose is to inspire all, and ease their credit journey.

This is my personal experience that I would like to share.

Sometimes, I do have more than 10 enquires a month, sometimes my overall spends goes above 4/5 lakhs, still my credit score remains same.

This is solely due to the reasons listed above.

Now, let me share one more incident.

As you know, I have multiple cards, so in Jan, this year I had a missed payment of around 1 Rs for a verification purpose like Lounge etc.

I wasn't aware and missed it.

I got reported also next month by XYZ bank, but my credit score remained same, even it rose by 1/2 points.

See, now you can imagine the power of credit history and how Robust it can make your CIBIL.

Later on, I got that Late payment removed from that bank, and CIBIL further increased by 2 points.

Hope you all have gained some learning from my journey.

Waiting to see some ROBUST profiles here, which are even unique and interesting at the same time.

Do attach your app screenshots showcasing your creditworthiness.

I have used 2 apps: Gpay and Airtel.