Editor’s note: This is a recurring post, regularly updated with new information and offers. Last Updated 18th October 2023.

HDFC Bank has recently launched the most speculated and much-awaited Marriott Bonvoy cobranded credit card in India. This is the first credit card ever launched in India by one of the most renowned global hotel chains in the world. The card is available on the Diners Club platform.

Here’s everything you wish to know about the card.

Charges and Welcome Benefits

| Joining Fees | ₹3000 + GST |

| Welcome Benefits | 1) 1 Free Award Night (valued up to 15,000 Marriott Bonvoy points) 2) 10 Elite Night Credits (ENCs) under the Marriott Bonvoy Program 3) Complimentary Marriott Bonvoy Silver Elite Status |

| Renewal Fees | ₹3000 + GST |

| Renewal Benefits | 1 Free Award Night (valued up to 15,000 Marriott Bonvoy points) |

| Renewal Fee Waiver | NIL |

deposited into your Marriott Bonvoy Member Account.

Reward Points Accrual

| Spends Area | Earn Rate | Monthly Capping |

| All retail spends* | 2 Marriott Bonvoy Points per ₹150 spent | NIL |

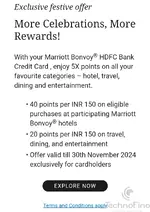

| Travel, Dining and Entertainment | 4 Marriott Bonvoy Points per ₹150 spent | 53335 Marriott Bonvoy Points (monthly spends threshold of ₹10,00,000) |

| Marriott Hotels | 8 Marriott Bonvoy Points per ₹150 spent | 13335 Marriott Bonvoy Points (monthly spends threshold of ₹5,00,000) |

- The points will be credited to your Marriott Bonvoy account within 3 months of bill generation.

- Maximum Eligible Spend for earning Marriott Bonvoy Points on grocery store spend (i.e., 2 Marriott Bonvoy Points per ₹150) will be capped at spends of INR 1,50,000 per month (i.e., maximum 2000 Marriott Bonvoy Points could be earned on grocery spends per month).

Reward Points Redemption

For Marriott Bonvoy we can assume one MB point to be easily around 50p though you can extract more than Re 1 at some properties in some regions.| Spends Area | Reward Rate |

| All retail spends* | 0.66% |

| Travel, Dining and Entertainment | 1.33% |

| Marriott Hotels | 2.66% |

Milestone Benefits

- 1 Free Night Award on Eligible Spend of ₹6 lakhs in an Anniversary Year

- 1 Free Night Award on Eligible Spend of ₹9 lakhs in an Anniversary Year

- 1 Free Night Award on Eligible Spend of ₹15 lakhs in an Anniversary Year

Other Benefits

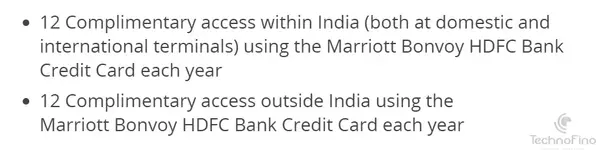

Airport Lounge Access

Access Via - Credit CardComplimentary Domestic Limit - 12 Visits/ Calendar year within India

Network - Diners Club India

Access Via - Credit Card

Complimentary International Limit - 12 Visits/ Calendar year on lounges outside India.

Golf Access

- Get access to 2 Complimentary golf lessons per quarter at select golf courses in India.

- Get 2 Complimentary Golf course access per quarter at select premium golf courses in India and golf courses internationally.

Fuel Surcharge Waiver

No fuel surcharge waiver is applicable on this card.Insurance Coverage

- Delay or loss of checked-in baggage cover of up to $250

- Loss of travel documents cover of up to $250

- Flight delay cover of up to $250

- Air accidental cover of up to $12,500

- Emergency medical expenses up to $18,750

- Credit shield of up to ₹100,000

- Loss liability cover of up to ₹100,000

Concierge Services

Enjoy the exclusive Concierge Services on your Marriott Bonvoy HDFC Bank Credit Card. Customers can connect to the concierge number from 9 a.m.-9 p.m.Toll Free: 18003093100

Email: support@marriotthdfcbank.com

Forex Markup Charges

- FCY Markup Fee: 3.5%+GST

- Reward Rate: 0.66%

- Net: –3.5% (loss)

Eligibility

Officially the bank has the following criteria but can vary as per your relationship with the bank.For Salaried Indian national

- Age: Min 21 years & Max 60 Years

- Net Monthly Income > ₹1 Lakh

- Age: Min 21 years & Max 65 Years

- ITR > ₹15 Lakhs per annum.

Last Thoughts

The mediocre features of this card suggest that Marriott is looking to tap into new customers or many who stay at Marriott properties but not into their loyalty programme Marriott Bonvoy. I am also expecting a much more premium card either from HDFC Bank or ICICI Bank soon. This card is up for keep since the joining fee is well compensated by the joining benefits even if you don't spend on this card.What are your thoughts about this card? Feel free to share in the comments below.